Japanese | English

Data and visuals are available in the following categories: GHG Emissions & Carbon Neutrality, Electricity, Thermal & Nuclear, Renewables, Energy Efficiency, Governance & Policy Making Process, Budget and Fiscal Policy, Global Data, and Others.

(Regarding the use of content on the website: Please refer to Terms of Use for details)

GHG Emissions & Carbon Neutrality

Japan’s GHG Emissions and Targets (FY2023)

Japan GHG emissions and pathway to net zero (base year 2013)

GHG emissions breakdown (FY2023)

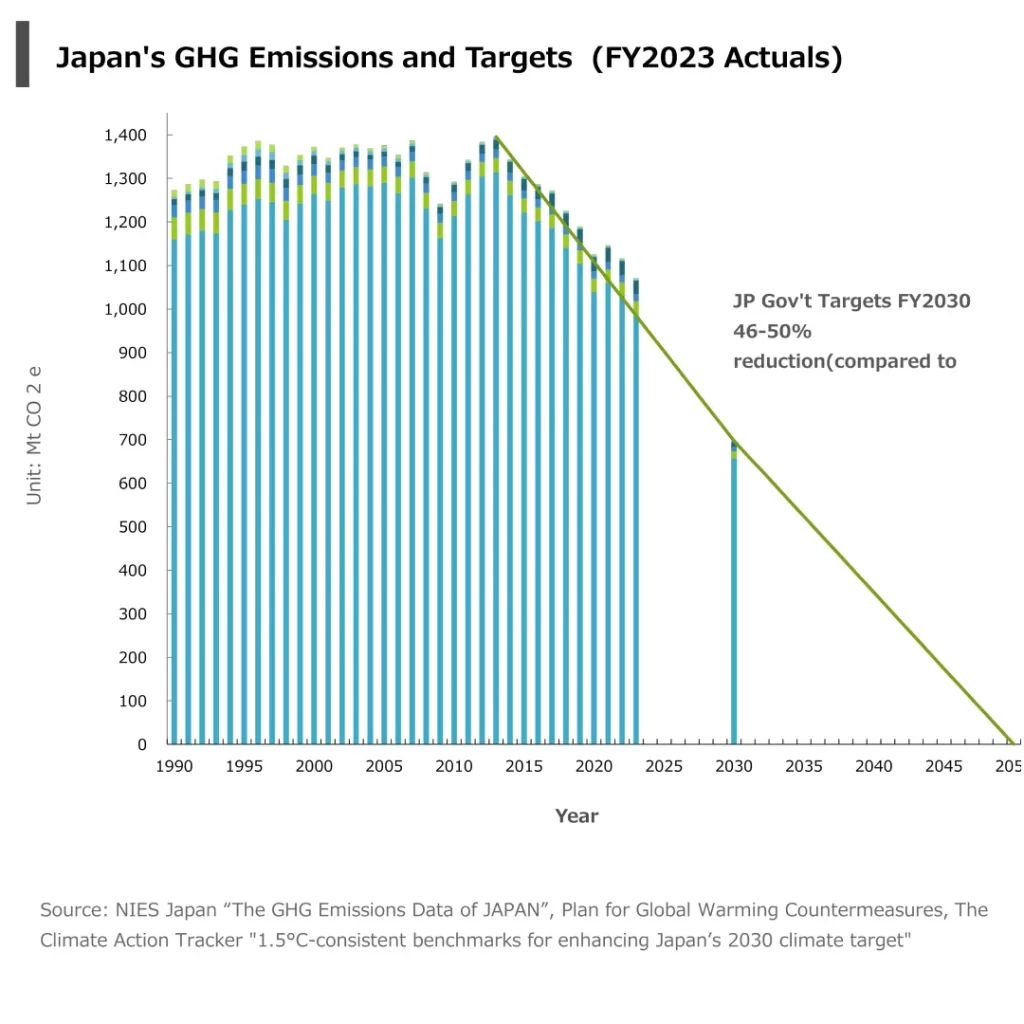

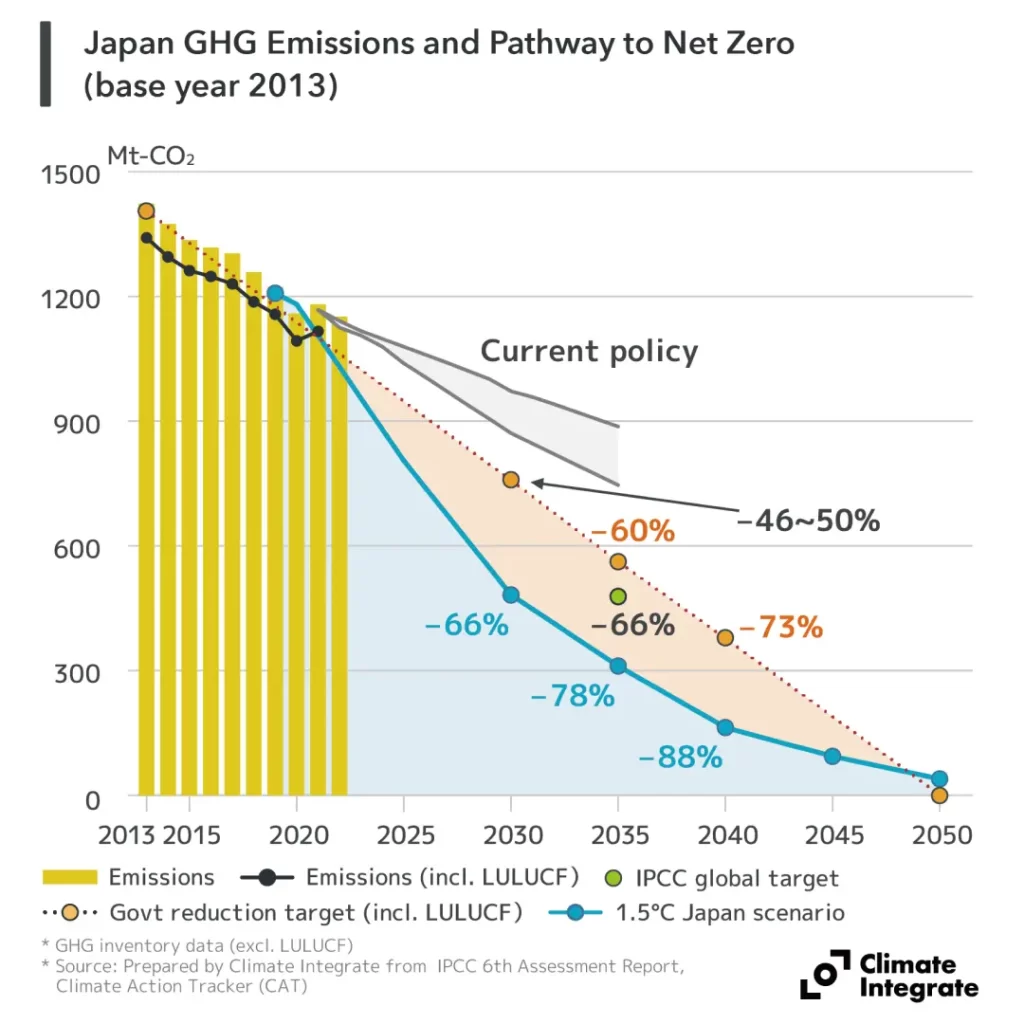

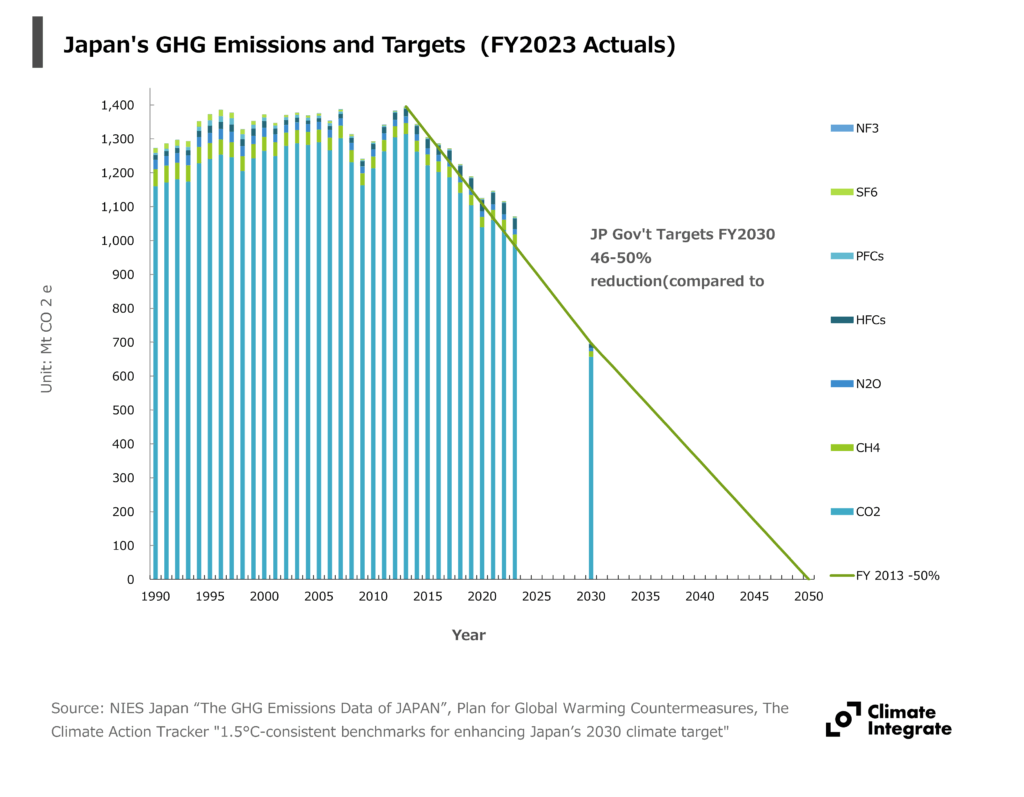

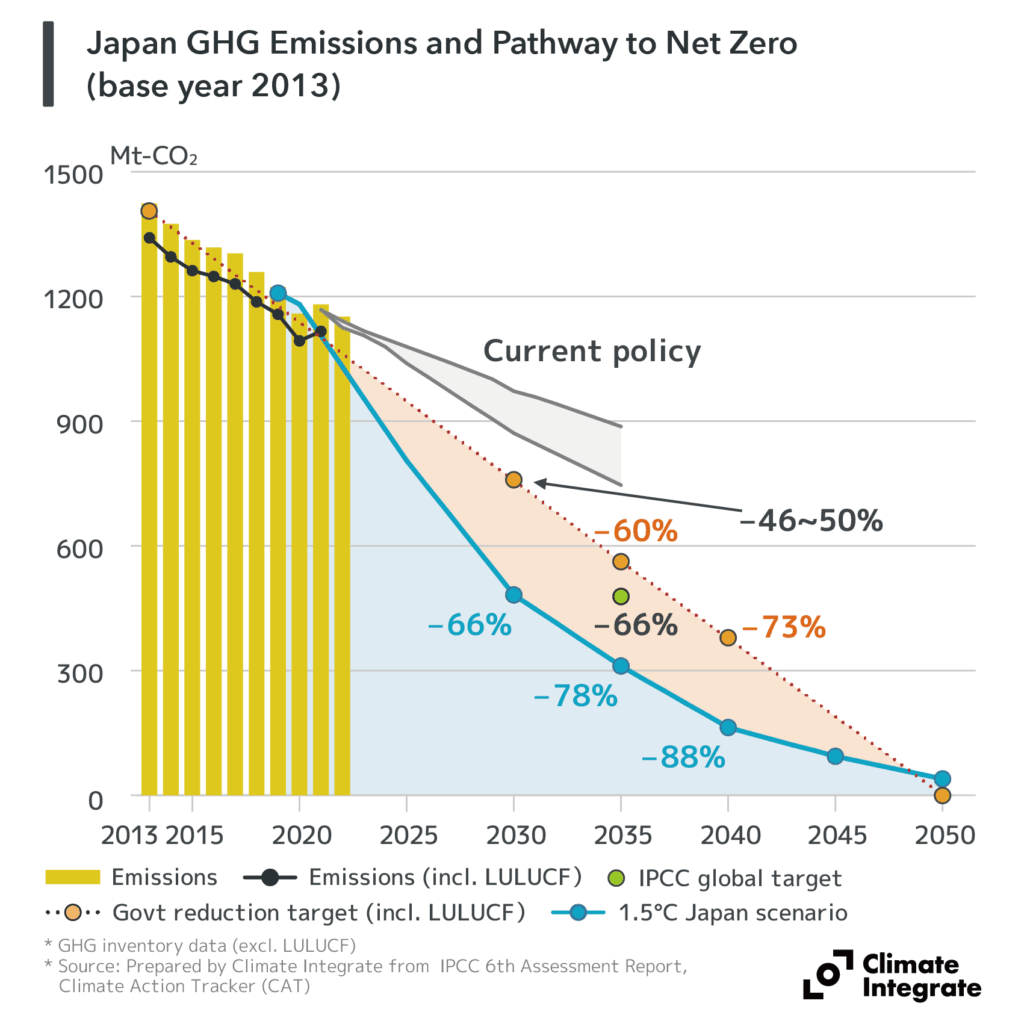

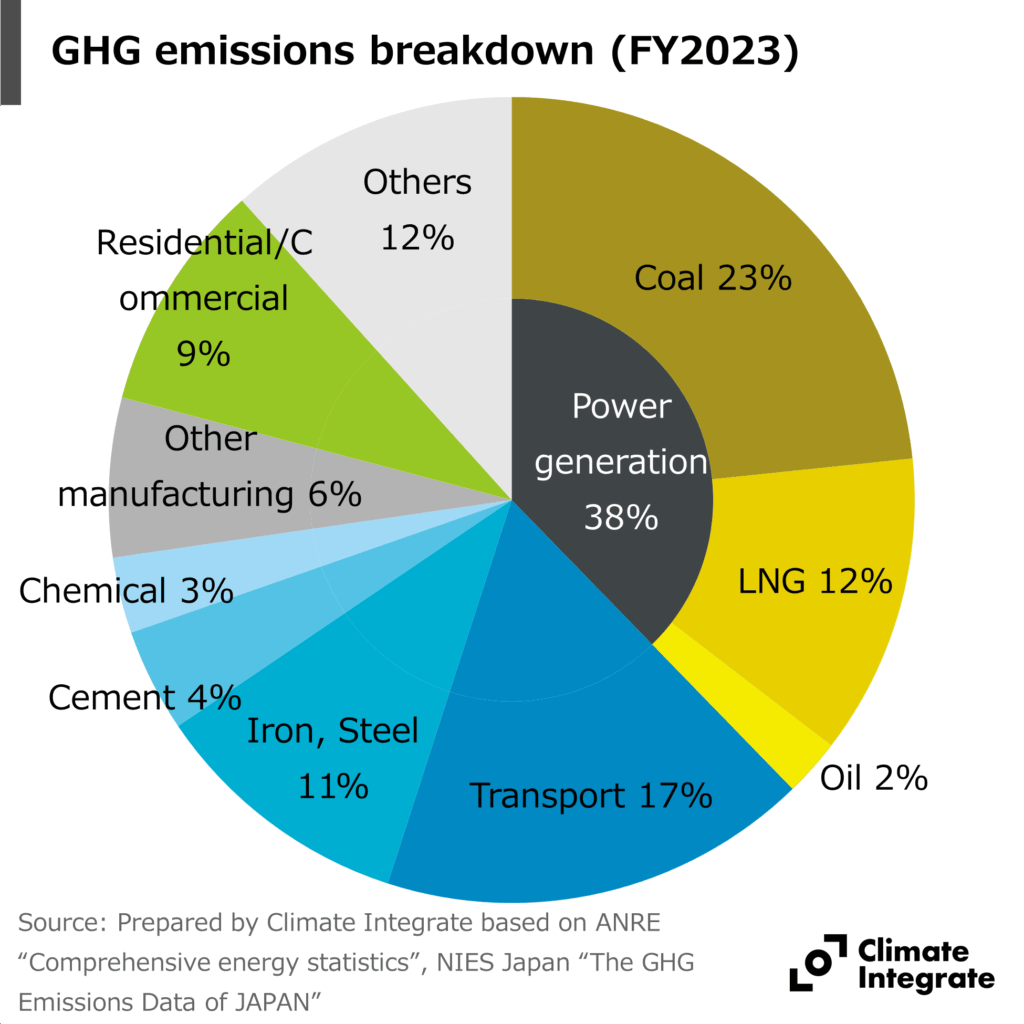

Japan’s GHG emissions in FY2023 (excl. LULUCF) were 1,071 Mt (CO2 equivalent) (down about 4% from FY2022 and about 23% from FY2013). Energy-related CO2 emissions, which account for about 86% of the total, fell 25.4% (from FY2013). The reduction trend continues, but further cuts are necessary to achieve net zero by 2050.

Japan’s GHG emission reduction targets are for 60% by 2035 and 73% by 2040 (relative to FY2013). These targets fall short of the IPCC’s median global emission pathway consistent with limiting warming to 1.5°C, which requires a 66% reduction by 2035, and are less ambitious than Japan’s own 1.5°C scenario, which calls for a 77% reduction by 2035 and 88% by 2040.

Related pages:

[Insights]Japan Policy Briefing: 7th Strategic Energy Plan, Climate Plan/NDC, and GX 2040 Vision

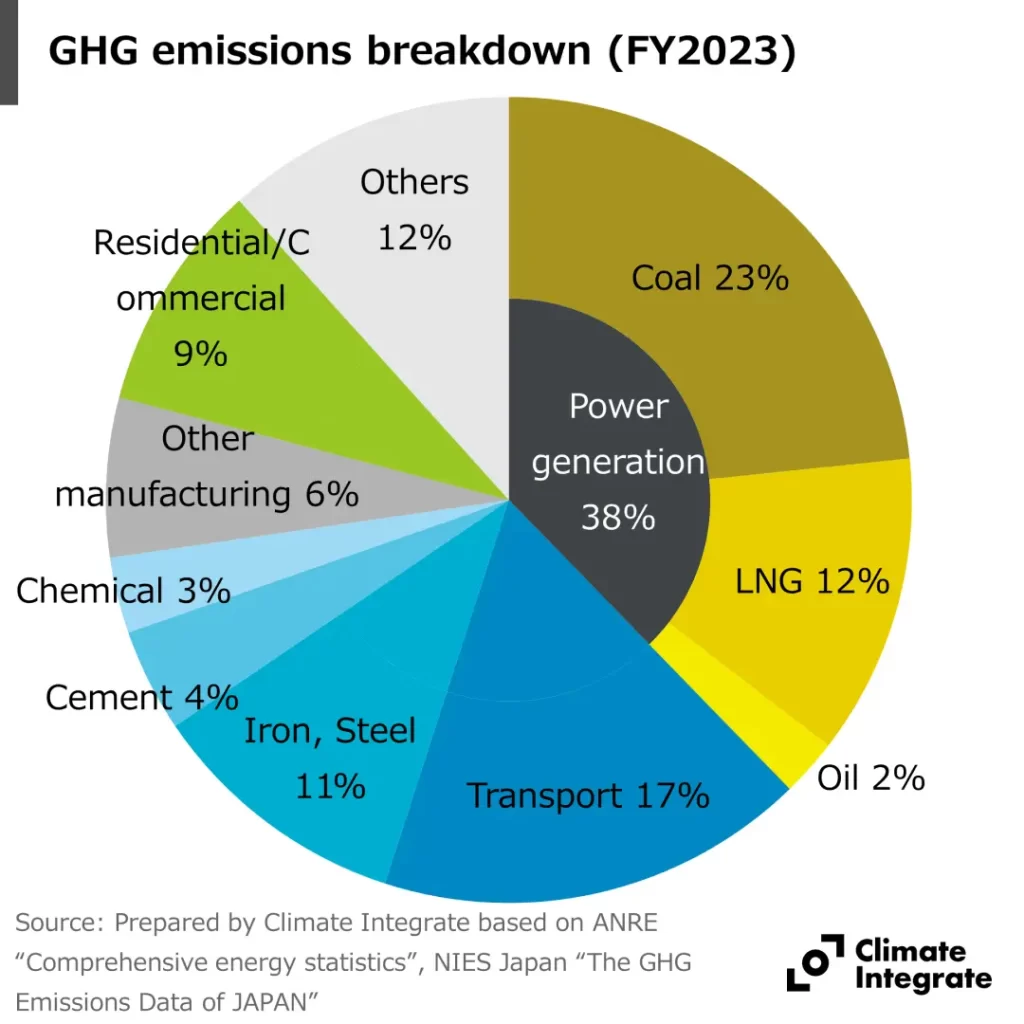

Large GHG emitters dominate in Japan, with >70% of emissions coming from thermal power, steel, cement, and petrochemical manufacturing. The largest source of emissions is coal-fired power, followed by the transportation sector.

Related pages:

[Insights]Fact sheet on Japan’s climate and energy policies

Electricity (General)

Final energy consumption & electricity generation

Power generation mix scenarios

Electricity mix and breakdown of renewables in FY2023

A variety of ways to enhance flexibility

Concept of sector coupling

Projected cost of electricity generation in Japan (new installations) (Berkeley Lab)

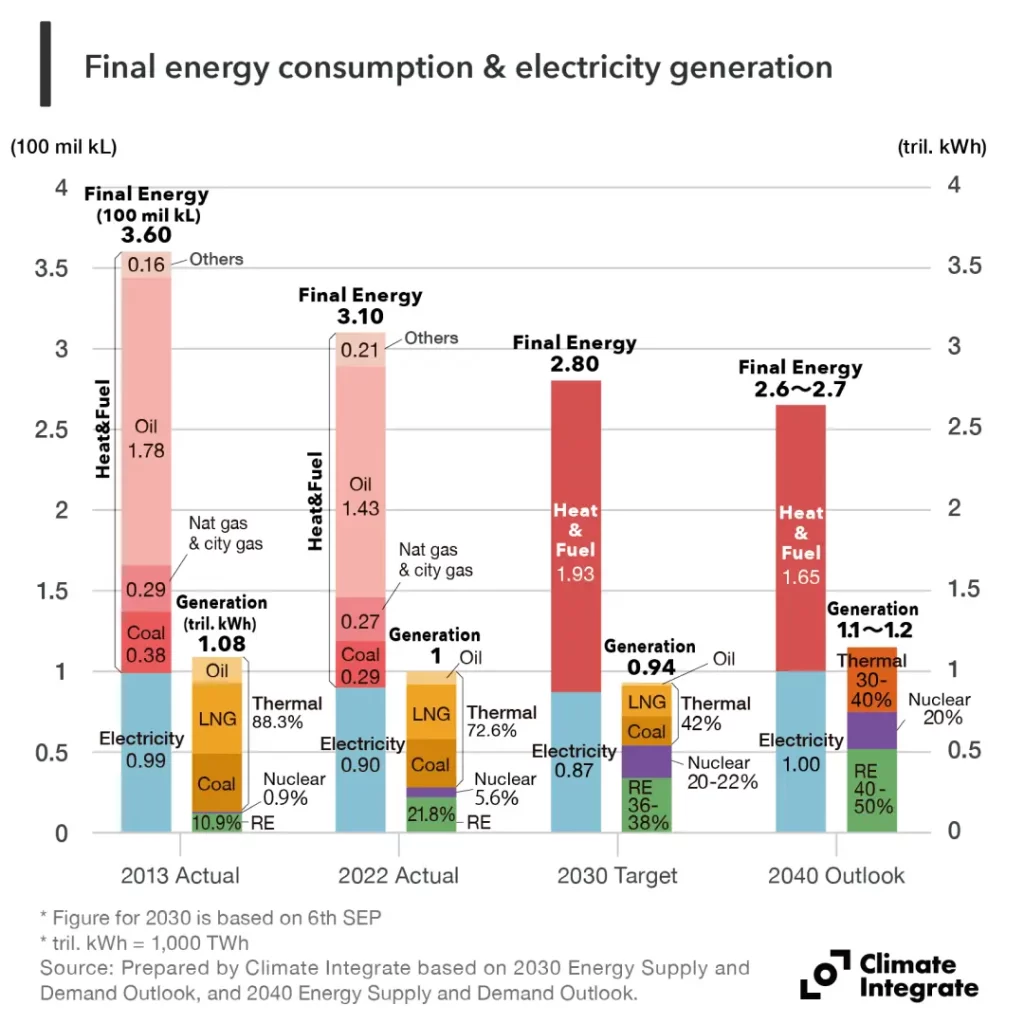

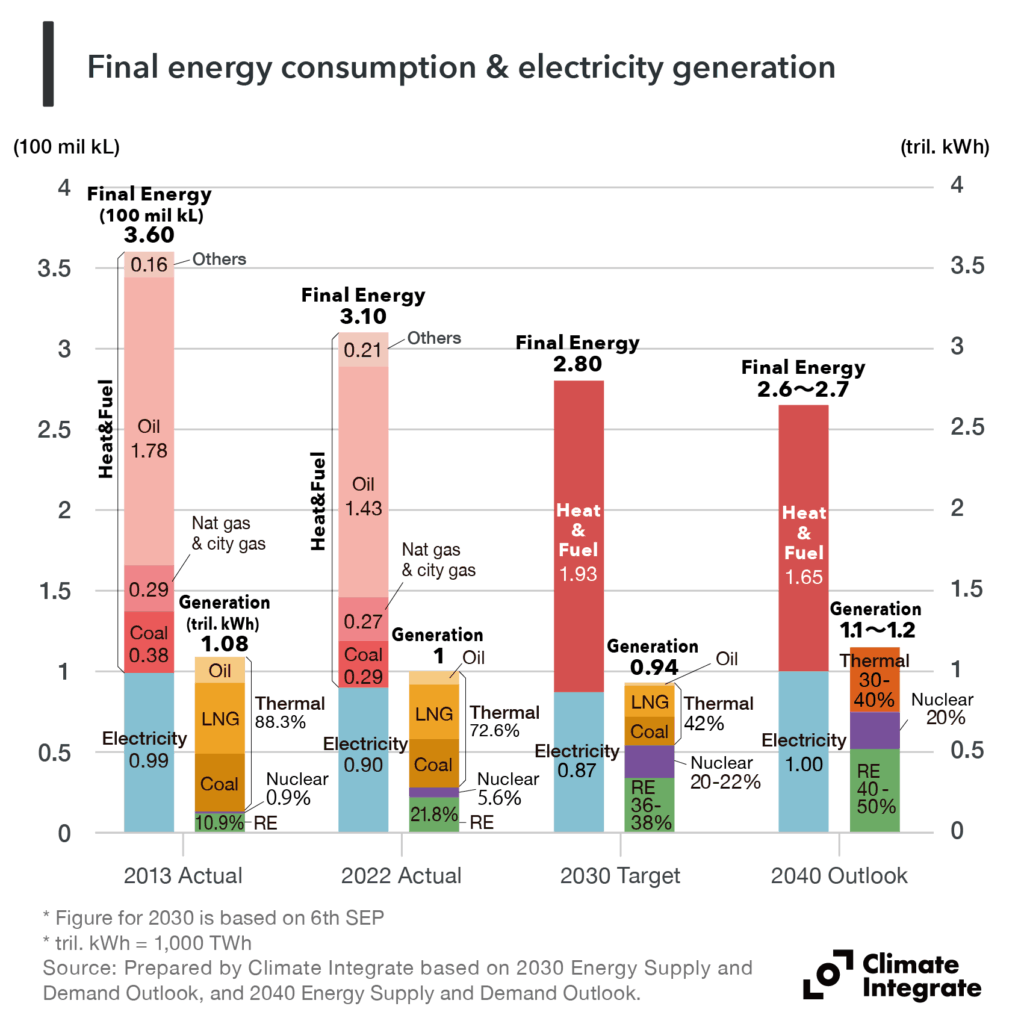

According to the government’s plan, final energy consumption is projected to decrease by 2040 (25% reduction compared to FY2013). On the other hand, electricity demand is expected to increase.

Related pages:

[Insights]Japan Policy Briefing: 7th Strategic Energy Plan, Climate Plan/NDC, and GX 2040 Vision

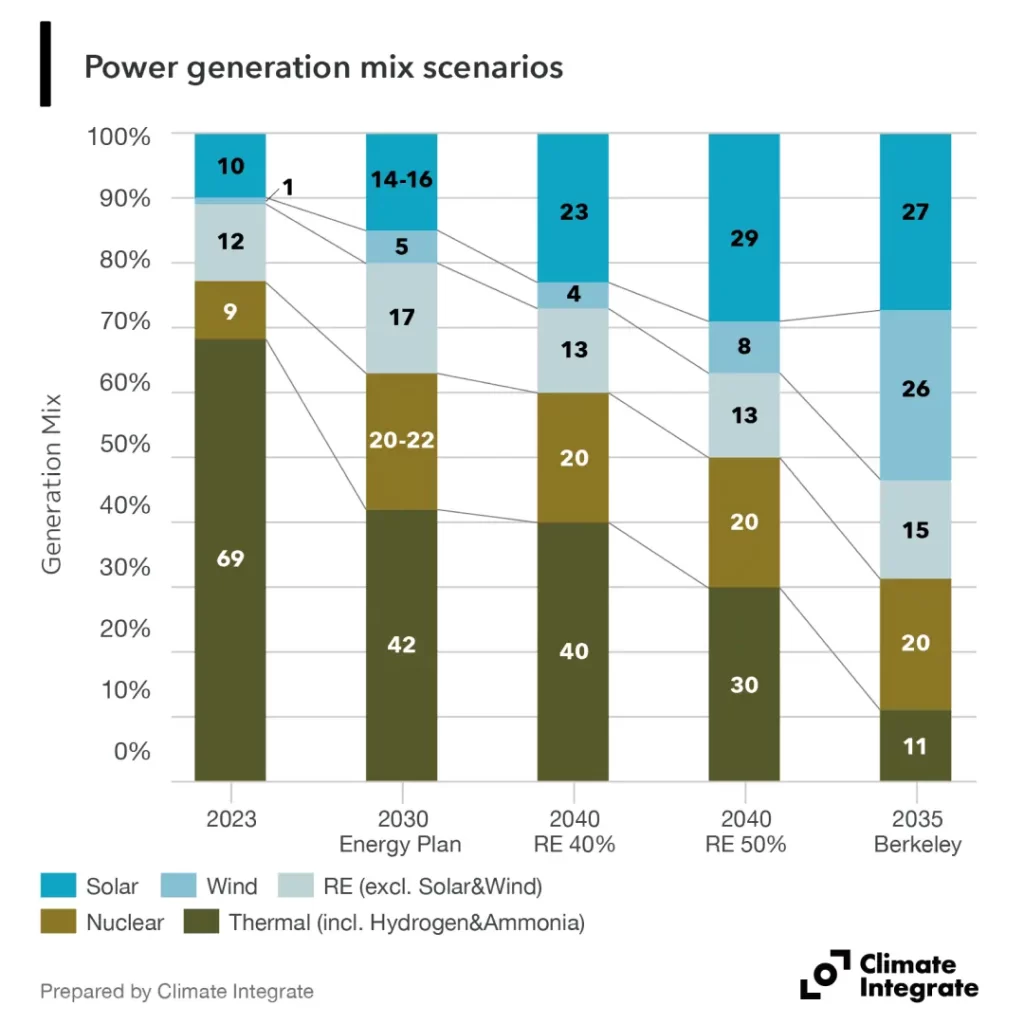

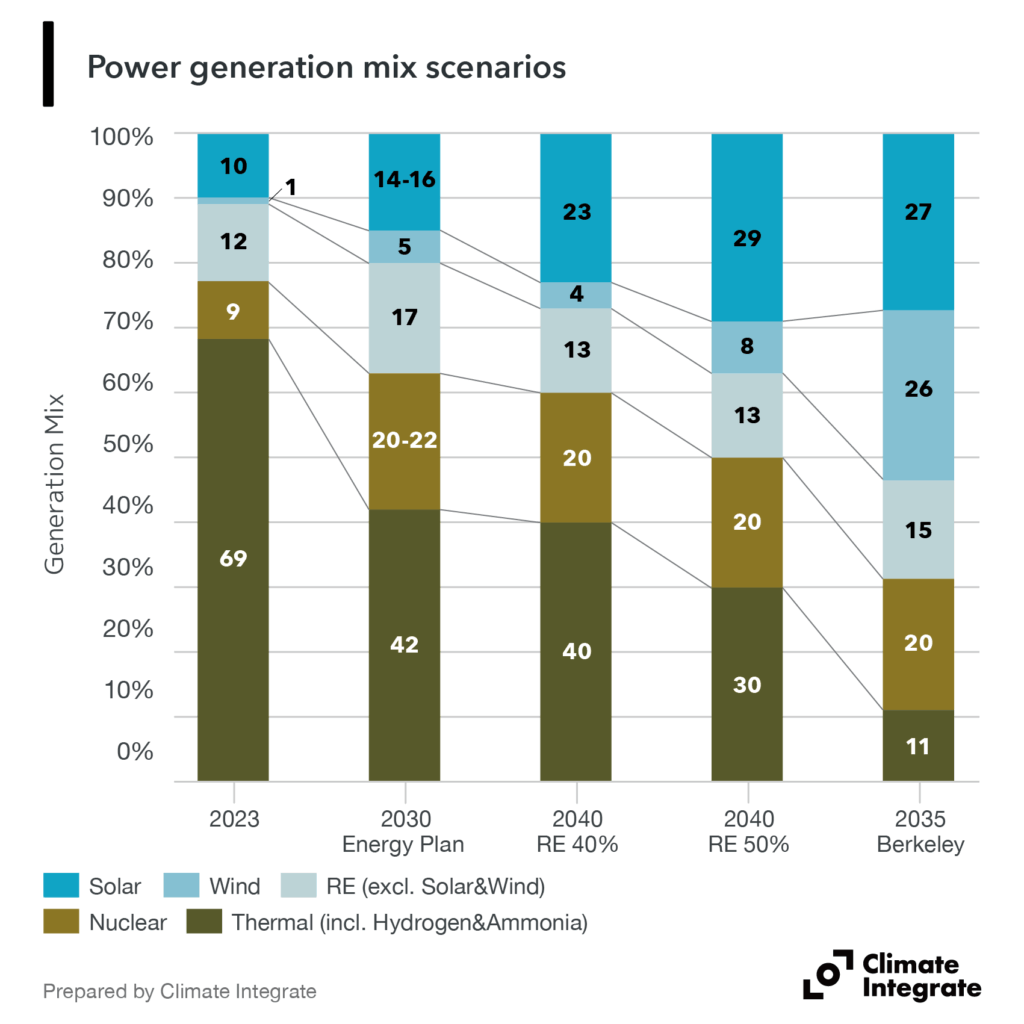

Japan’s Strategic Energy Plan for 2040 shows a power generation mix of 40–50% renewable energy, 20% nuclear power, and 30–40% thermal power (including LNG, coal, oil, co-firing with hydrogen and ammonia, and CCS, though the breakdown is unclear). The outlook suggests a continued high dependence on fossil fuels compared to the Berkeley Lab’s Clean Energy Scenario (right bar graph).

Related pages:

[Insights]Japan Policy Briefing: 7th Strategic Energy Plan, Climate Plan/NDC, and GX 2040 Vision

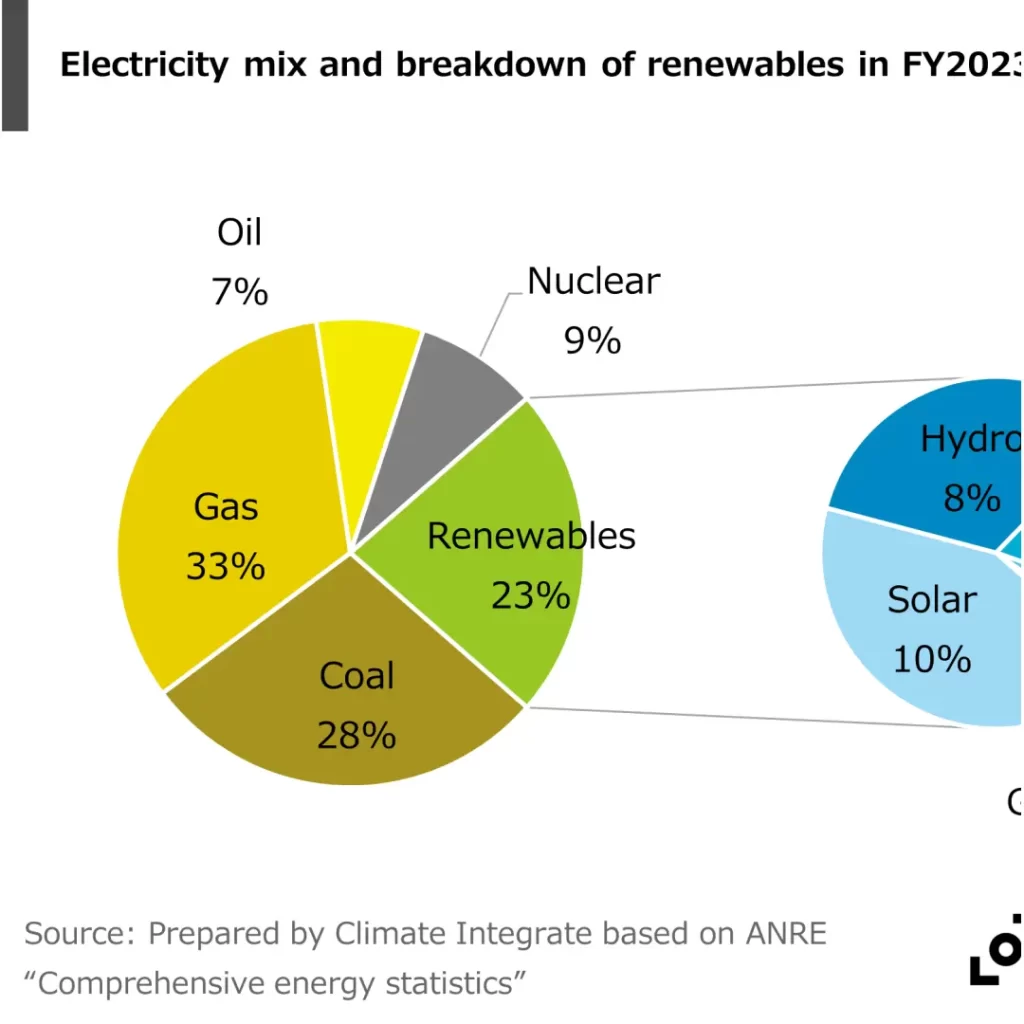

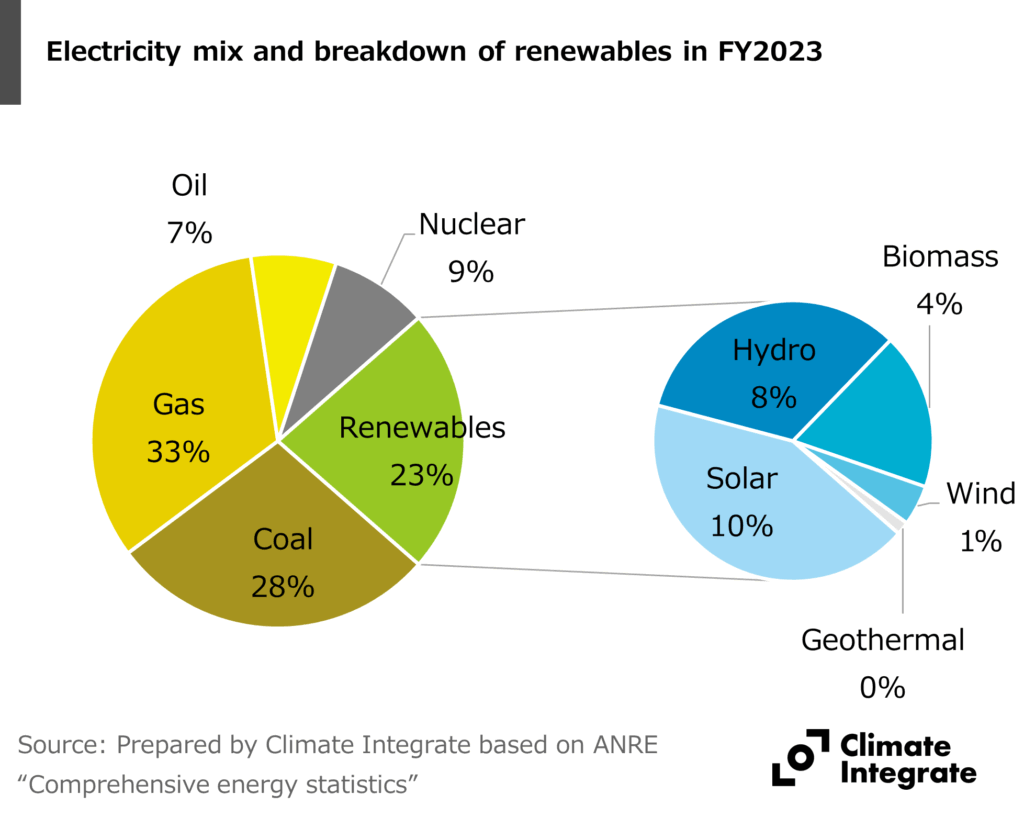

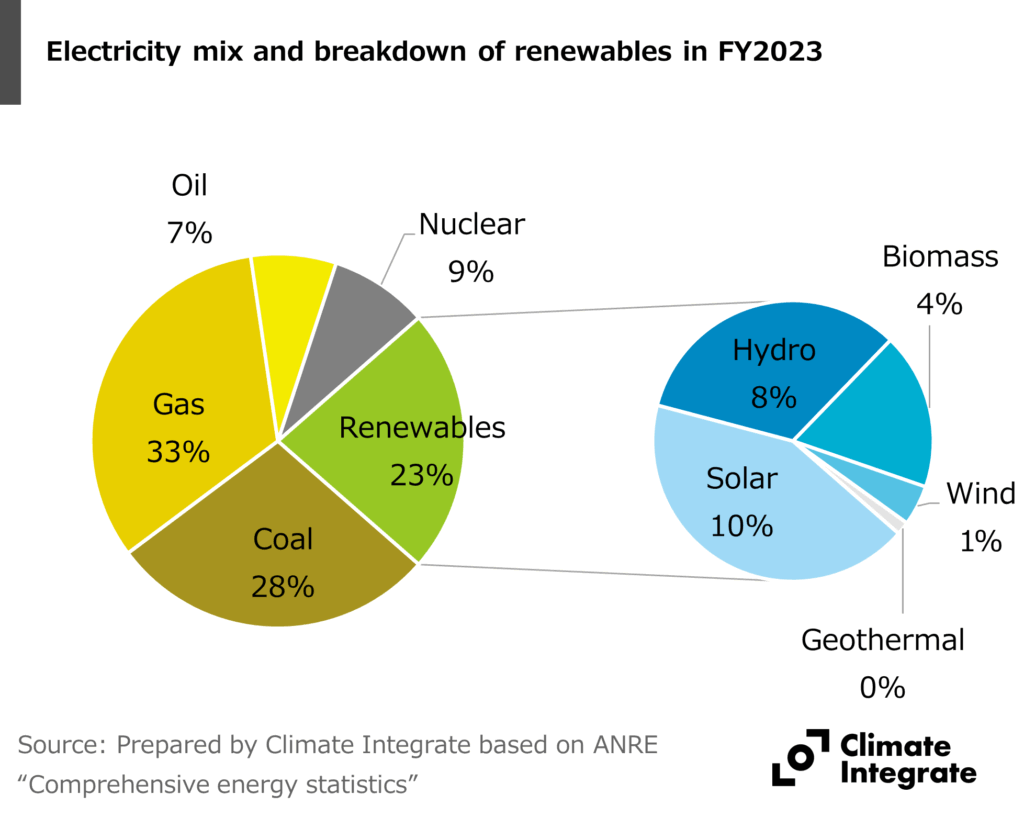

Japan’s FY2023 power generation mix showed a high dependence on thermal power, with 33% from natural gas and 28% from coal. Electricity decarbonization is lagging due to the uncertain outlook for nuclear power and slow adoption of renewable energy. Japan’s CO2 intensity is highest in the G7. A large gap between the current path and 2030 target.

Related pages:

[Insights]Fact sheet on Japan’s climate and energy policies

Japan’s FY2023 power generation mix showed a high dependence on thermal power, with 33% from natural gas and 28% from coal. Electricity decarbonization is lagging due to the uncertain outlook for nuclear power and slow adoption of renewable energy. Japan’s CO2 intensity is highest in the G7. A large gap between the current path and 2030 target.

Related pages:

[Insights]Fact sheet on Japan’s climate and energy policies

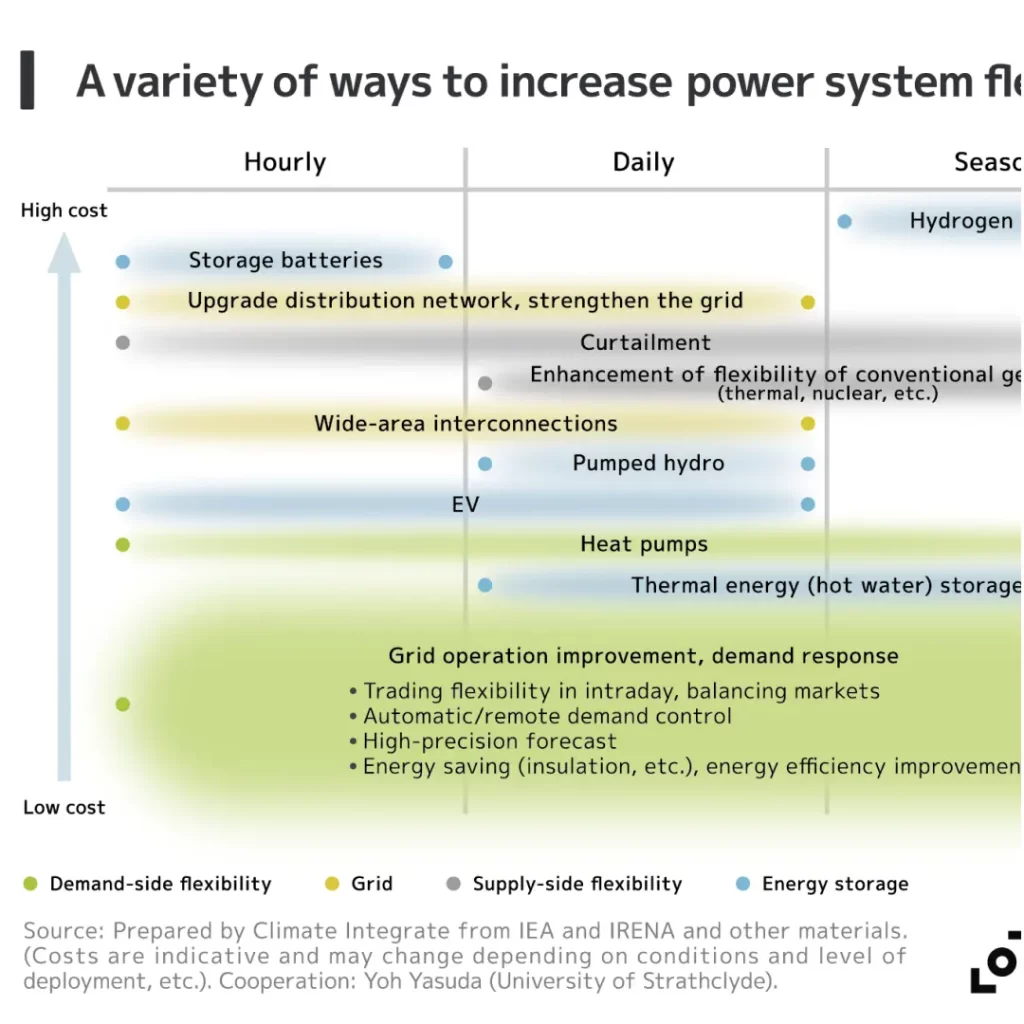

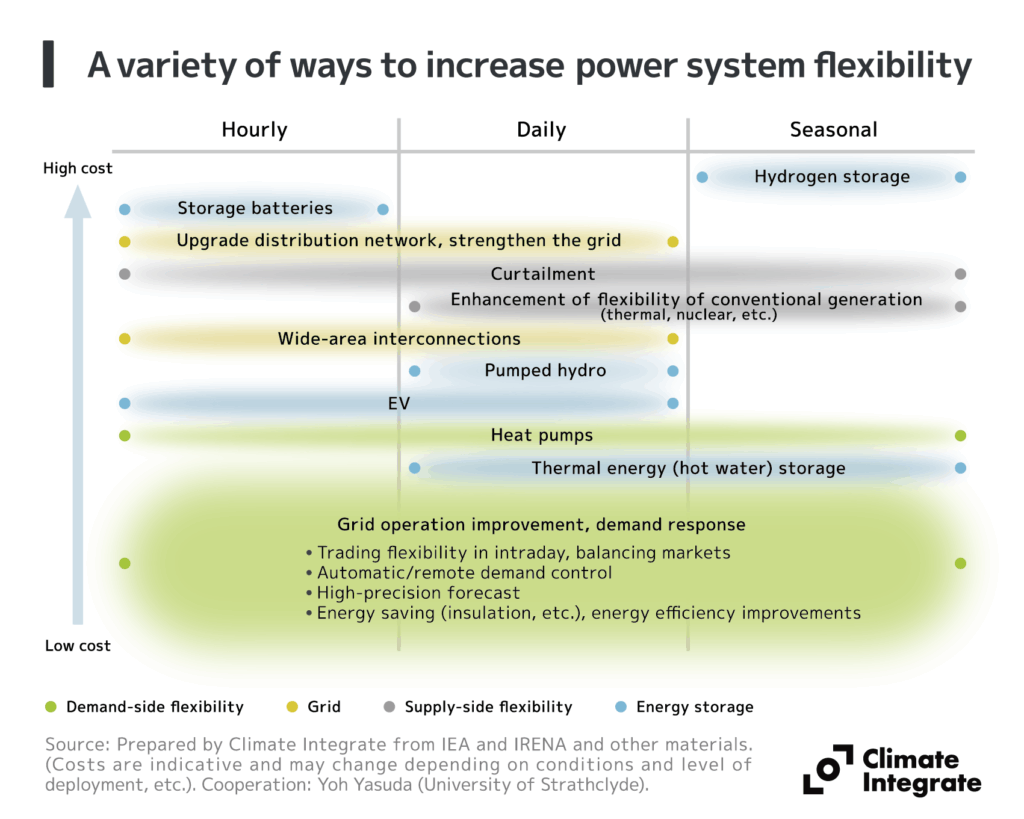

Enhancing grid flexibility is essential for integrating large shares of renewables into the grid. A range of flexibility resources can address hourly, daily, and seasonal variability, and costs can be reduced by combining technological innovations with market and regulatory reforms.

Related pages:

[Insights]Mainstreaming Renewable Energy in Japan

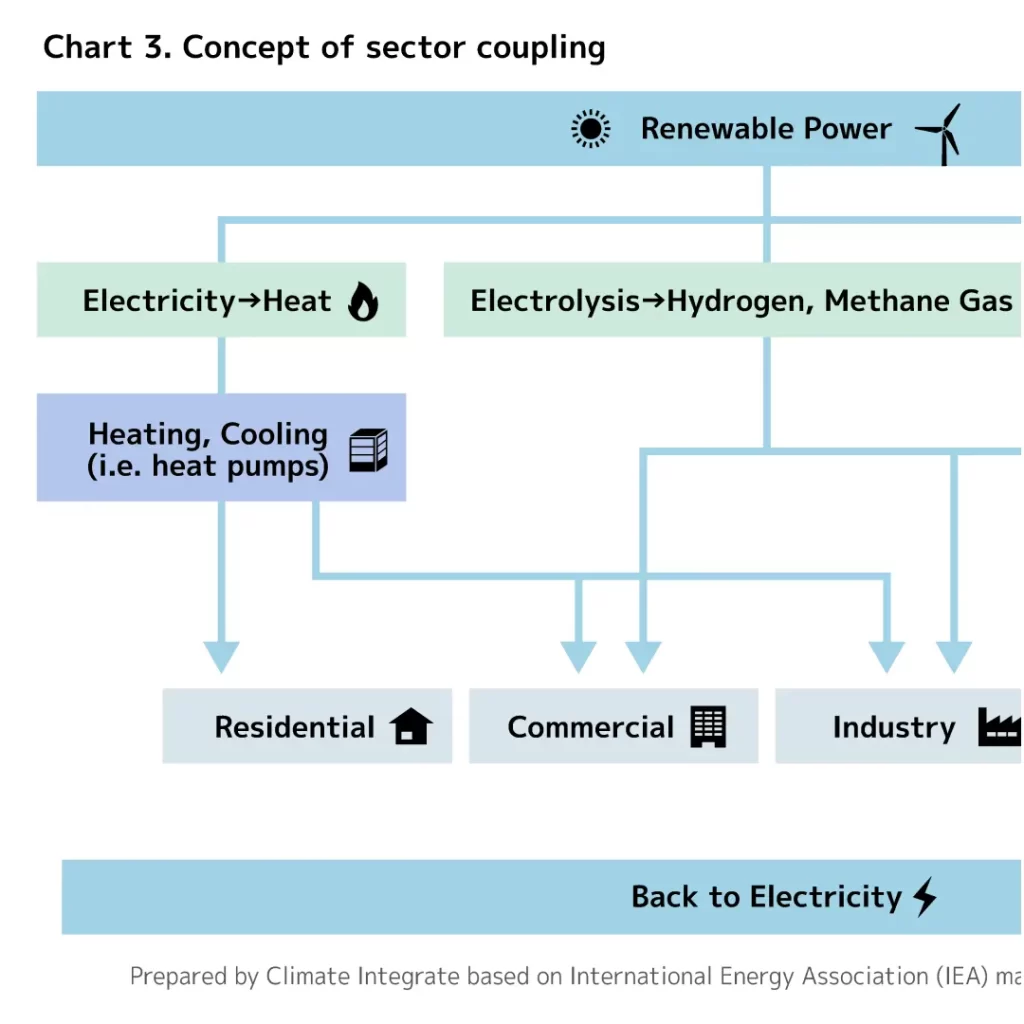

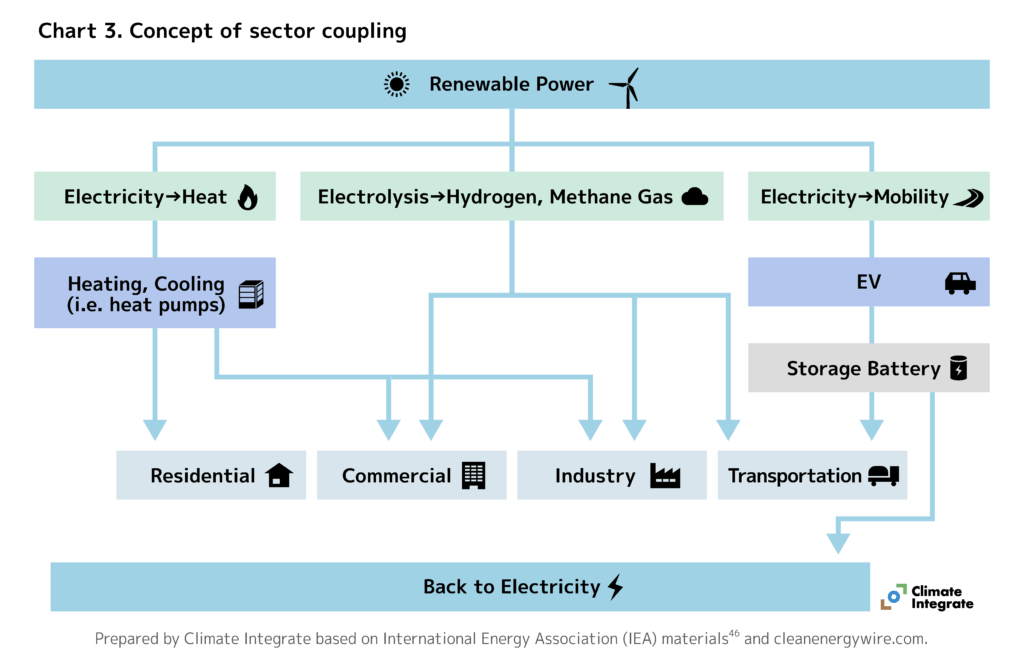

Sector coupling enables energy transfer across sectors (electricity, heat), providing a sink for surplus renewable generation. As renewable capacity grows, excess electricity can be absorbed by advancing electrification in manufacturing, residential, commercial, and transportation.

Related pages:

[Reports]Report “Decarbonizing Japan’s Electricity System: Policy Change to Trigger a Shift”

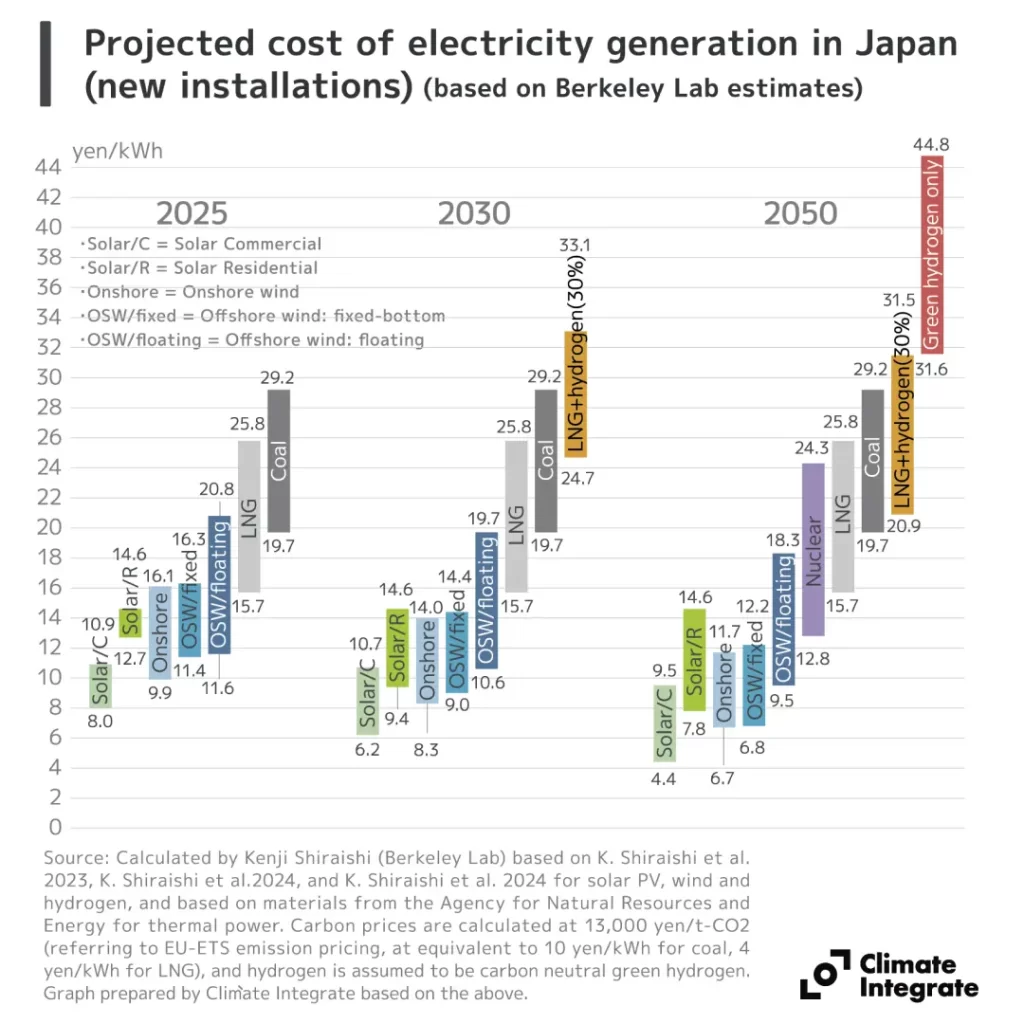

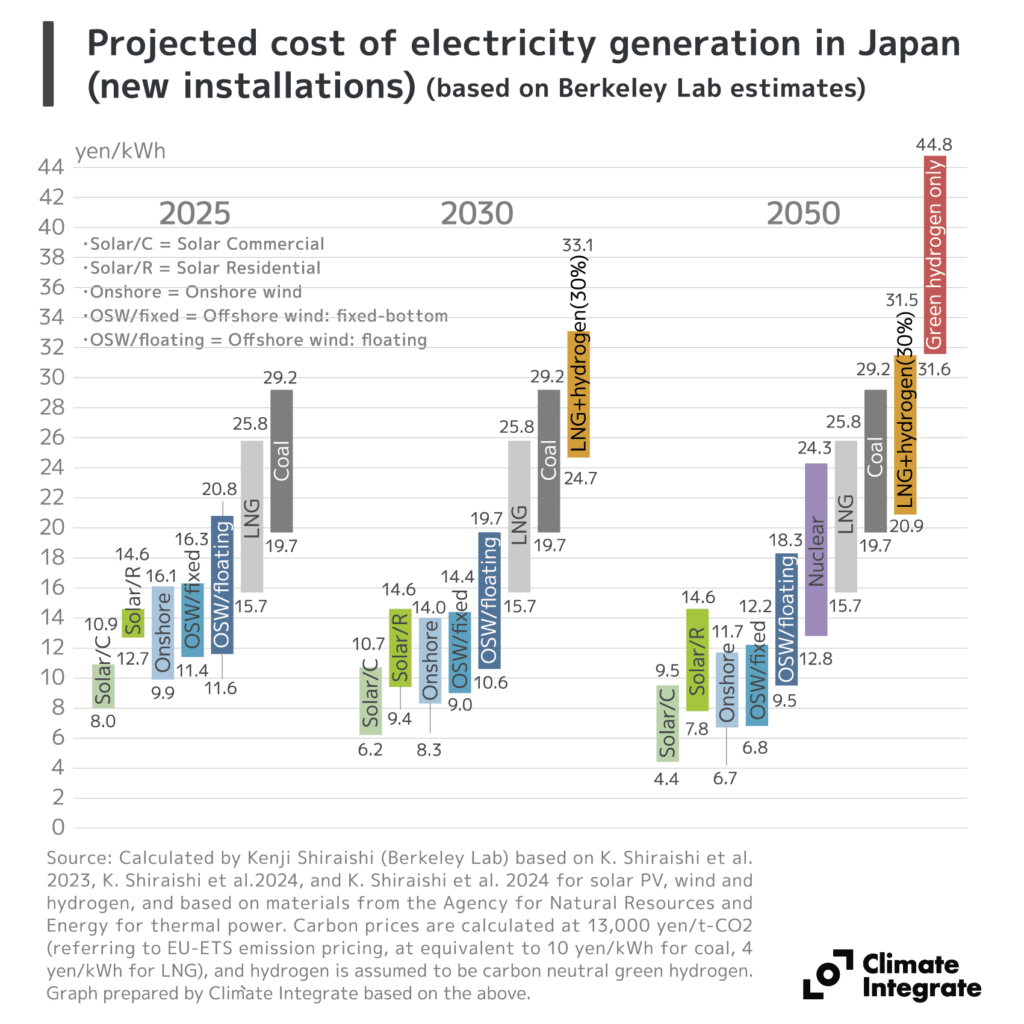

The costs of solar and wind continue to drop significantly in Japan. Rapid innovation and economies of scale are expected to drive further cost reductions, according to a scenario by Berkeley Lab. Cost-effective renewable energy can keep electricity prices low and stable.

Related pages:

[Insights]Mainstreaming Renewable Energy in Japan

Electricity: Thermal & Nuclear

Projected cost of electricity generation in Japan (new installations) (based on Berkeley Lab)

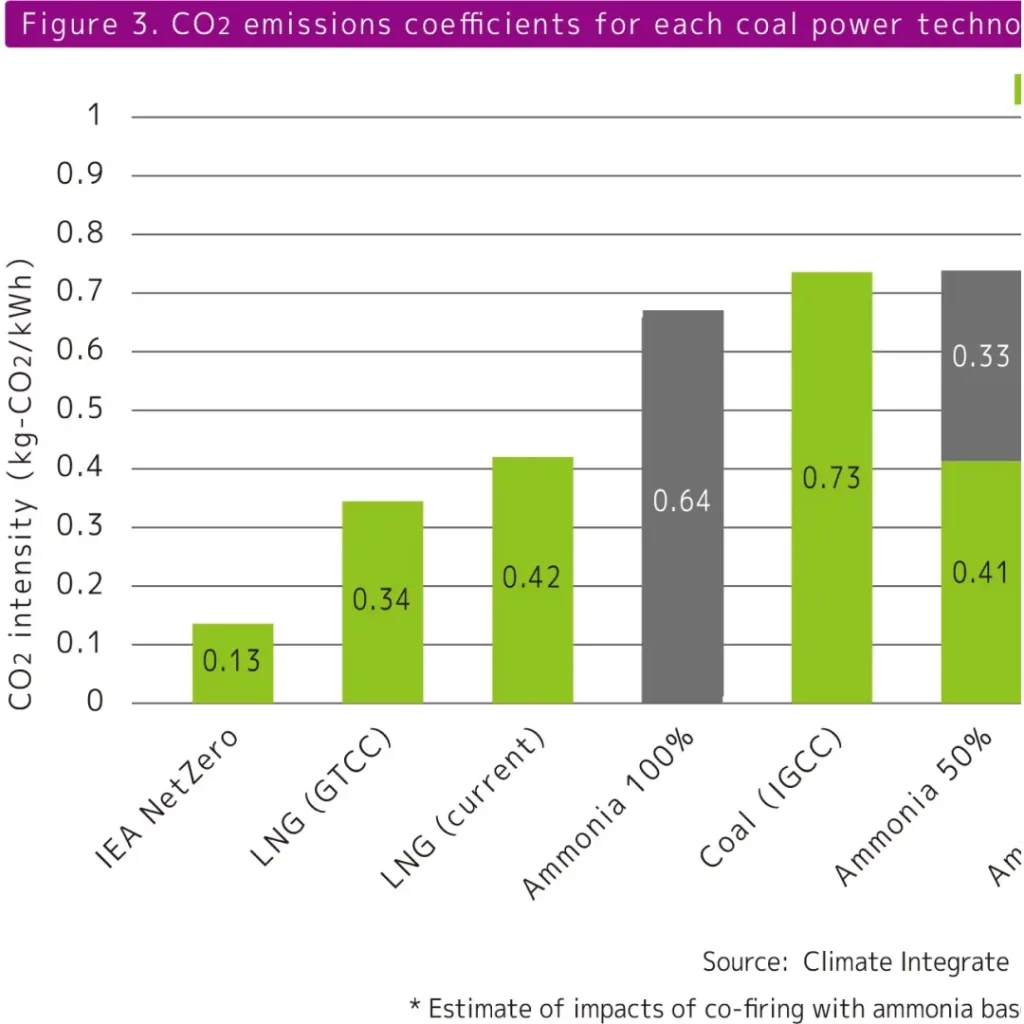

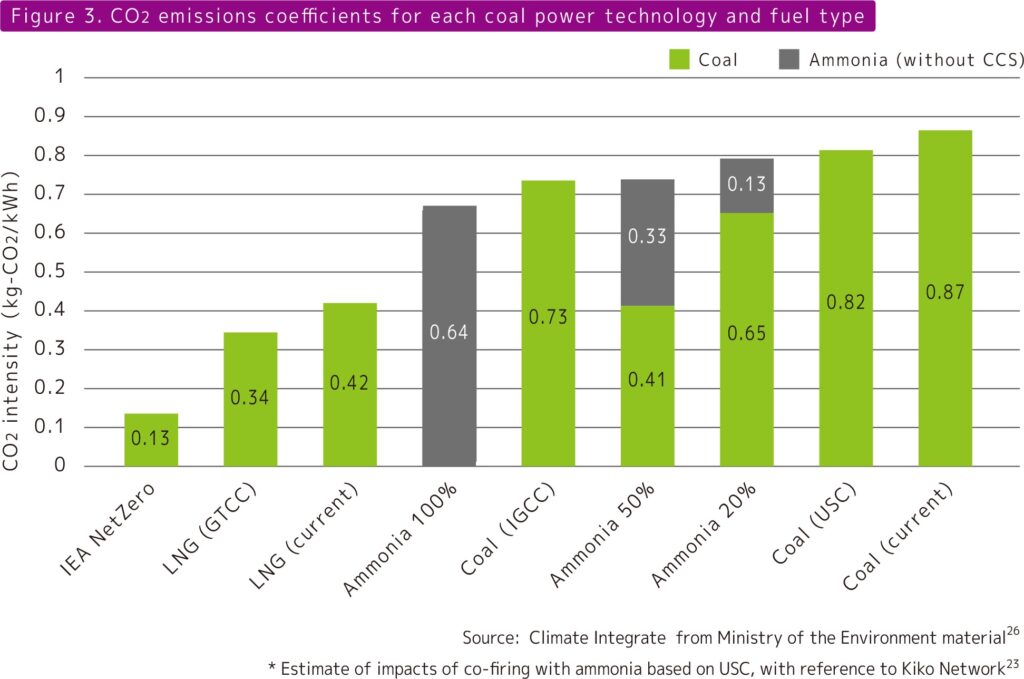

CO2 emissions coefficients for each coal power technology and fuel type

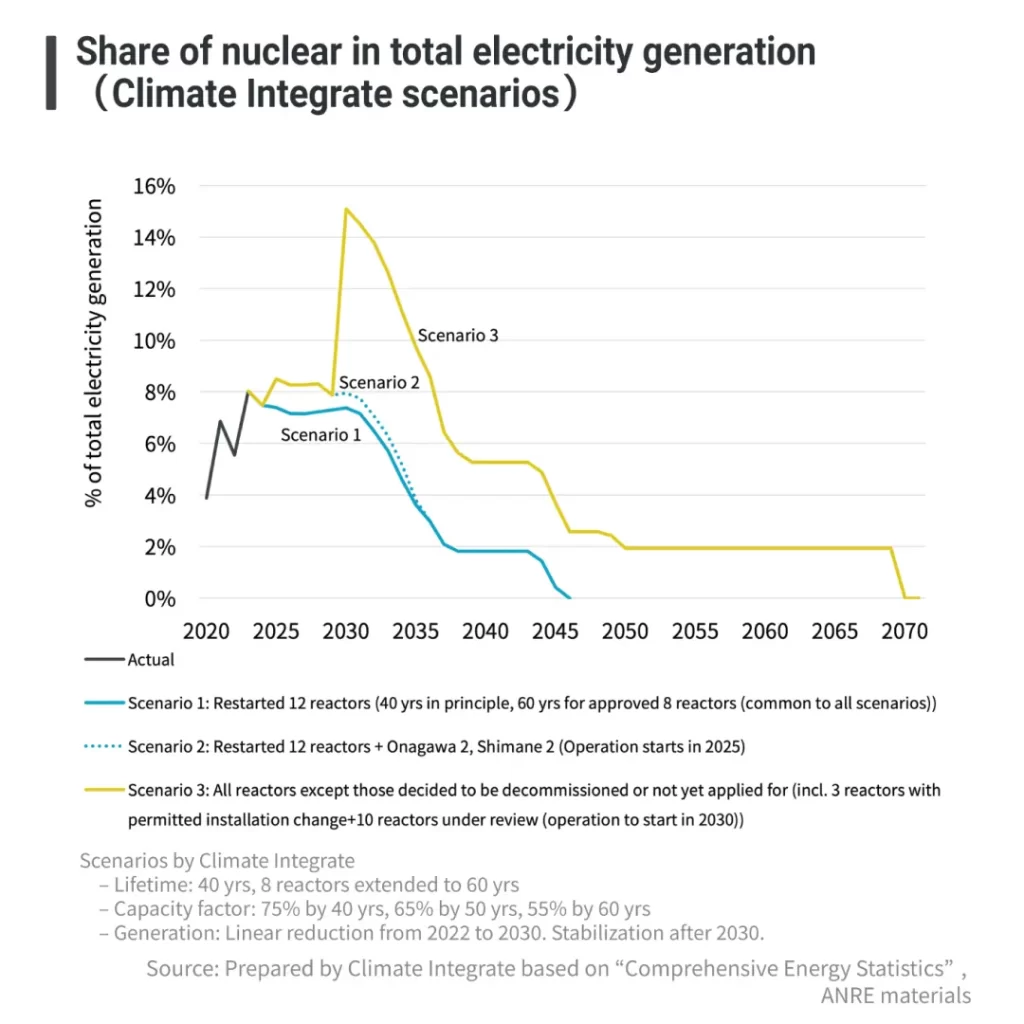

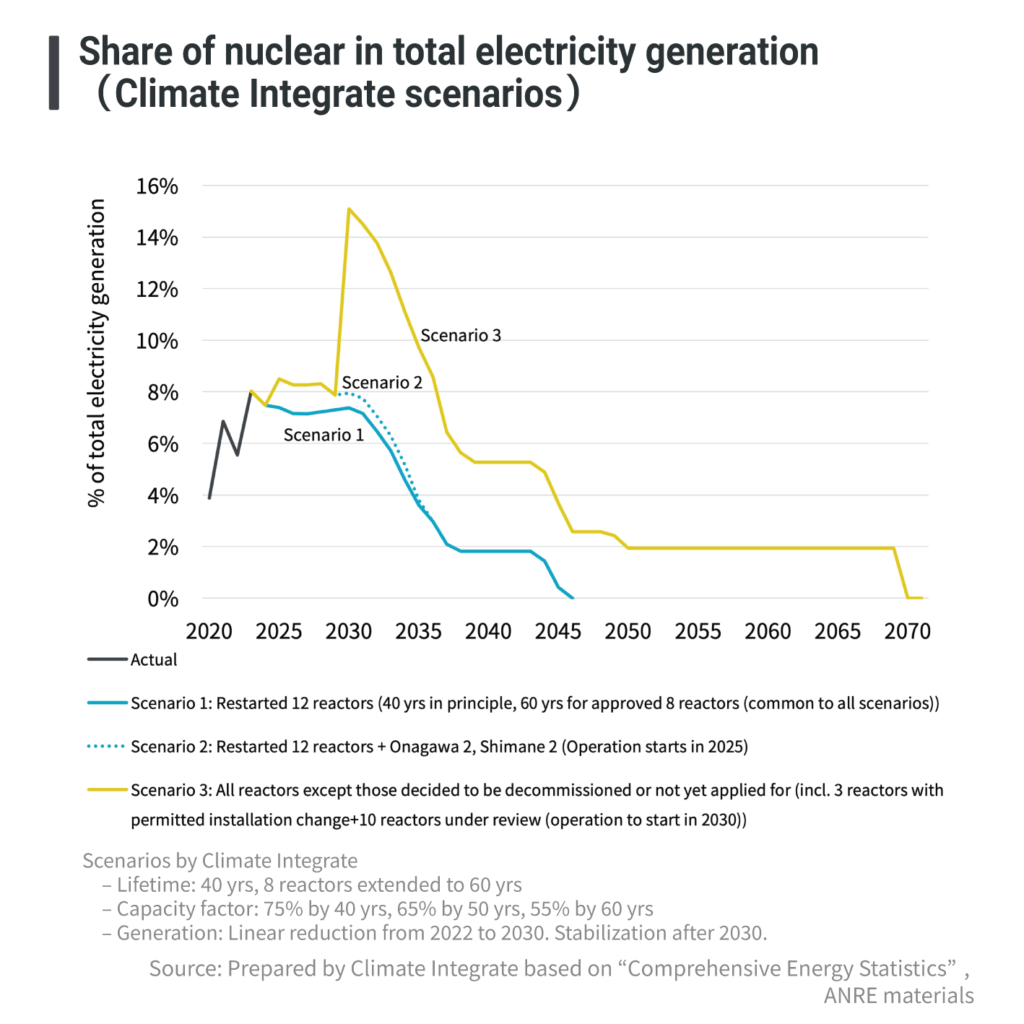

Share of nuclear in total electricity generation (Climate Integrate scenarios)

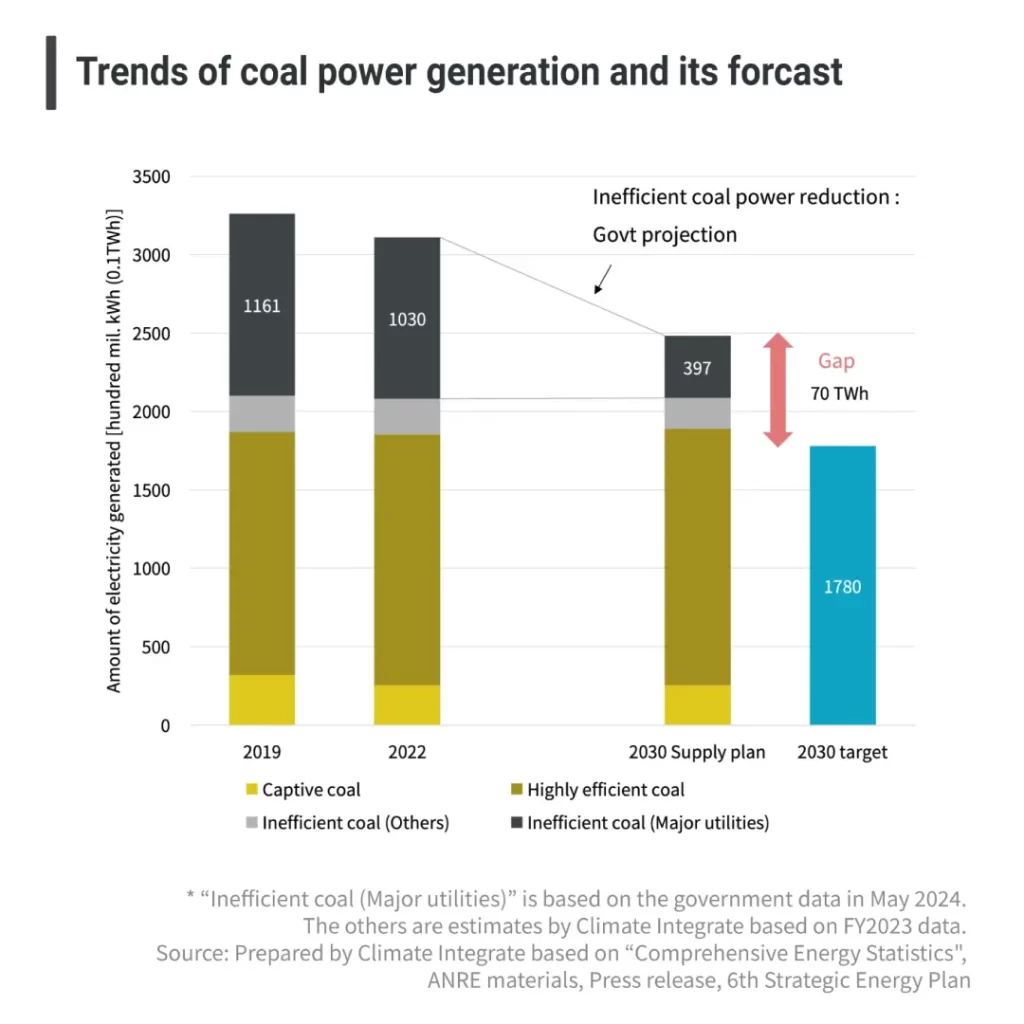

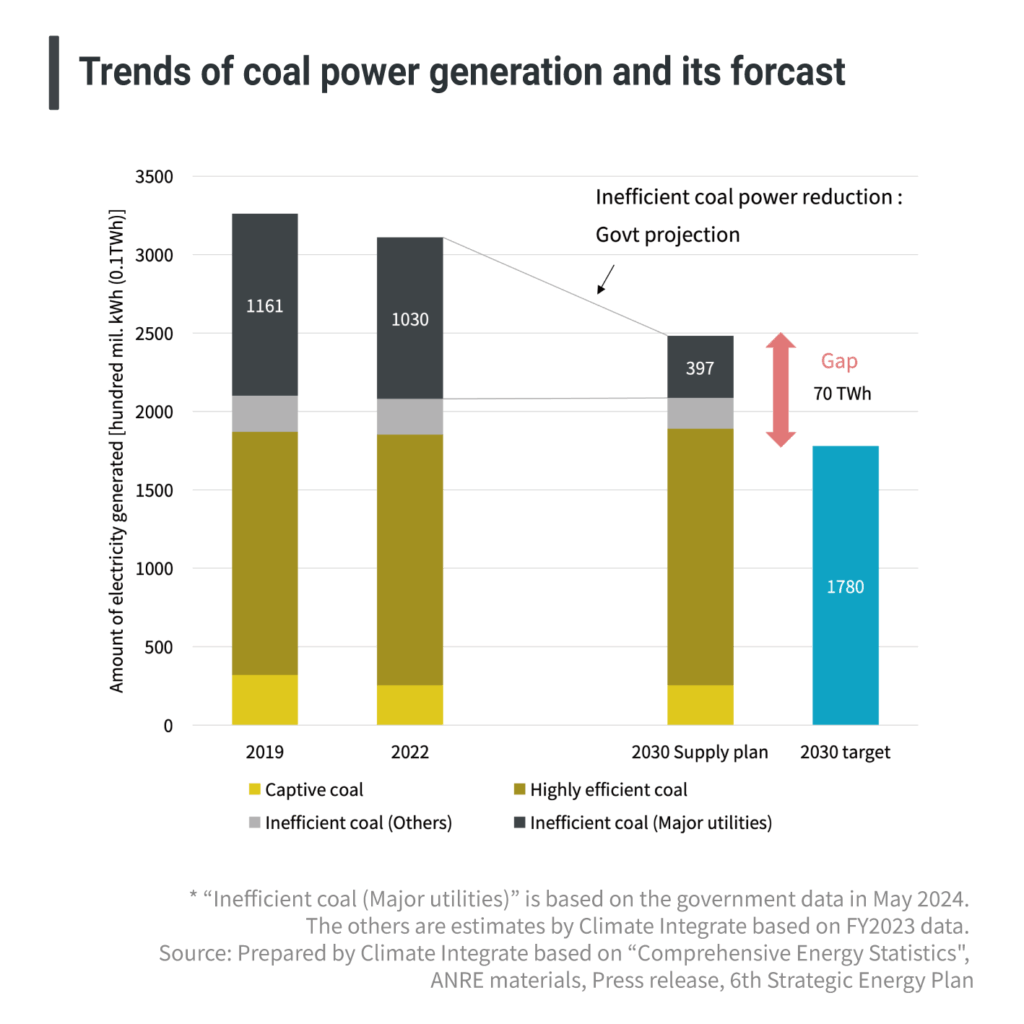

Japan’s government target is to cut coal power to 19% of the electricity mix by FY2030, well behind rising global expectations for advanced economies to phase out coal in the 2030s. With current policies focused only on “fading out” inefficient plants even this limited target will be difficult to meet.

Related pages:

[Insights]Fact sheet on Japan’s climate and energy policies

Conventional coal power has the highest CO₂ emissions, followed by LNG, based on CO₂ emission coefficients, technology, and fuel type. The Japanese government is promoting ammonia, but with 20% ammonia co-firing, reductions are minimal due to emissions from ammonia production, and even 100% ammonia firing emits over 1.5 times more CO₂ than LNG power.

Related pages:

[Reports]Report “Getting Lost on the Road to Decarbonization: Japan’s Big Plans for Ammonia”(updated June, 2022)

Even if the existing reactors are restarted or lifetimes extended, nuclear is still likely to peak at 7–15% of Japan’s electricity mix, then decline rapidly. Reaching the government’s target of 20% appears to be unlikely.

Related pages:

[Insights]Fact sheet on Japan’s climate and energy policies

Electricity: Renewables

Mainstreaming Renewable Energy (RE) in Japan

Benefits for Japan from mainstreaming RE

Merits of expanding RE

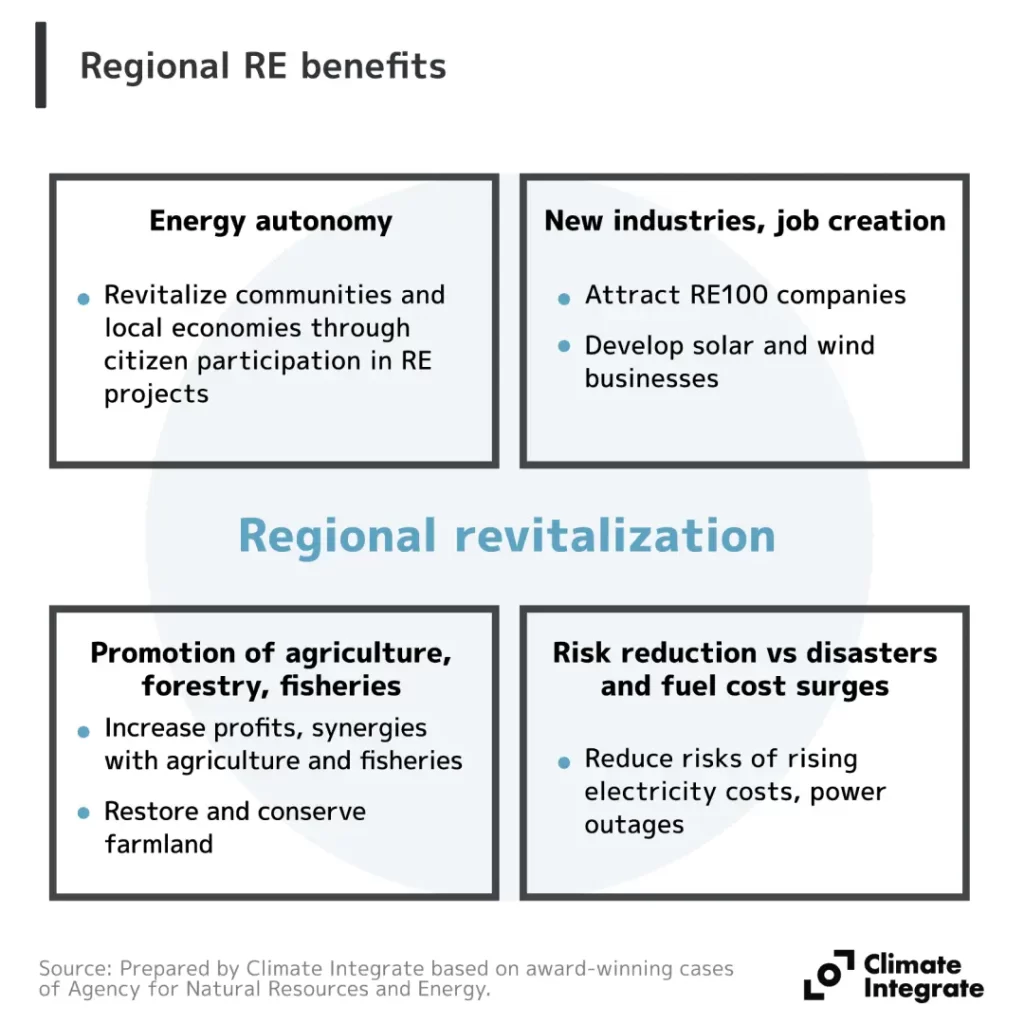

Regional RE benefits

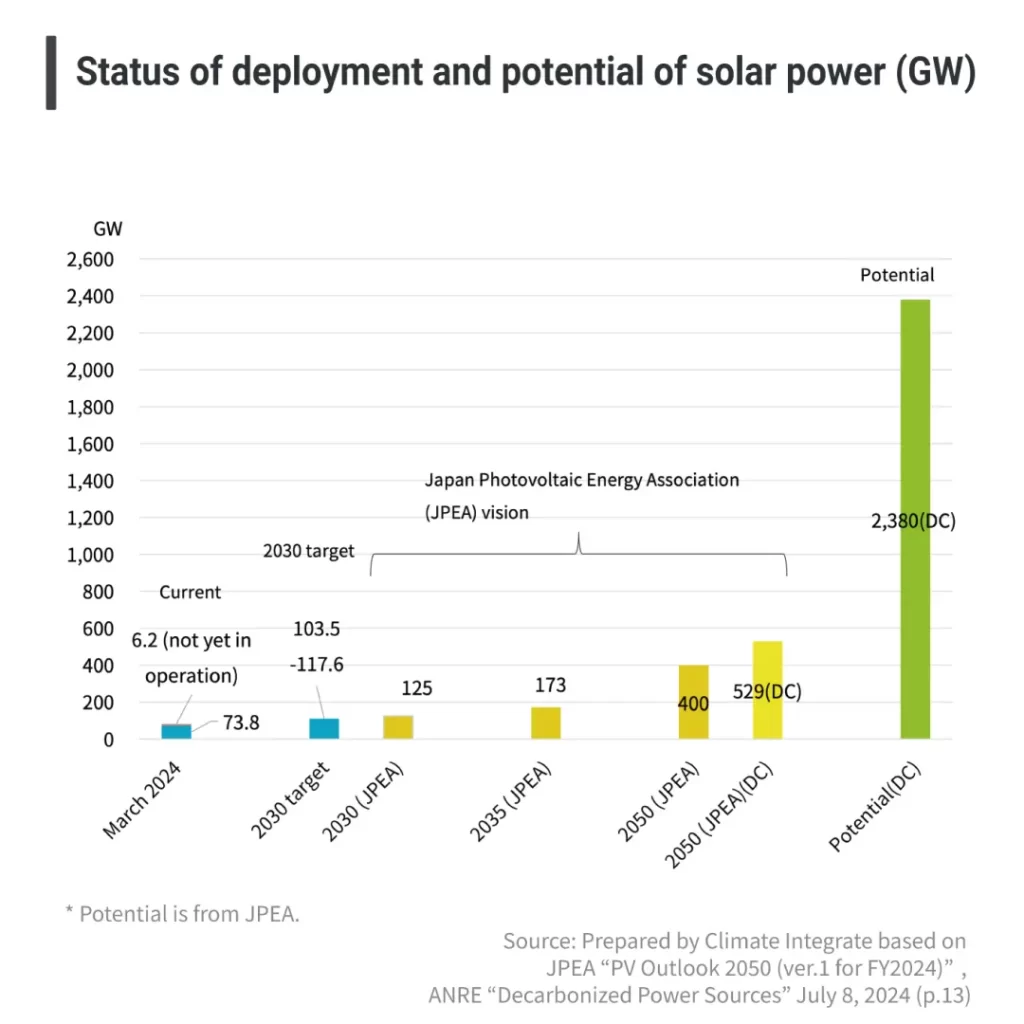

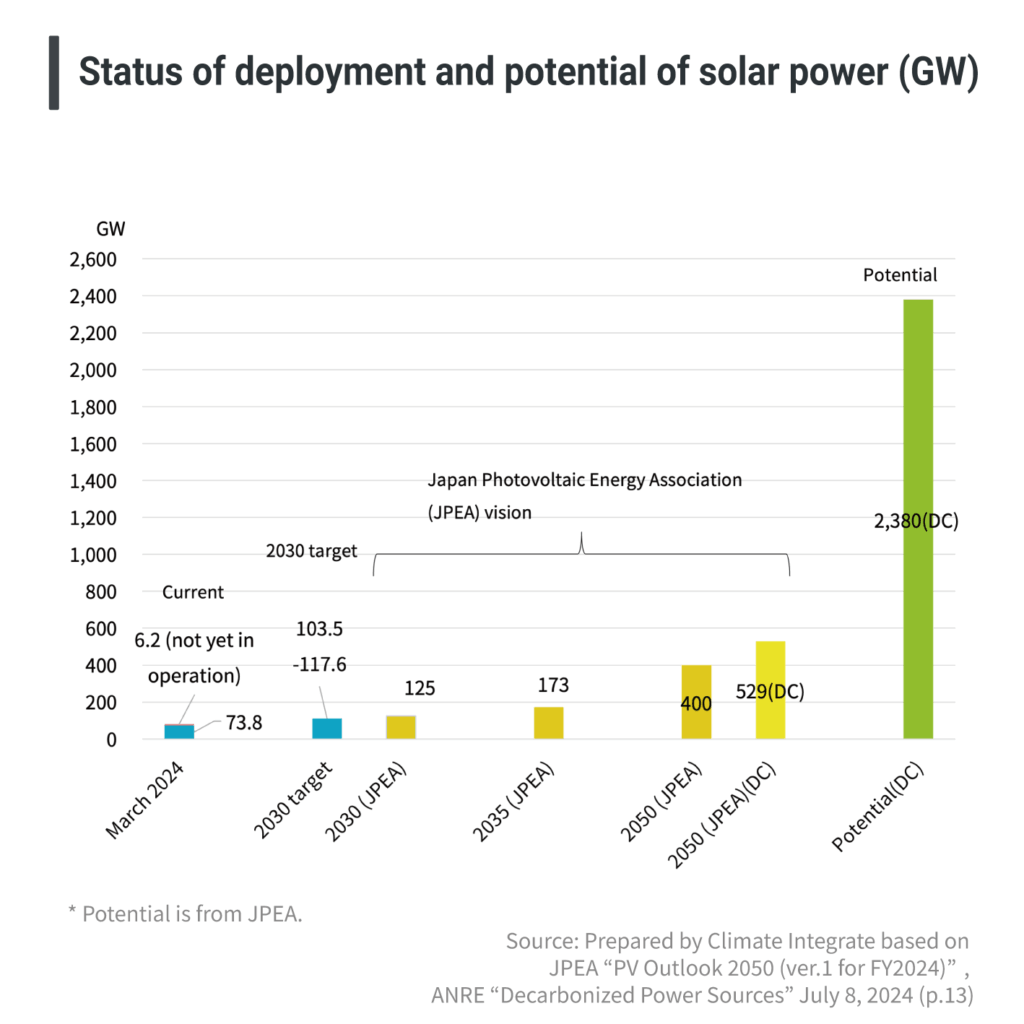

Status of deployment and potential of solar power (GW)

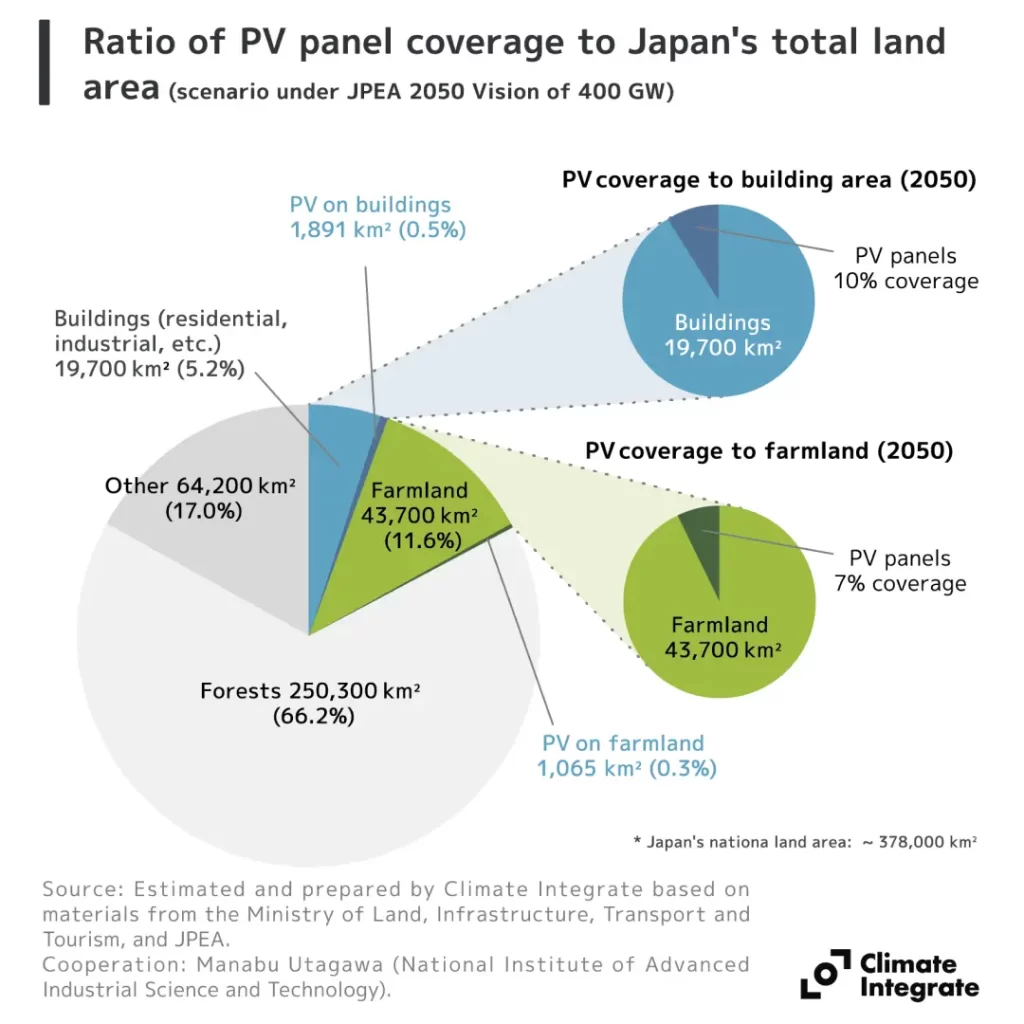

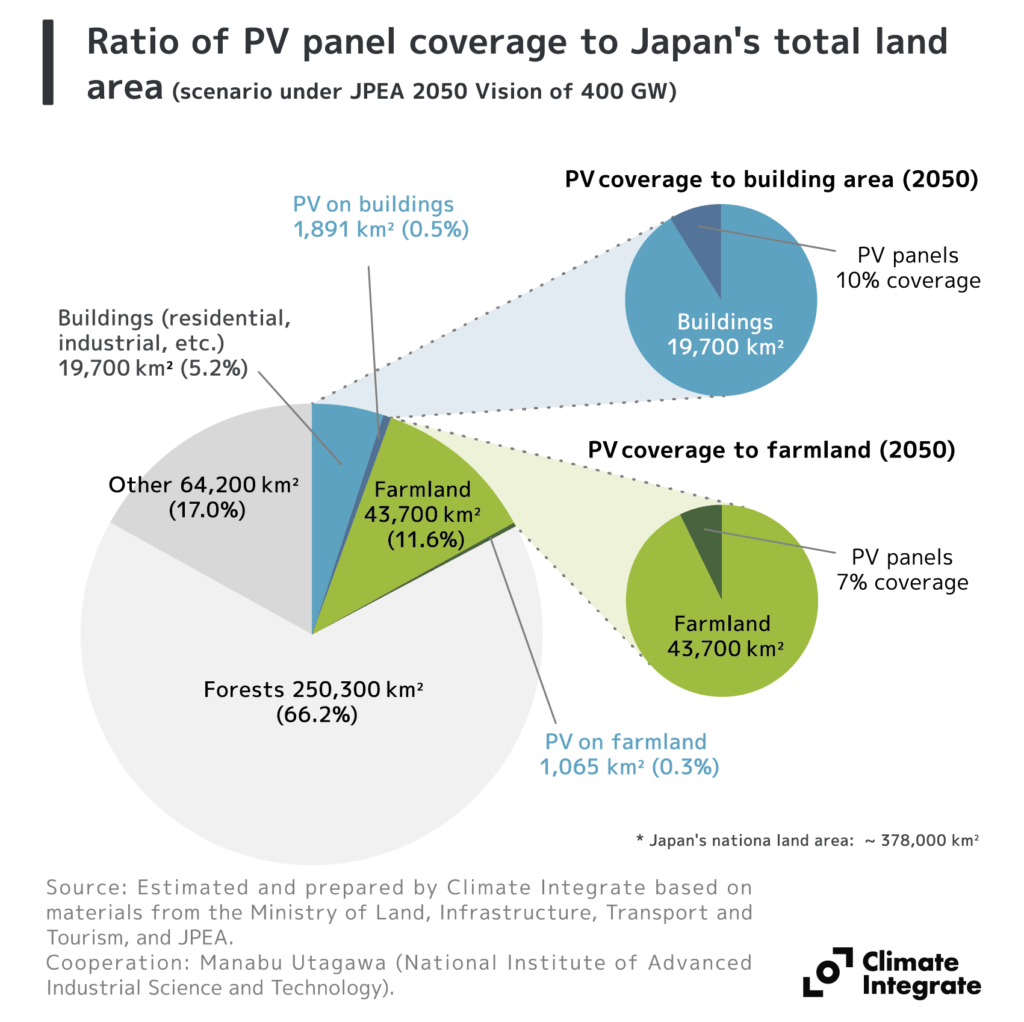

Ratio of PV panel coverage to Japan’s total land

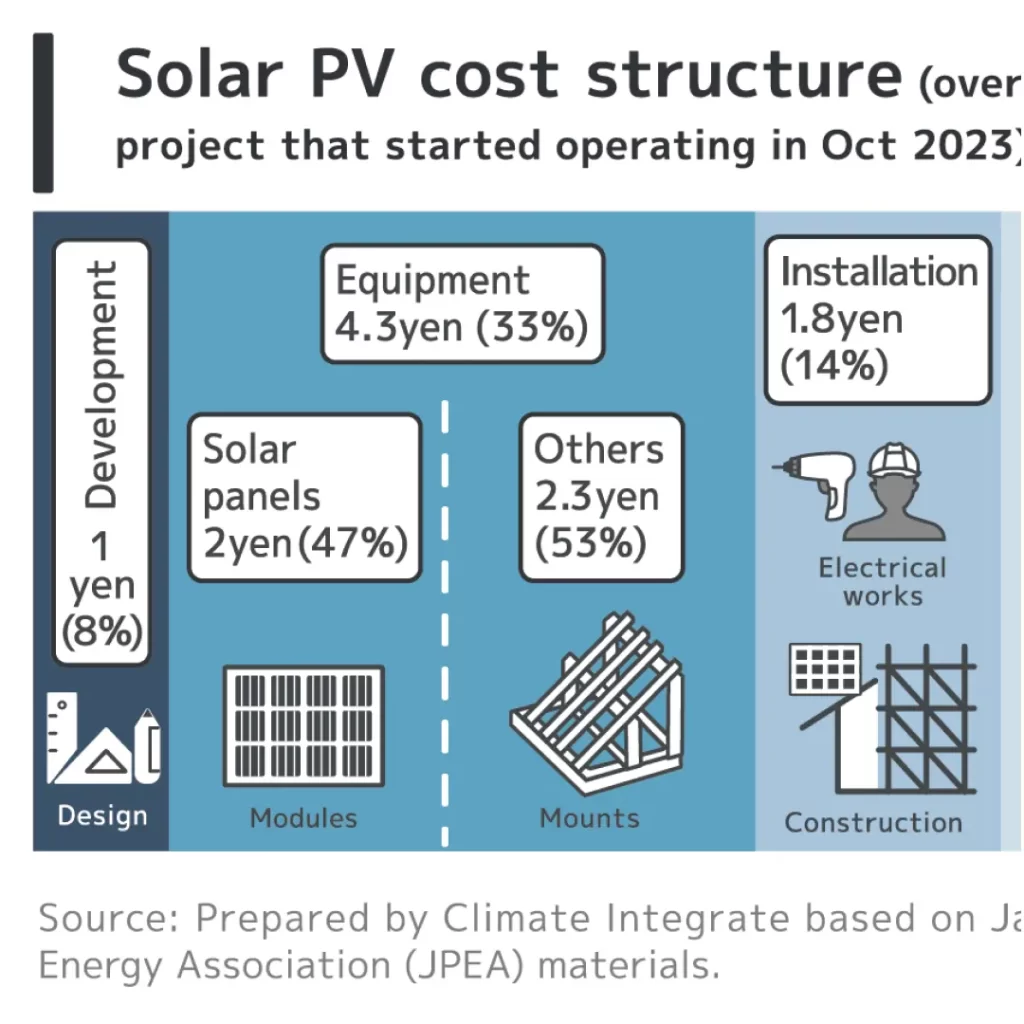

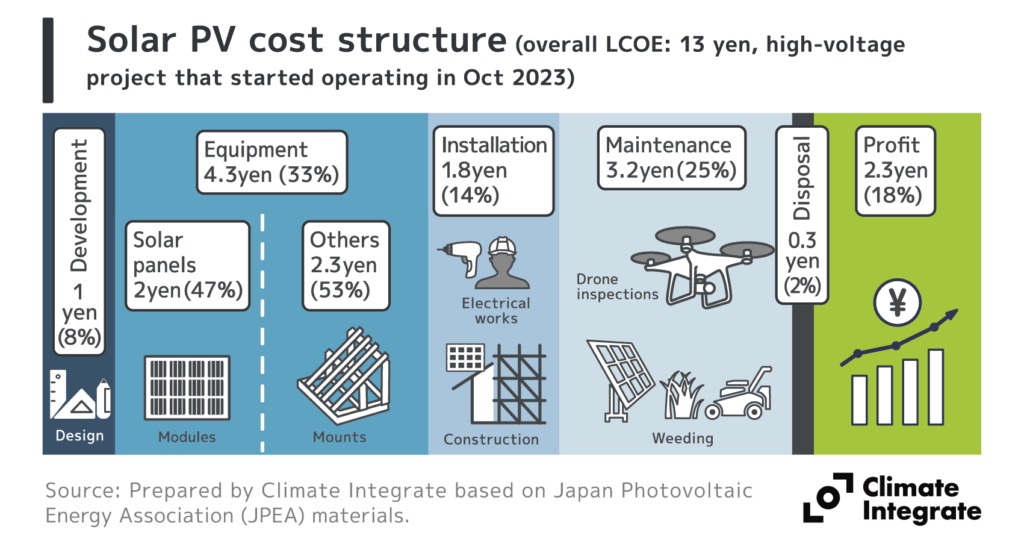

Cost structure for solar (LCOE: 13 yen/kWh, plants connected to HV grid commissioning in Oct. 2023)

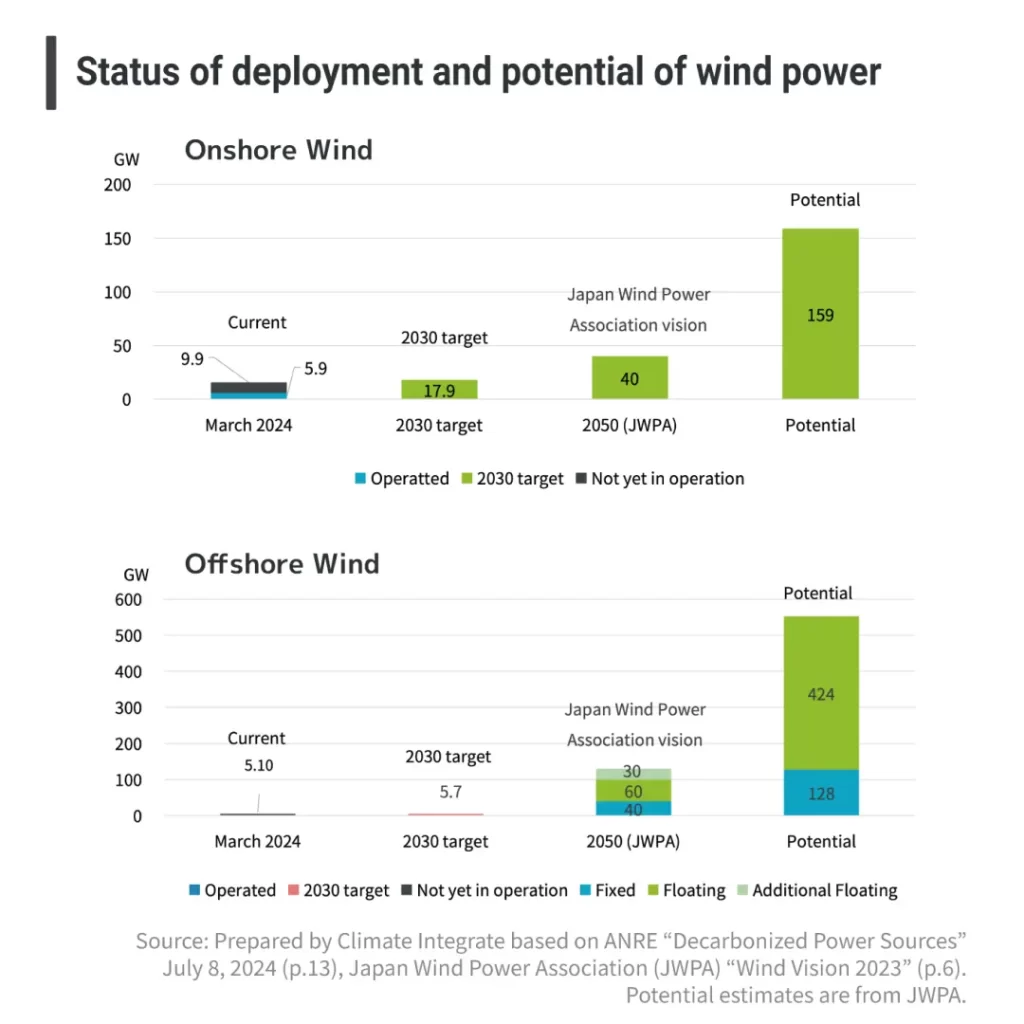

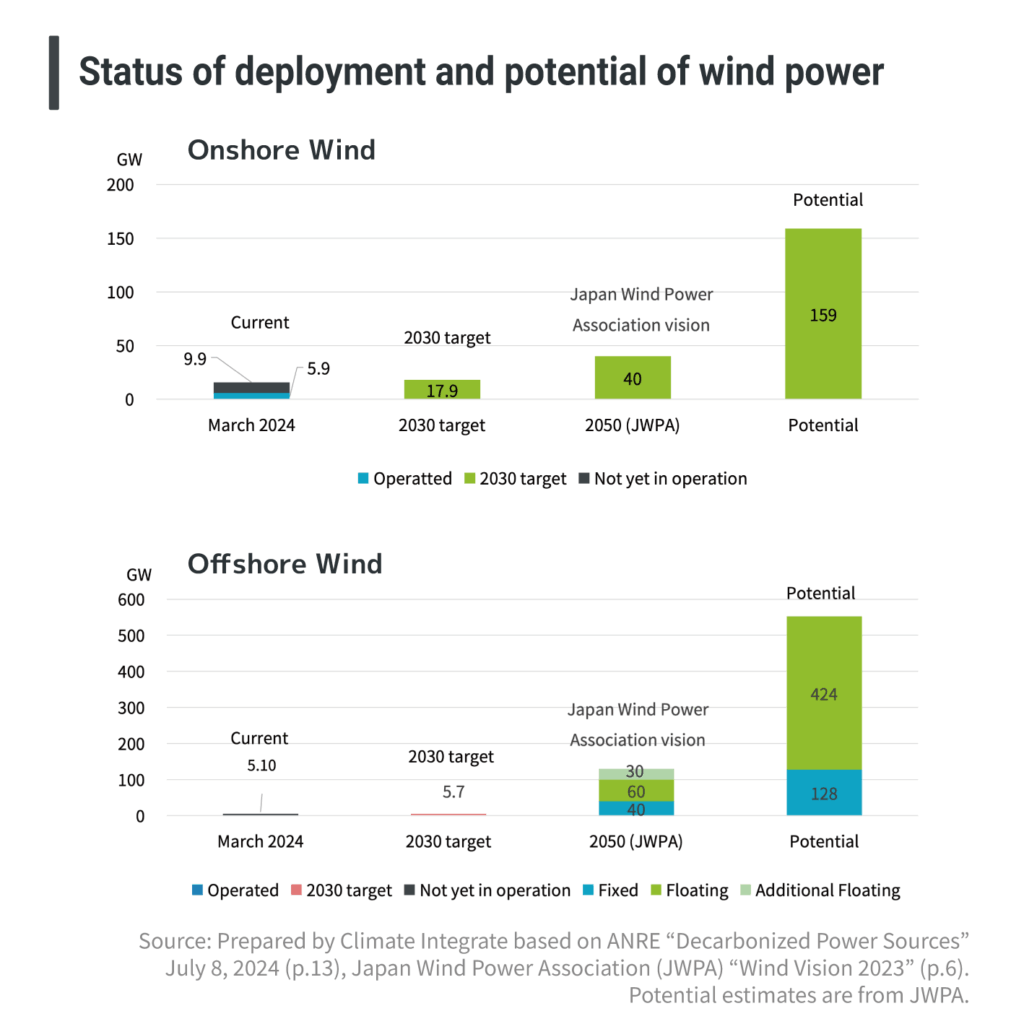

Status of deployment and potential of wind power

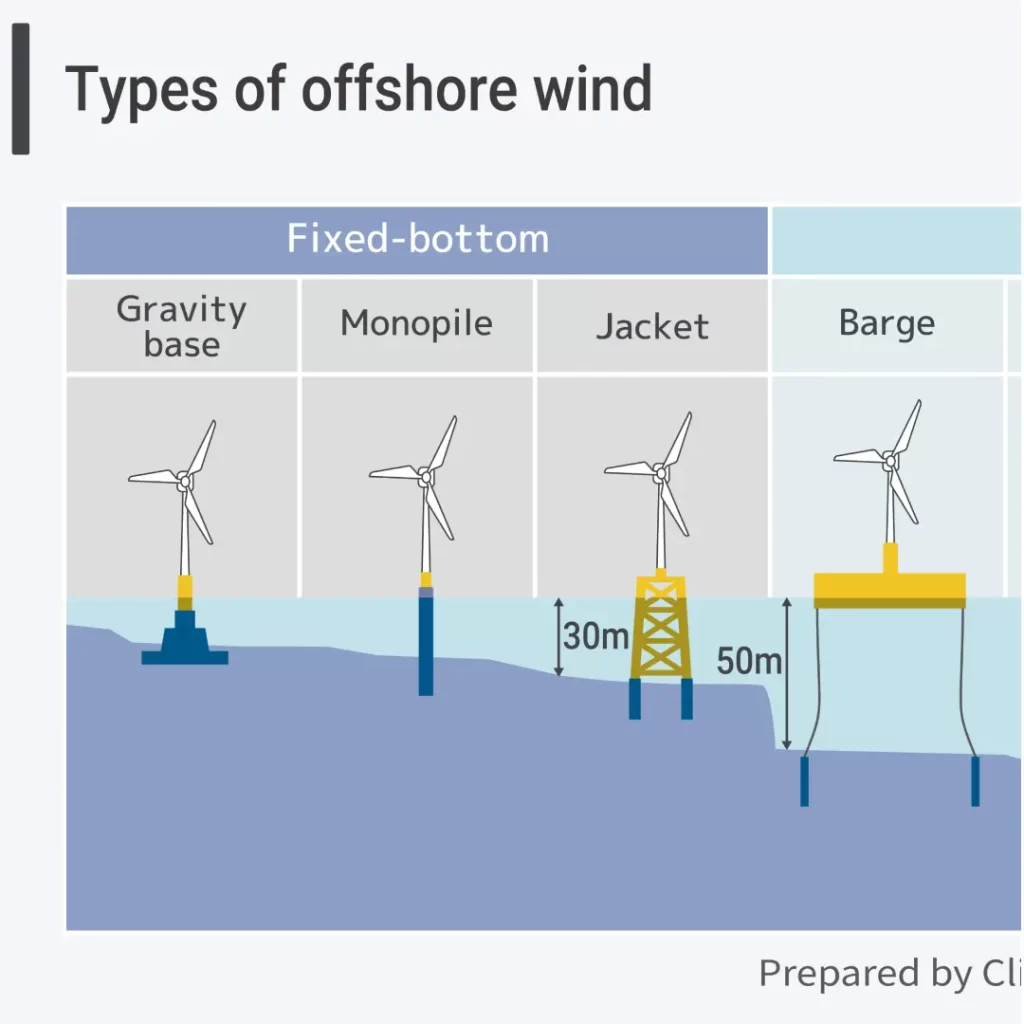

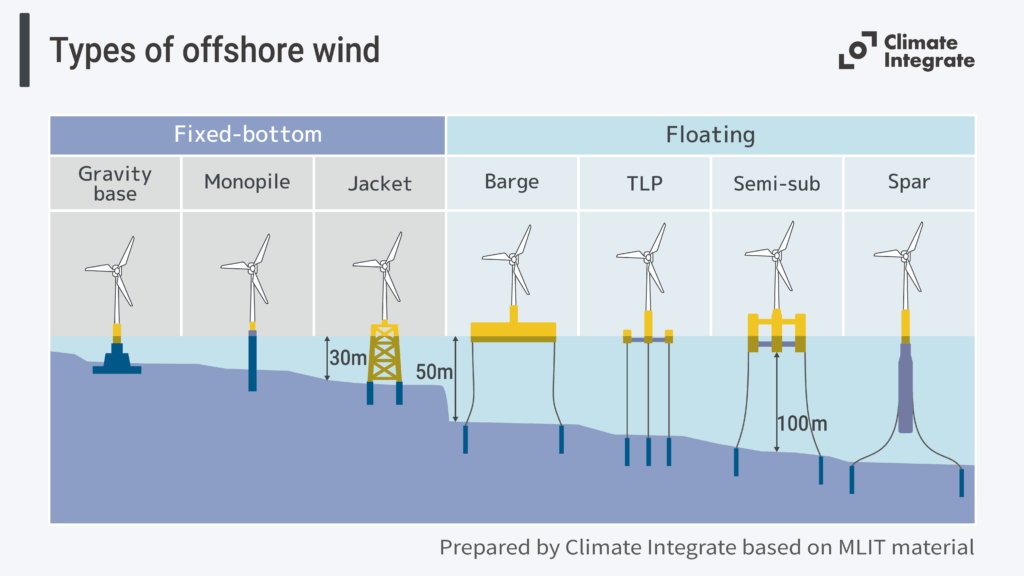

Types of offshore wind

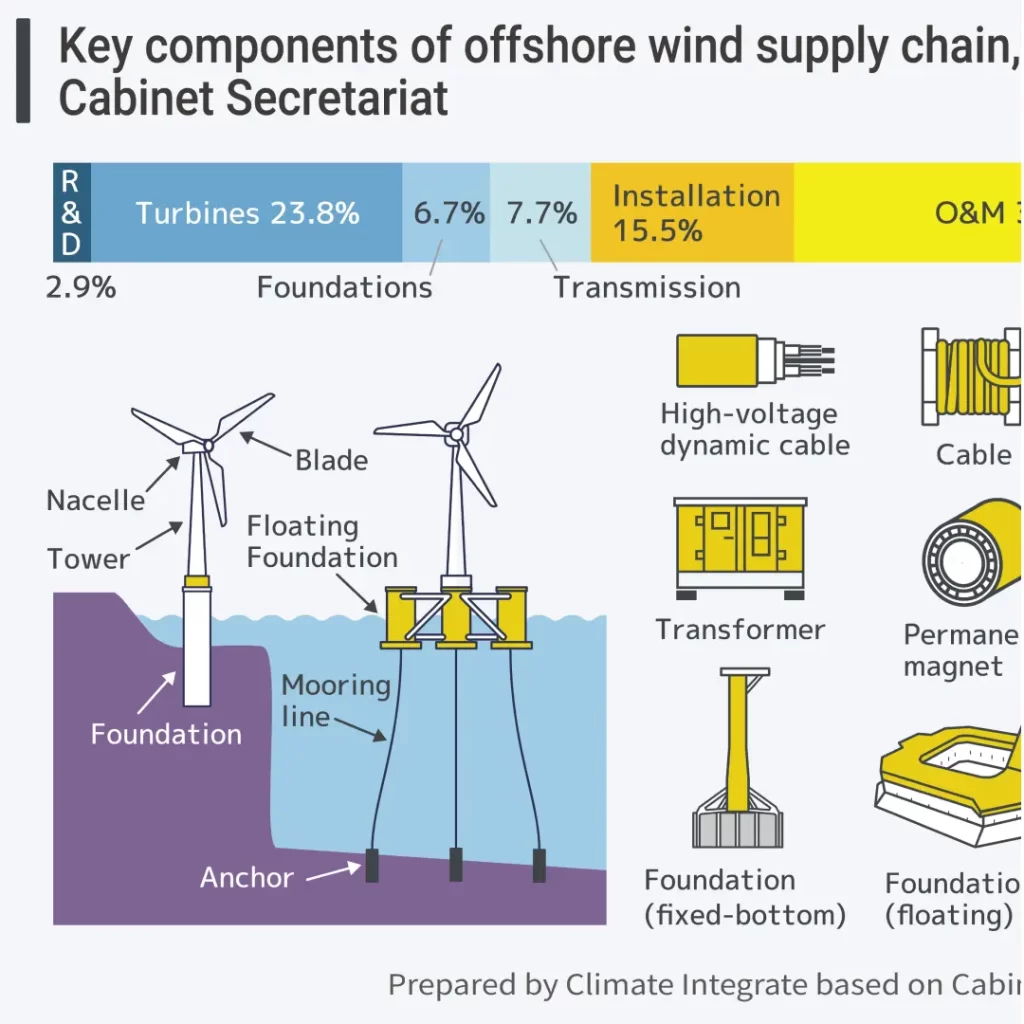

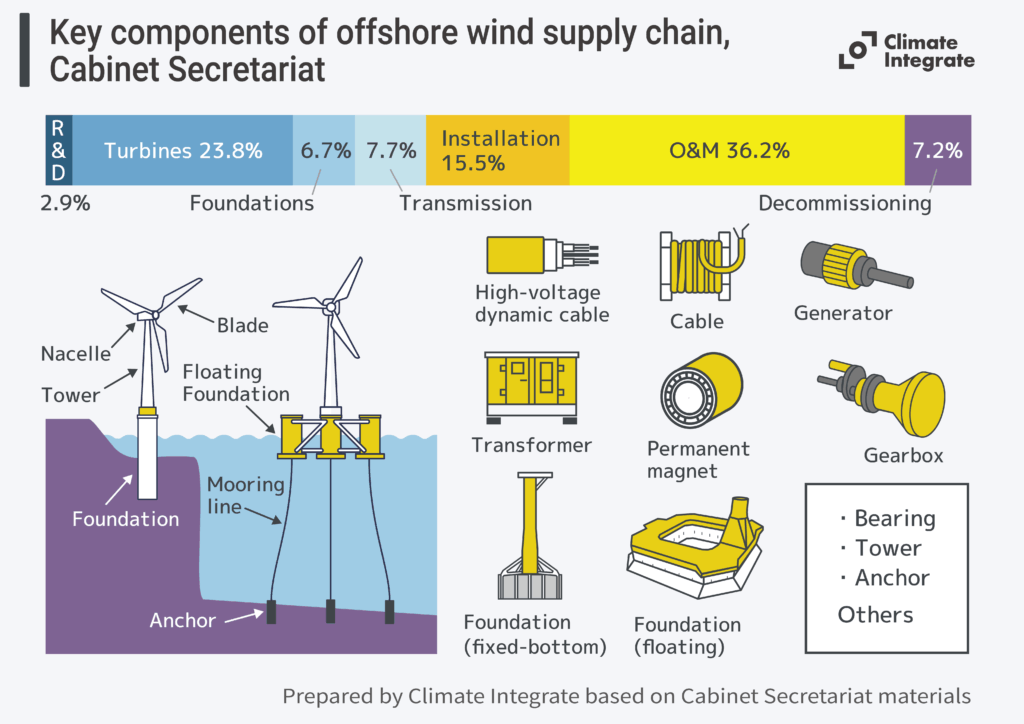

Key components of offshore wind supply chain, Cabinet Secretariat

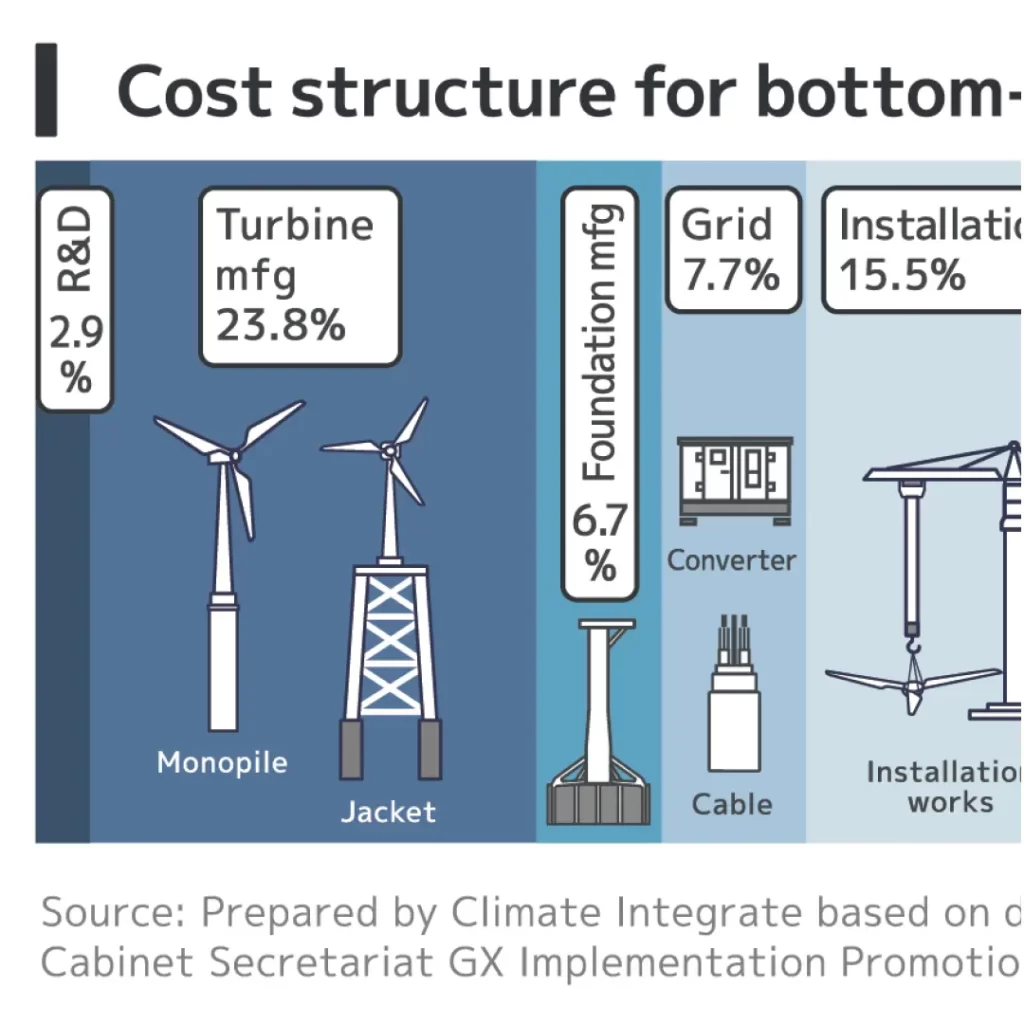

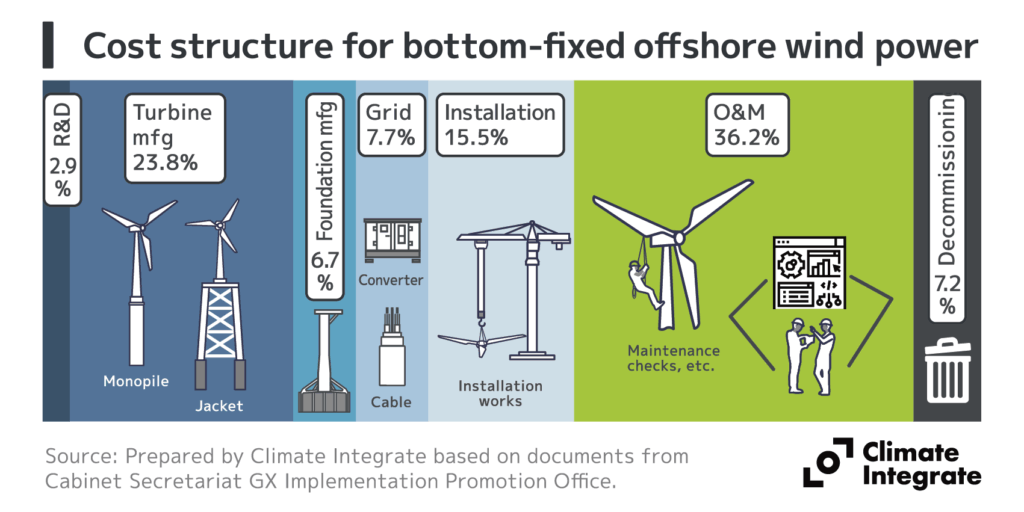

Cost structure for fixed-bottom offshore wind

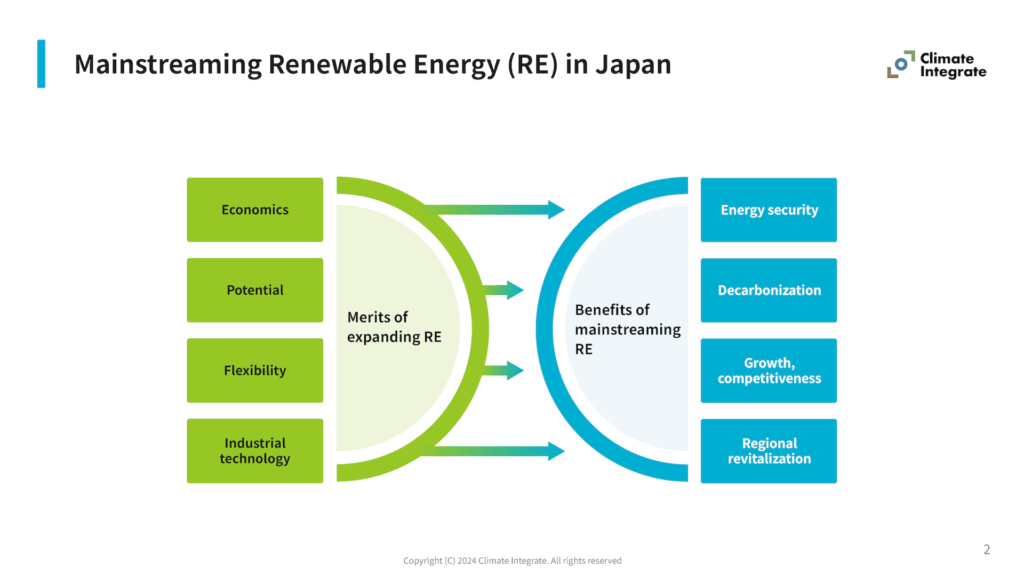

Mainstreaming renewable energy raises various discussions on its multiple “strengths” in boosting power supply capacity, as well as its broad “benefits” for national interests, the economy, local communities, and everyday life.

Related pages:

[Insights]Mainstreaming Renewable Energy in Japan

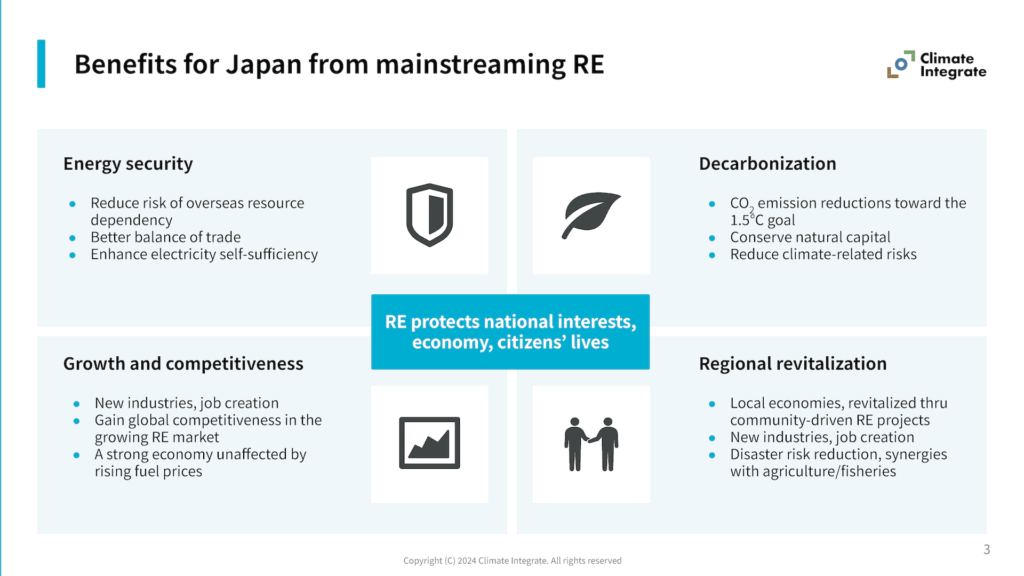

Mainstreaming renewable energy offers numerous benefits for Japan’s national interests, economy, and everyday life from the following perspectives:

1. Enhanced energy security

2. Transition to decarbonized society

3. Economic growth & enhanced international competitiveness

4. Regional revitalization

Related pages:

[Insights]Mainstreaming Renewable Energy in Japan

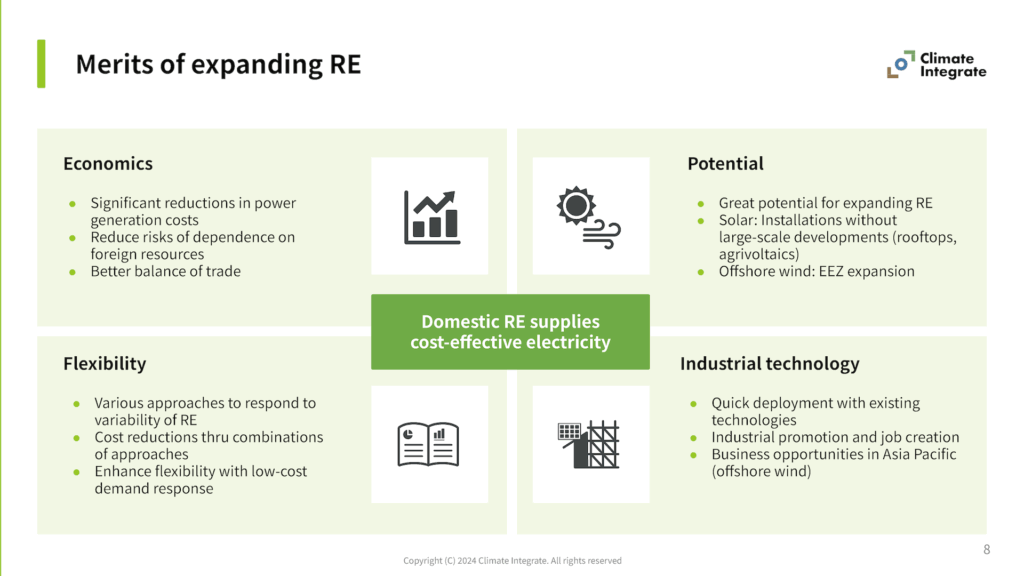

Mainstreaming renewable energy offers a range of strengths that enhance electricity supply capacity through (i) economics, (ii) vast potential to expand, (iii) flexibility, and (iv) industrial technology.

Related pages:

[Insights]Mainstreaming Renewable Energy in Japan

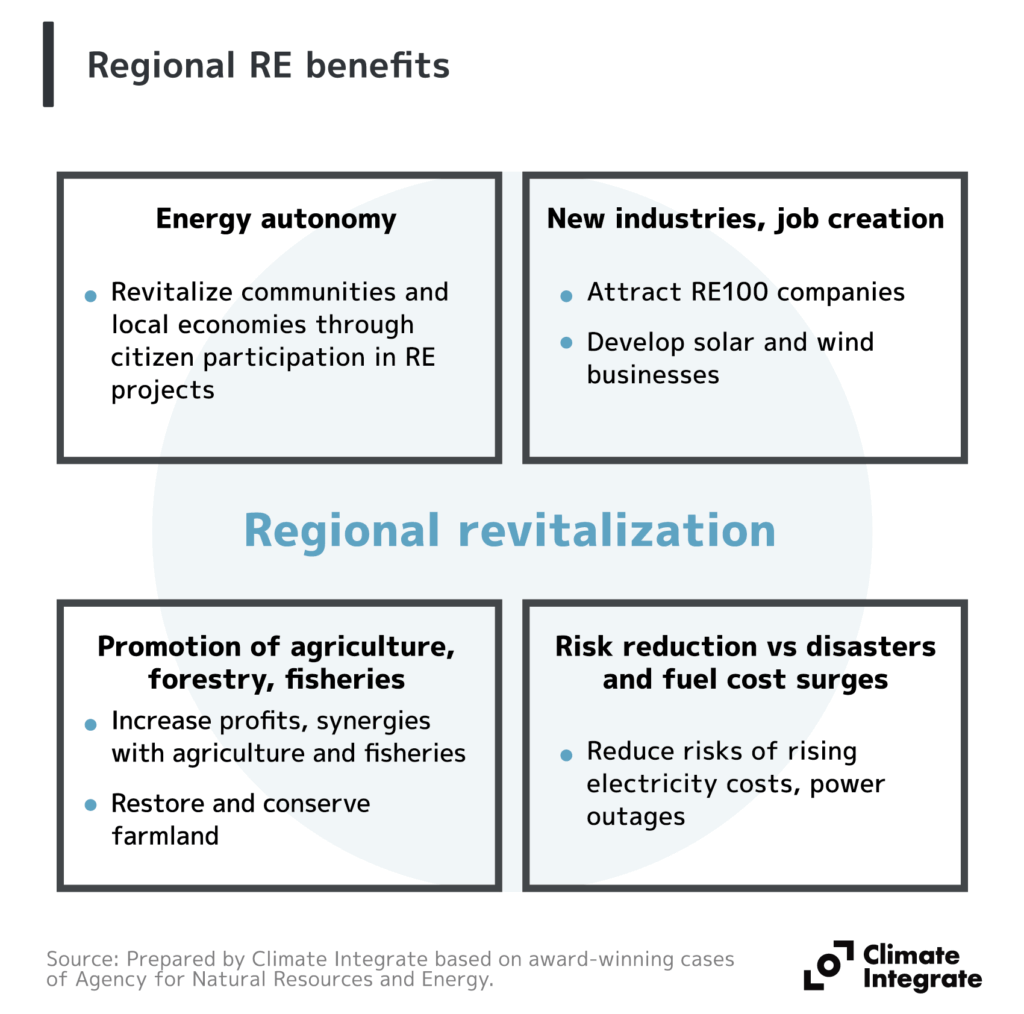

Renewable energy resources are local assets that can create industries and jobs, promote local economic flows, and strengthen communities. They also generate synergies with agriculture and fisheries, as well as benefits for disaster risk reduction and electricity costs.

Related pages:

[Insights]Mainstreaming Renewable Energy in Japan

Japan has significant potential for solar power generation. Installed capacity stood at 73.8 GW (as of March 2024), compared with the 2030 targets of 103.5 to 117.6 GW. The recent deployment rate of 5 GW/year is about half of the peak level of 9.4 GW/year. The Japan Photovoltaic Energy Association has set its own target of 400 GW by 2050.

Related pages:

[Insights]Fact sheet on Japan’s climate and energy policies

In the case of achieving 400 GW (JPEA 2050 Vision scenario), PV would cover ~1% of Japan’s total land area. Agrivoltaics (107 GW) would cover 7% of farmland while rooftop PV (228 GW) would occupy 10% of roof area. If installed in suitable locations, PV can be a major source of electricity supply.

Related pages:

[Insights]Mainstreaming Renewable Energy in Japan

Solar panels only account for about 15% of the total cost structure for solar power generation (LCOE). While reliance on overseas suppliers for solar panels is a concern, expenditures for equipment, construction, and operation and maintenance are expected to generate domestic business opportunities.

Related pages:

[Insights]Mainstreaming Renewable Energy in Japan

As of March 2024, Japan’s installed capacity of onshore wind stood at 5.9 GW, against the 2030 target of 17.9 GW. Due to local concerns, 9.9 GW has not yet begun operating even after receiving approvals. Installed capacity of offshore wind stood at 0.15 GW, against the 2030 target of 5.7 GW, which includes 5.1 GW (mainly bottom-fixed), now at various stages of development.

Related pages:

[Insights]Fact sheet on Japan’s climate and energy policies

Offshore wind power comes in two types: turbines fixed to the seabed (“fixed-bottom”) and those mounted on floating foundations. Fixed-bottom systems are currently more common in Japan, but the country’s deep surrounding waters offer substantial potential for floating offshore wind.

Related pages:

[Reports]Report “Offshore Wind in Japan: Policy Agenda and Prospects”

The supply chain for offshore wind consists of many components such as blades and nacelles, as well as specialized vessels, offering potential to stimulate domestic industries. Developing the supply chain will also require upgrades or new construction of port facilities able to handle large components.

Related pages:

[Reports]Report “Offshore Wind in Japan: Policy Agenda and Prospects”

The cost structure of offshore wind spans all phases of work, from site surveys to decommissioning. Operations and maintenance account for a larger share (36.2%) than turbine manufacturing (23.8%), creating opportunities for domestic companies to enter the market.

Related pages:

[Insights]Mainstreaming Renewable Energy in Japan

Energy Efficiency

Improve energy efficiency

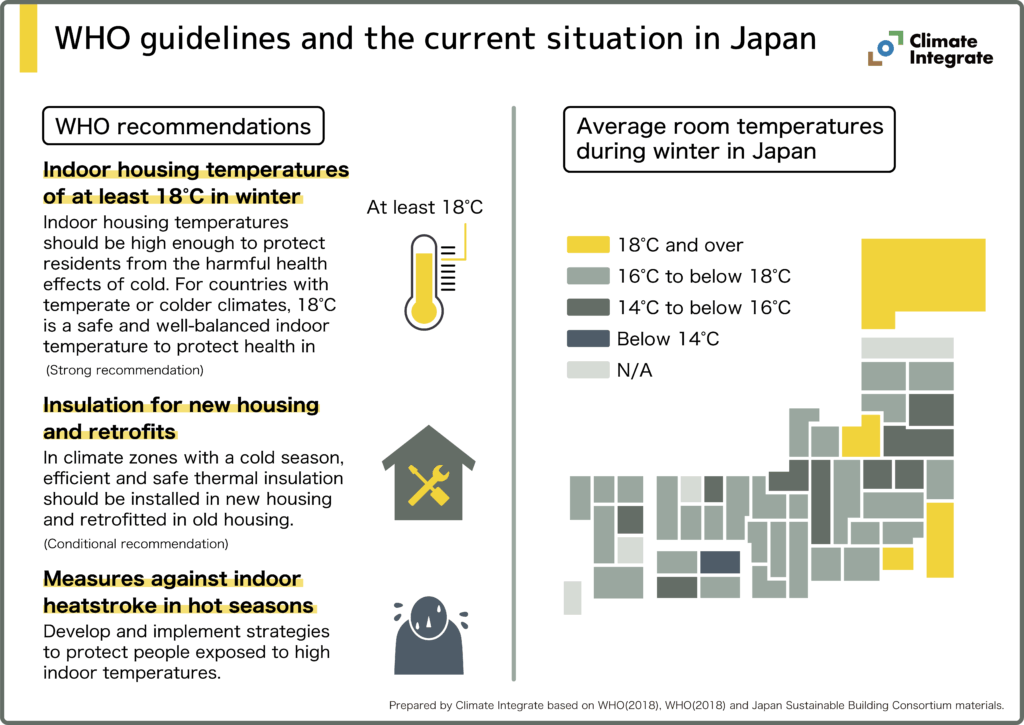

WHO guidelines and the current situation in Japan

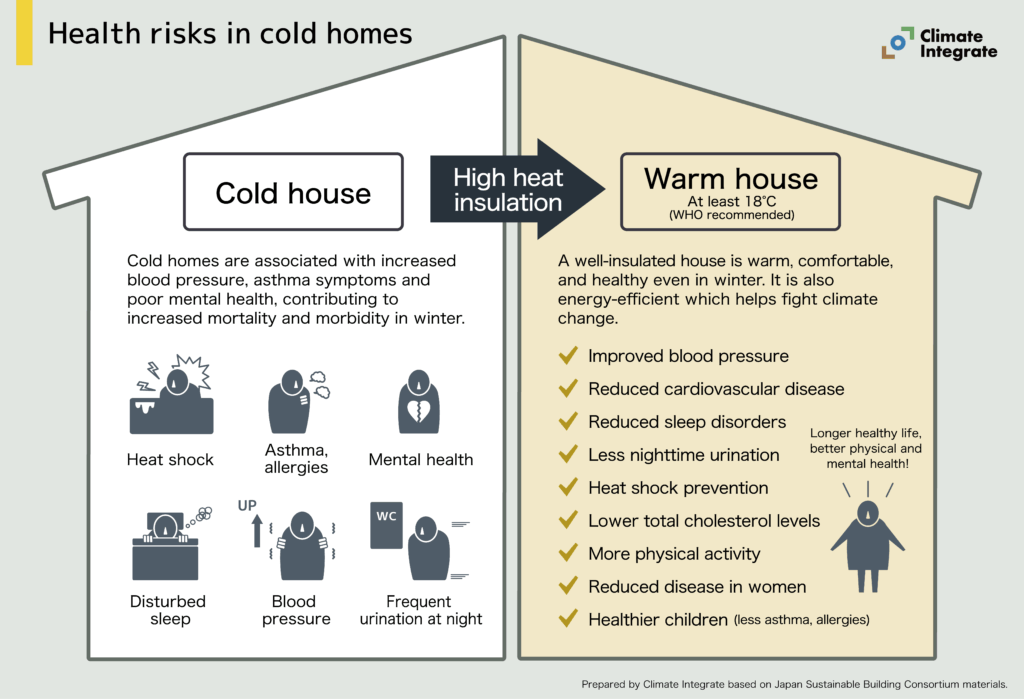

Health risks in cold homes

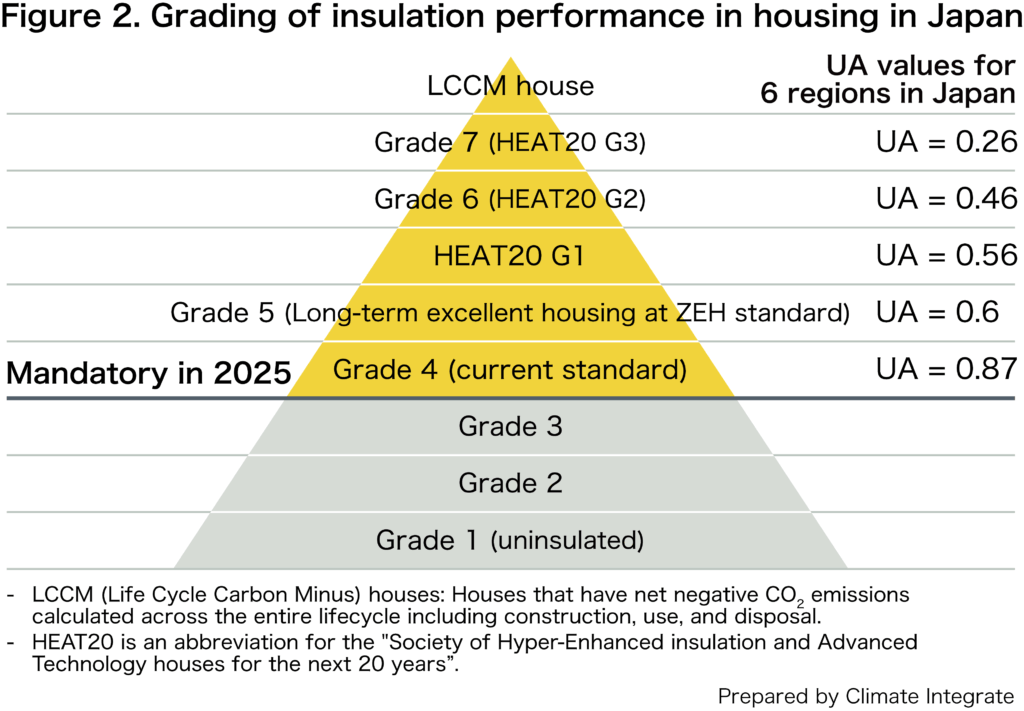

Grading of insulation performance in housing in Japan

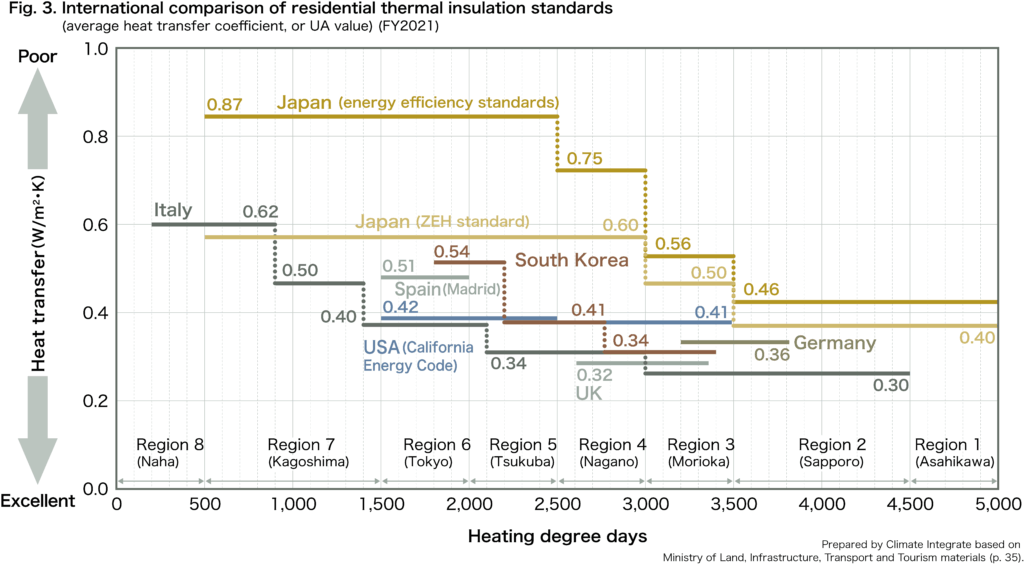

International comparison of residential thermal insulation standards

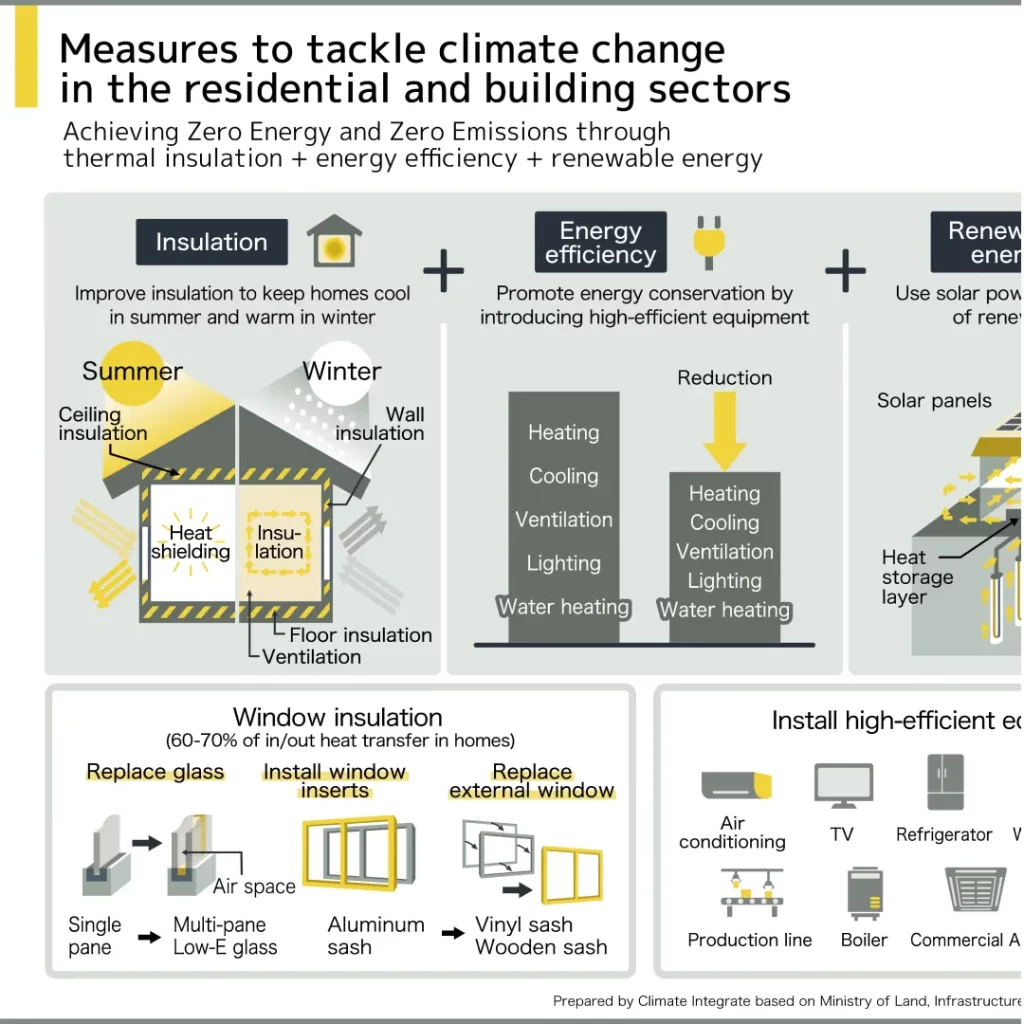

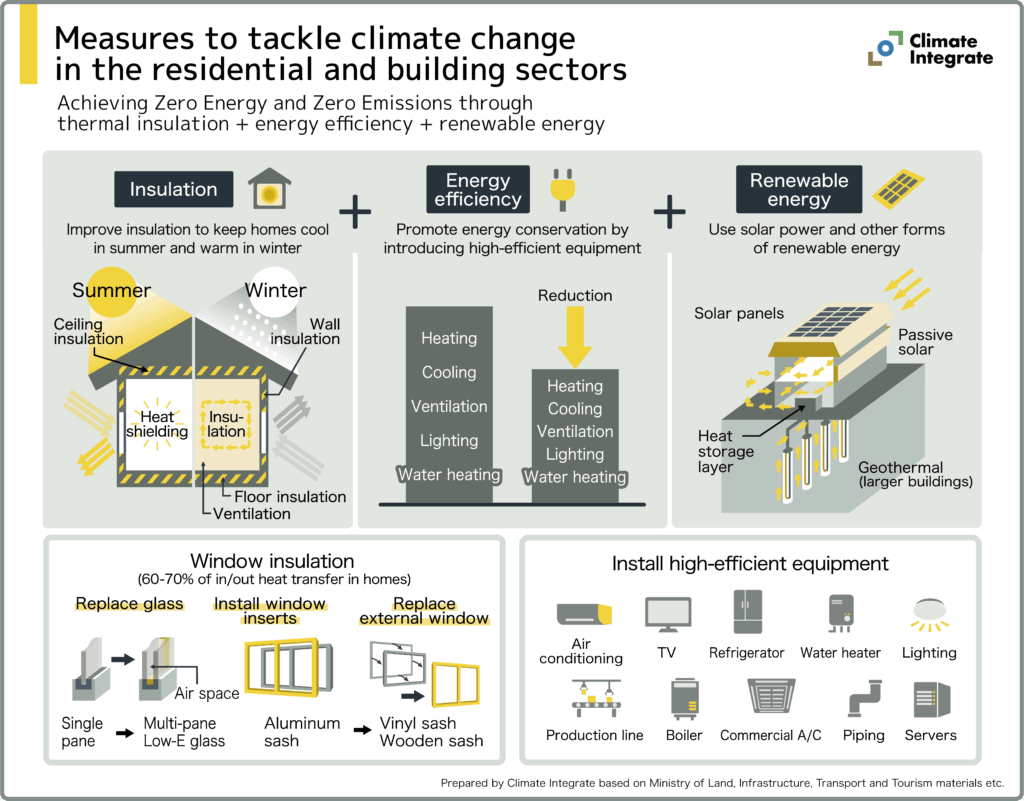

Measures to tackle climate change in the residential and building sectors

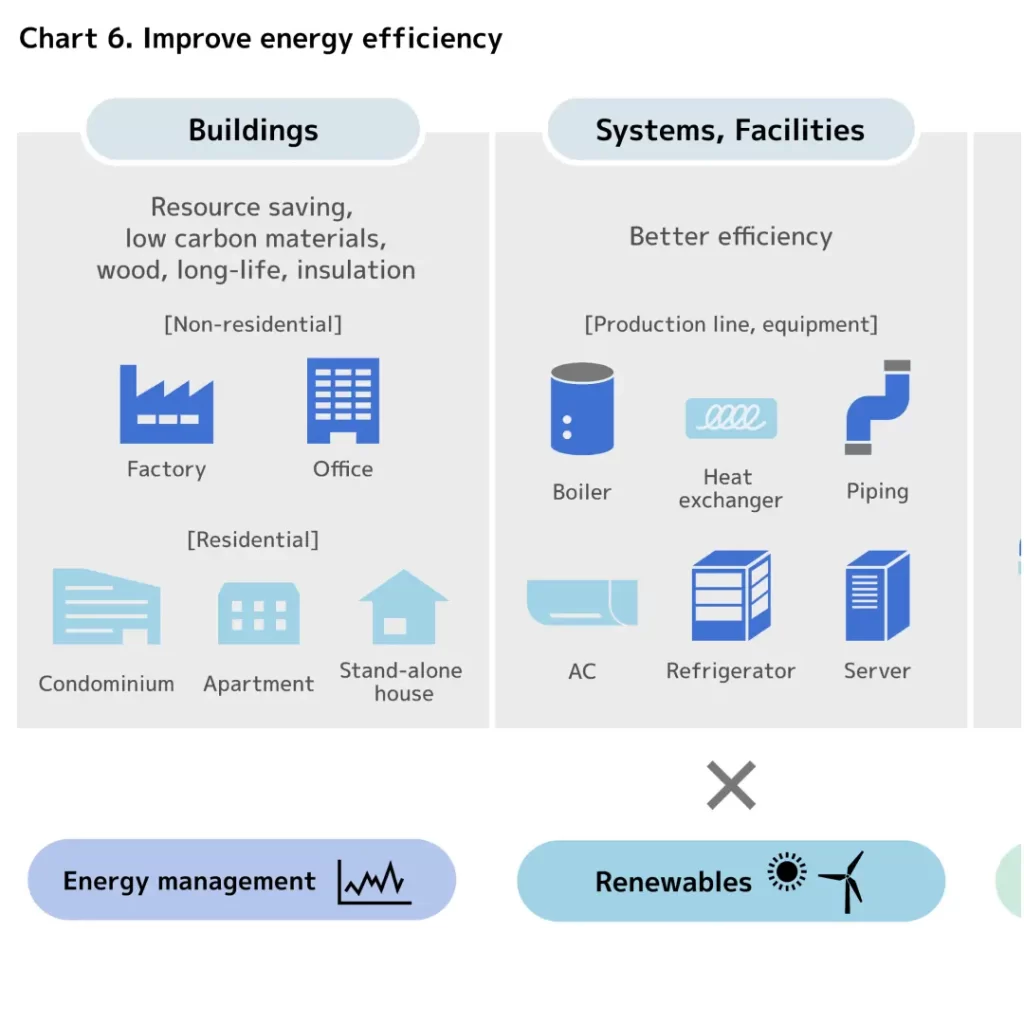

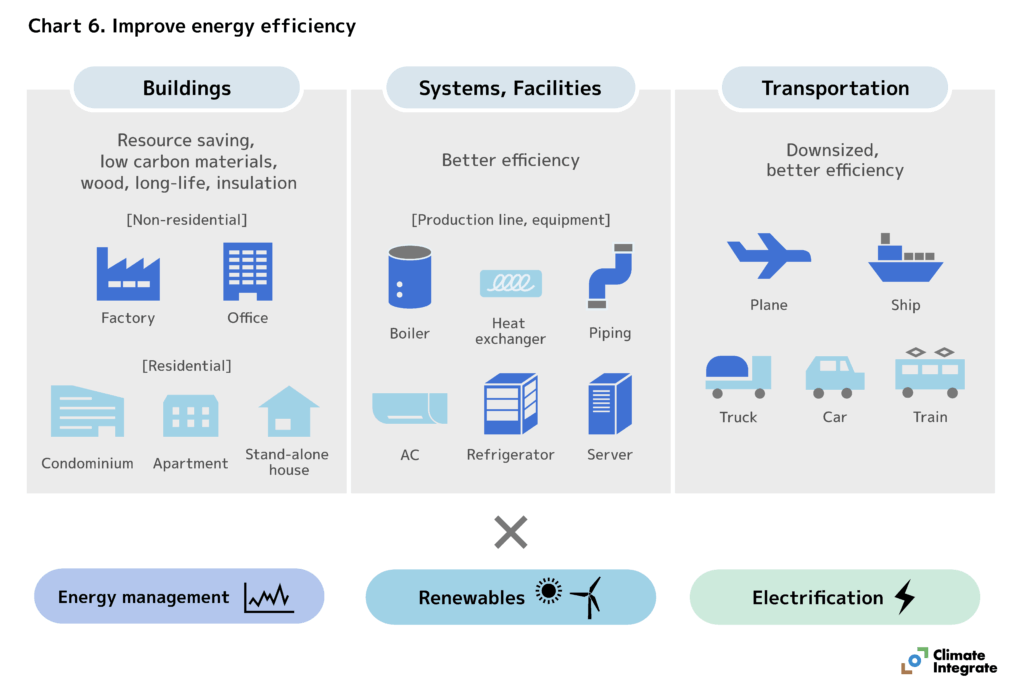

Improving energy efficiency on the demand side (industries, transport, commercial, and residential) holds significant potential for reducing CO₂ emissions. It can improve the energy efficiency of buildings, systems, facilities, equipment, and transportation.

Related pages:

[Reports]Report “Decarbonizing Japan’s Electricity System: Policy Change to Trigger a Shift”

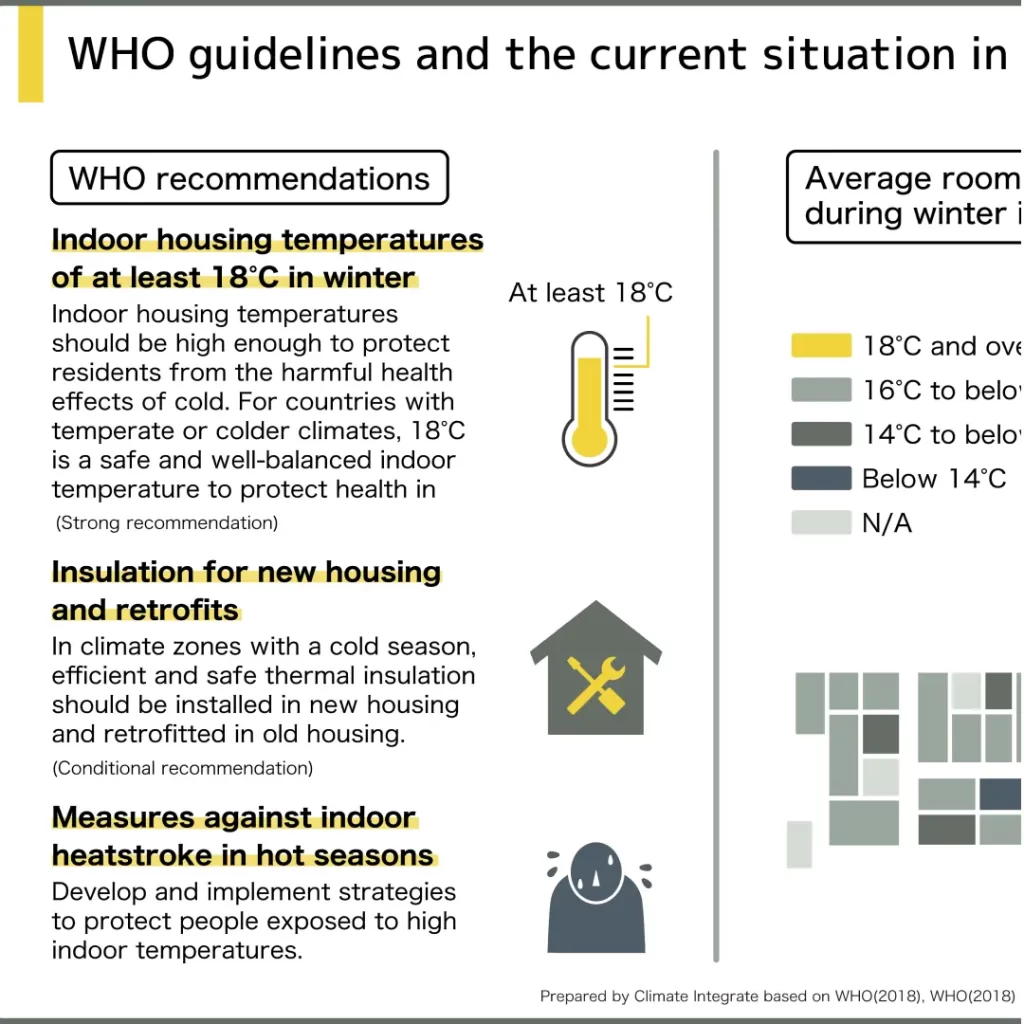

The World Health Organization (WHO) recommends maintaining maximum indoor temperatures of below 32°C during the day and below 24°C at night during hot weather, and keeping at or above 18°C in winter, as low indoor temperatures can lead to serious health impacts. In Japan, however, only 10% of housing meet WHO’s recommended winter standards, and many Japanese people are accustomed to their homes being cold in winter.

Related pages:

[Insights]Tackling climate change in residential and building sectors

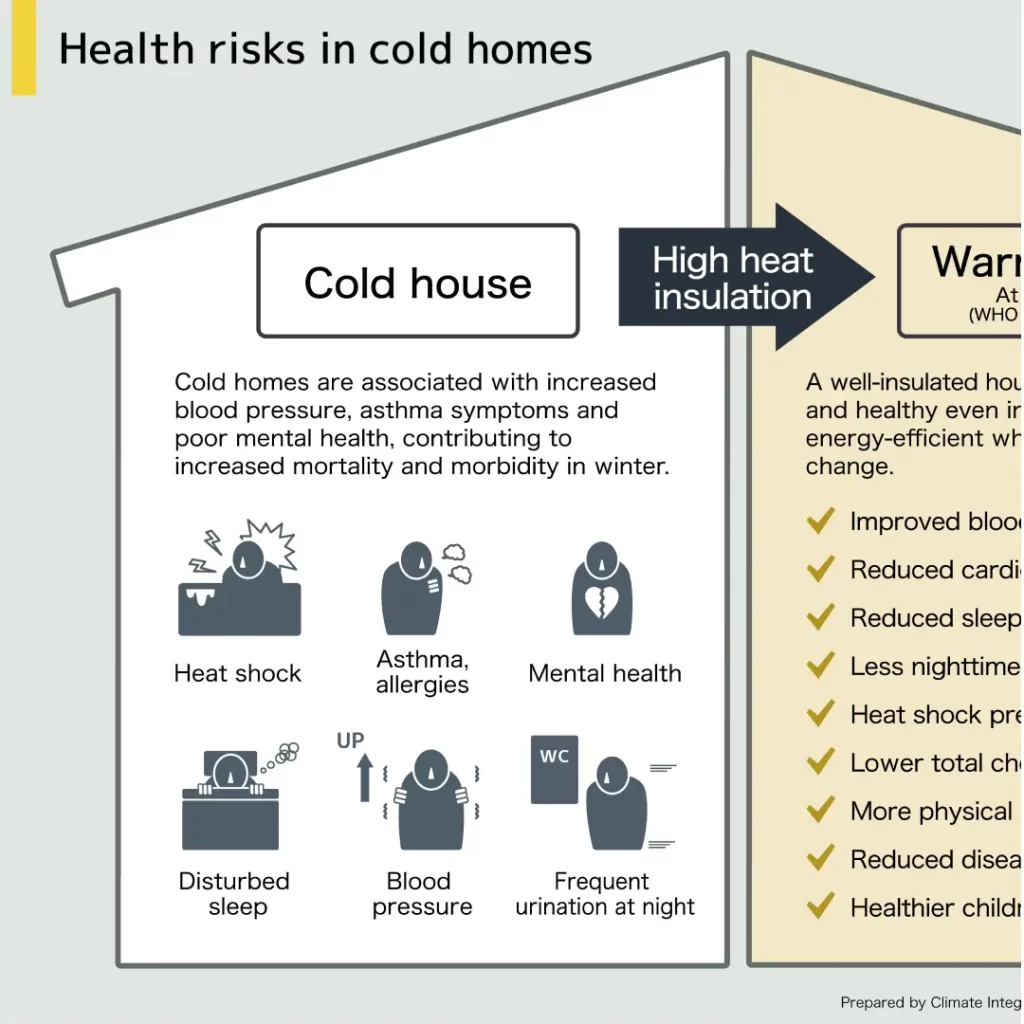

Living in homes where indoor temperatures fall below 18°C poses health risks, including elevated blood pressure, asthma, mental health deterioration, and increased risk of heat shock. Research shows that improving insulation can mitigate these risks, enabling healthier living in warm, well-insulated homes.

Related pages:

[Insights]Tackling climate change in residential and building sectors

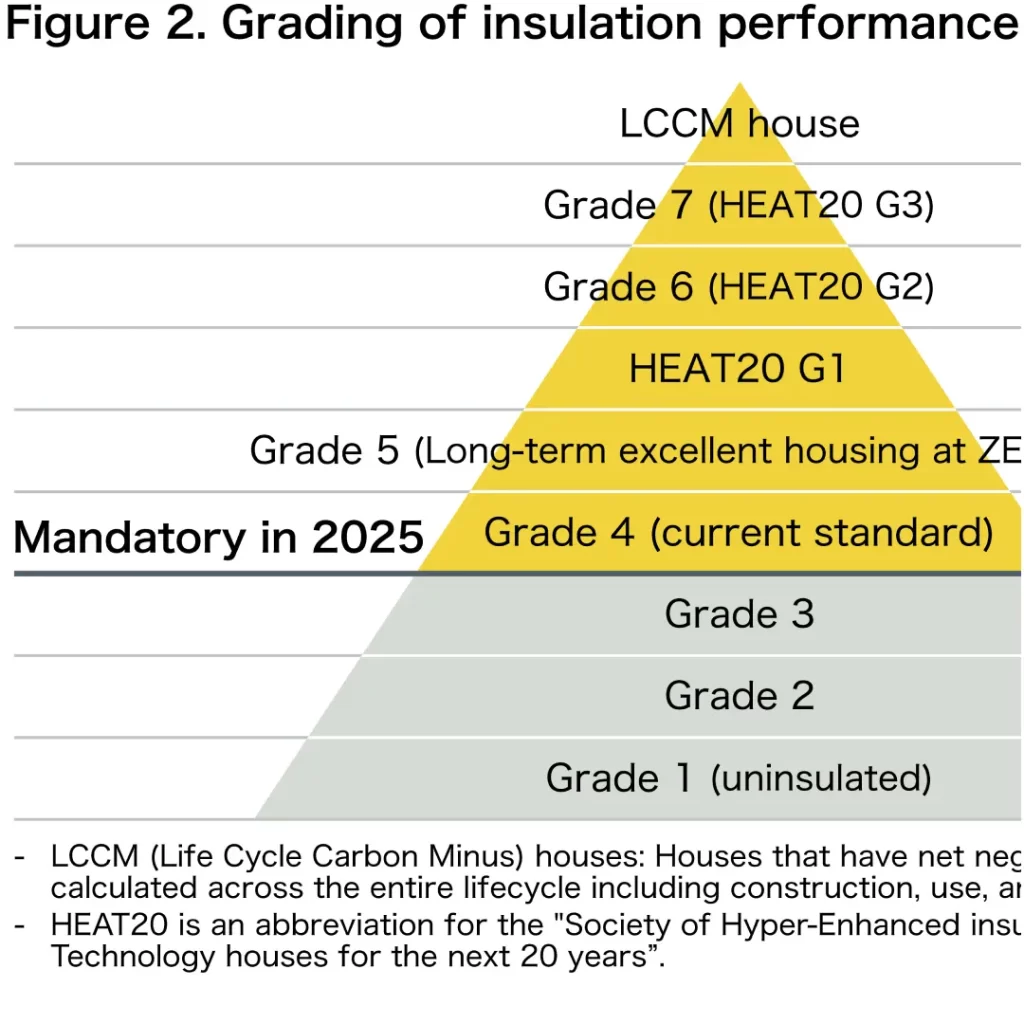

Insulation performance in Japanese housing is classified into Grades 1 to 7, and compliance with Grade 4 became mandatory in April 2025. However, Grade 4 is still low, and achieving zero emissions will require raising the level to Grades 6 or 7.

Related pages:

[Insights]Tackling climate change in residential and building sectors

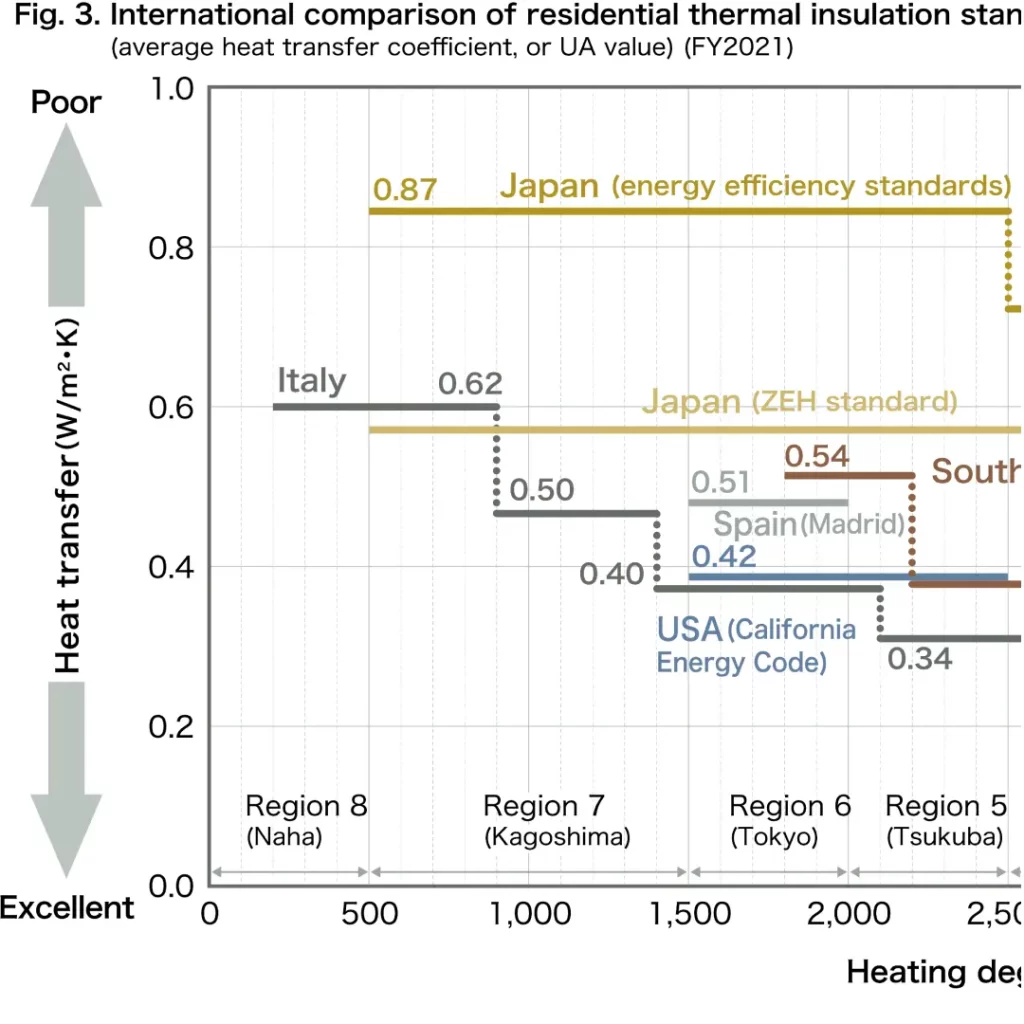

Japan’s residential thermal insulation standards are lower compared to those of other major countries.

Related pages:

[Insights]Tackling climate change in residential and building sectors

To reduce energy consumption and approach net zero CO2 emissions in the residential and building sectors, it will be crucial to achieve progress with thermal insulation, energy efficiency, and renewable energy.

Related pages:

[Insights]Tackling climate change in residential and building sectors

Corporations

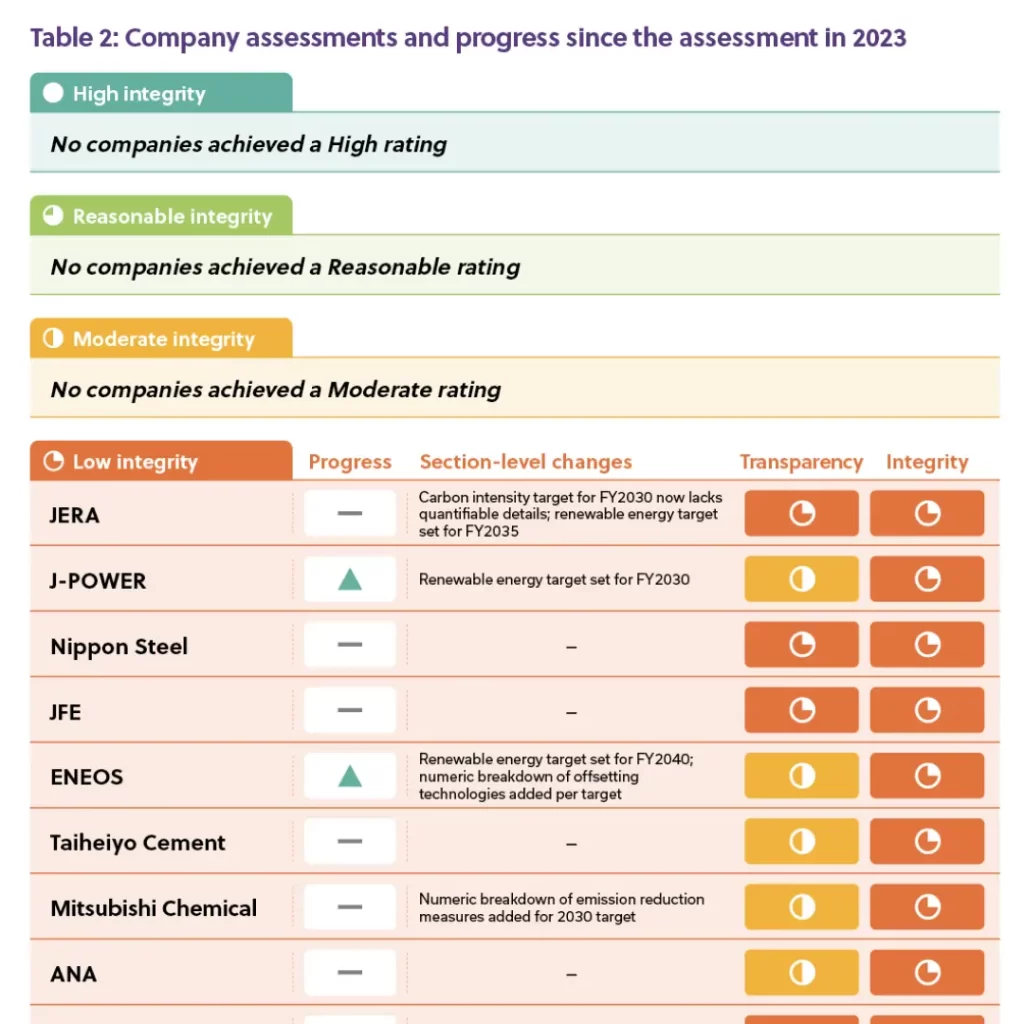

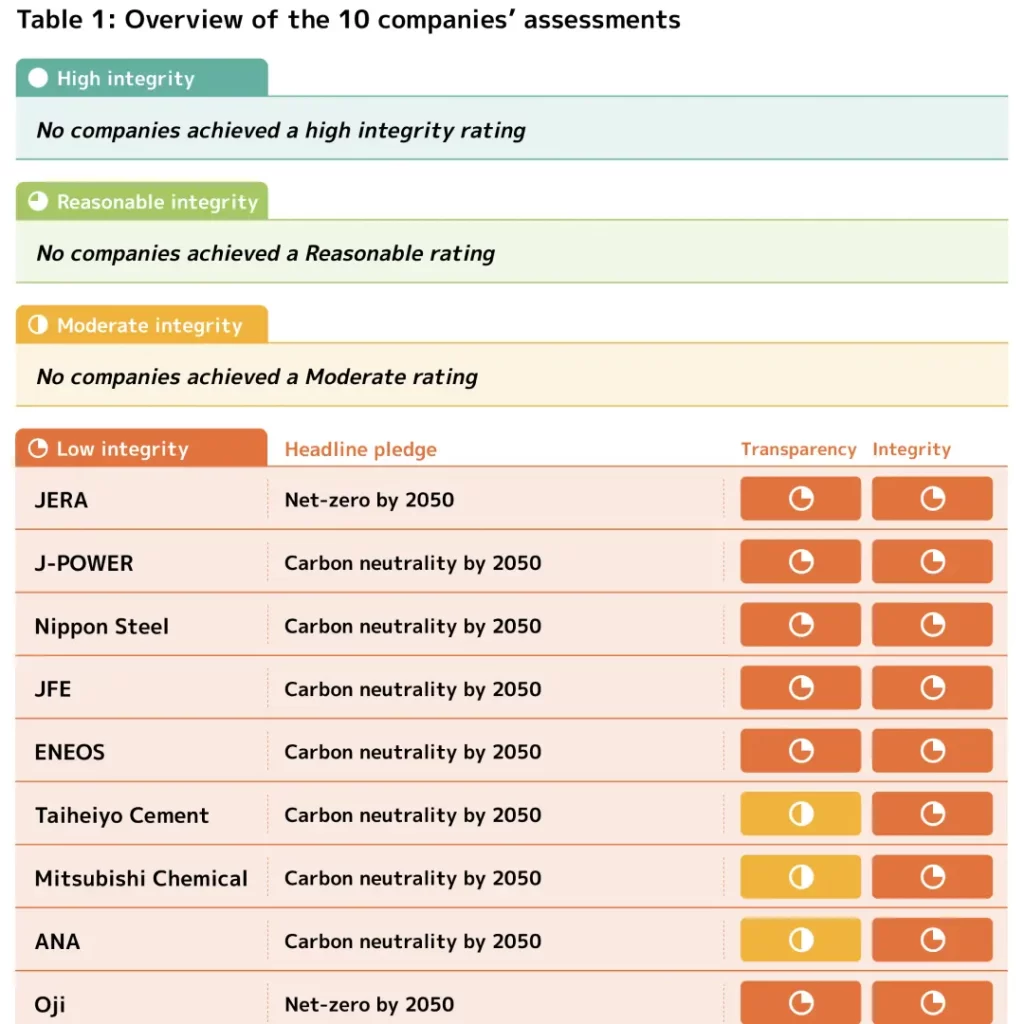

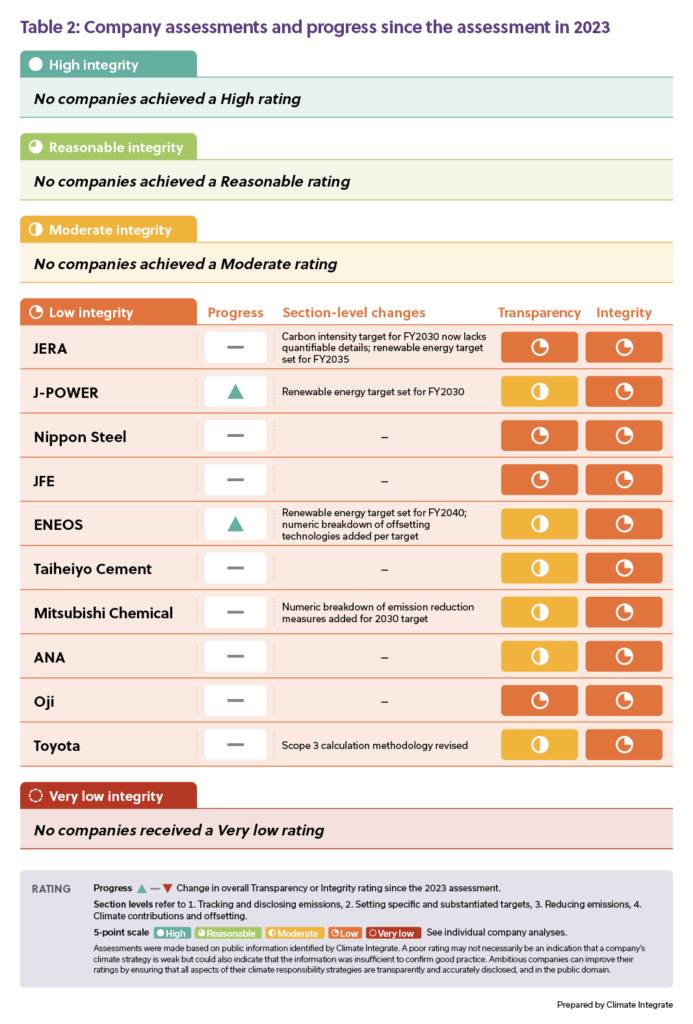

Company assessments and progress since the assessment in 2023

Overview of the 10 companies’ assessments

An updated analysis of 10 major emitting companies in Japan finds that all companies continue to score “low” for the quality and credibility of their climate actions, although some companies improved in transparency. This assessment is based on FY2023 information disclosed through integrated reports and other company materials.

Related pages:

[Reports]Report “Assessing Net Zero 2025: Tracking Progress of 10 Japanese Companies”

The analysis of 10 major emitting companies in Japan finds that all companies score “low” for the quality and credibility of their climate actions. This assessment is based on FY2021 information disclosed through integrated reports and other company materials.

The companies analyzed are JERA and J-POWER (electric utilities), Nippon Steel and JFE (steel), ENEOS (oil and gas), Taiheiyo Cement (cement), Mitsubishi Chemical (chemicals), ANA (transport services), Oji Holdings (paper and forestry), and Toyota (transport OEMs).

Related pages:

[Reports]Report “Assessing Net Zero: Integrity Review of 10 Japanese Companies”

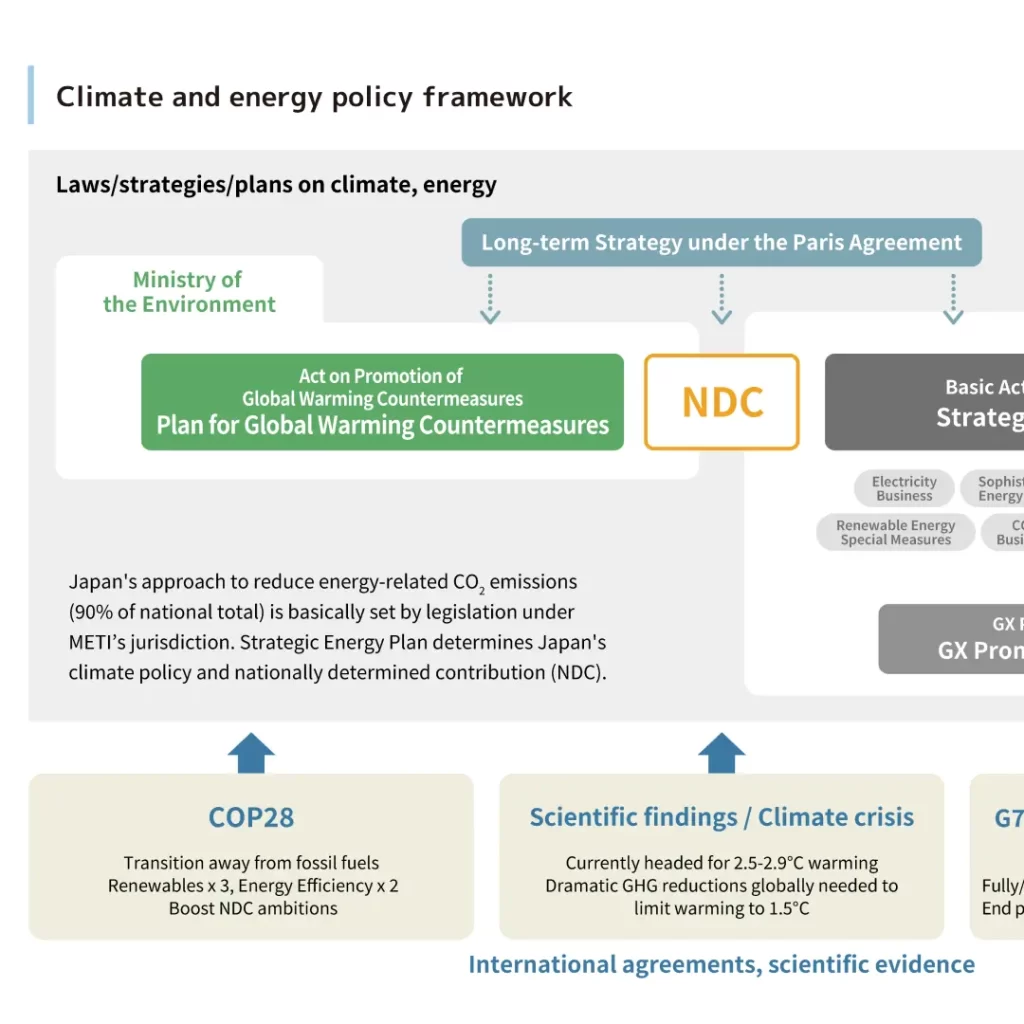

Governance & Policy Making Process

Japan’s climate and energy policy framework

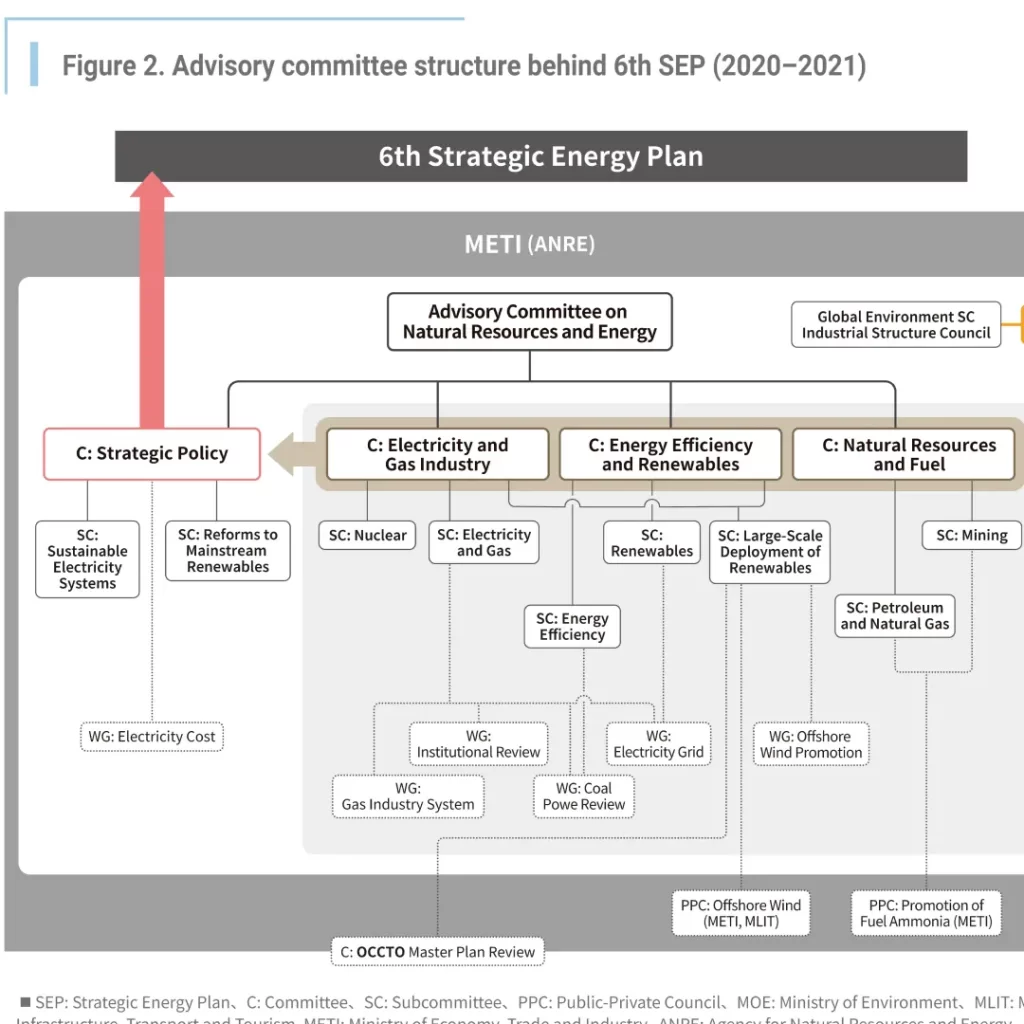

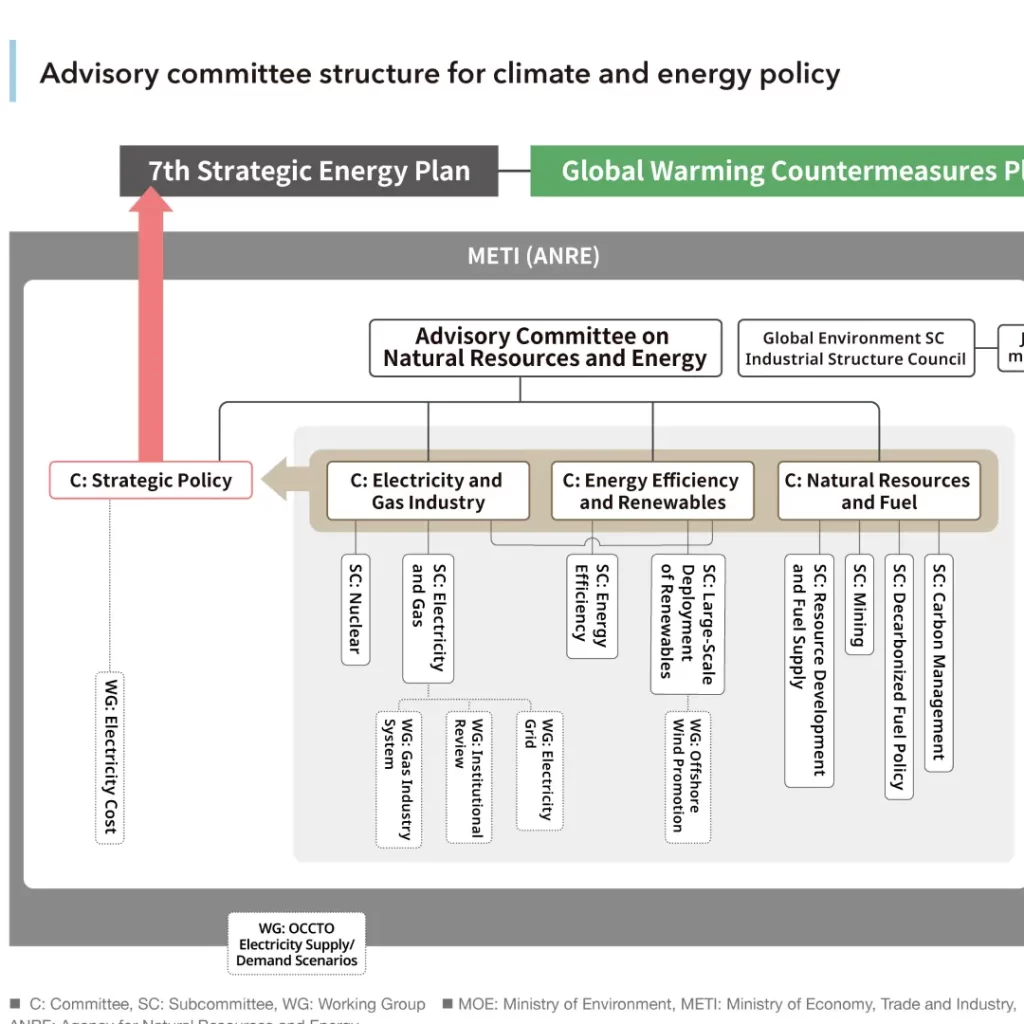

Advisory committee structure behind 6th SEP (2020–2021)

Advisory committee structure for climate and energy policy

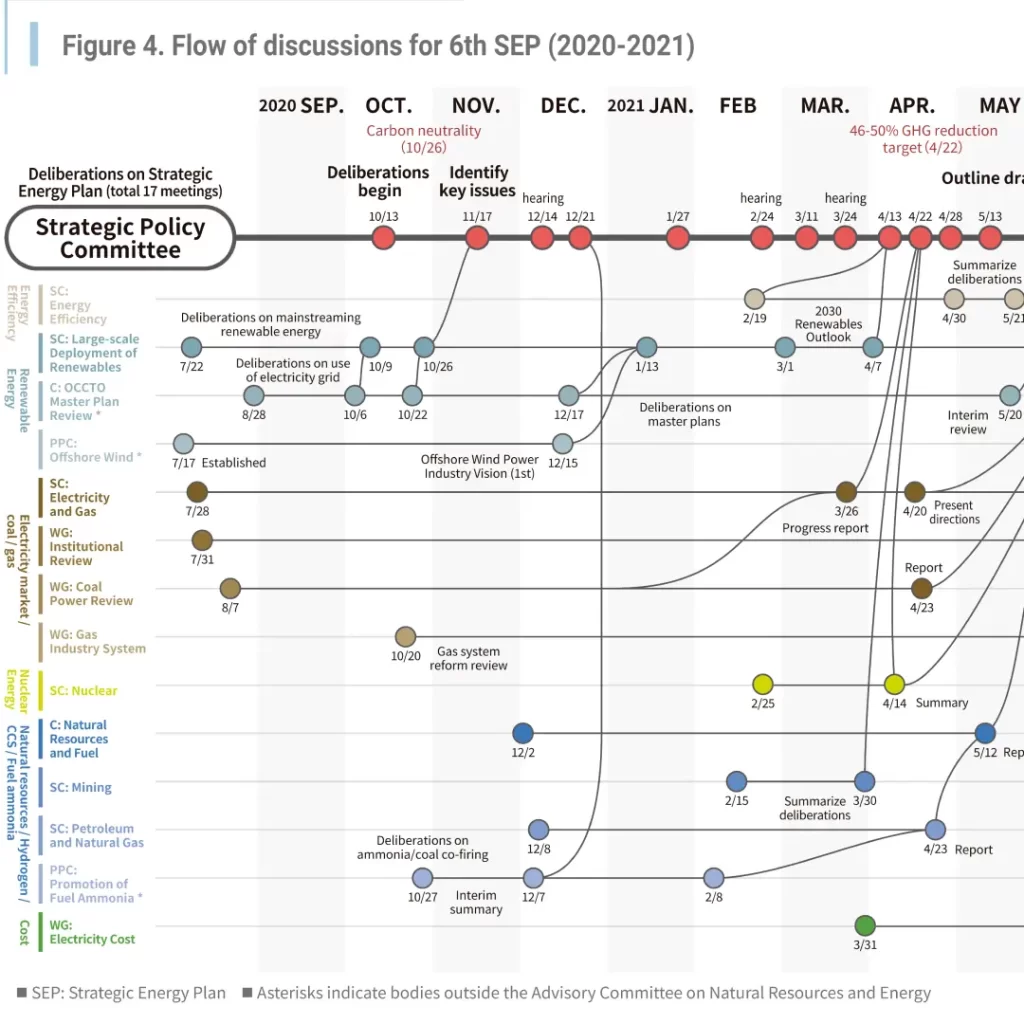

Flow of discussions for 6th SEP (2020-2021)

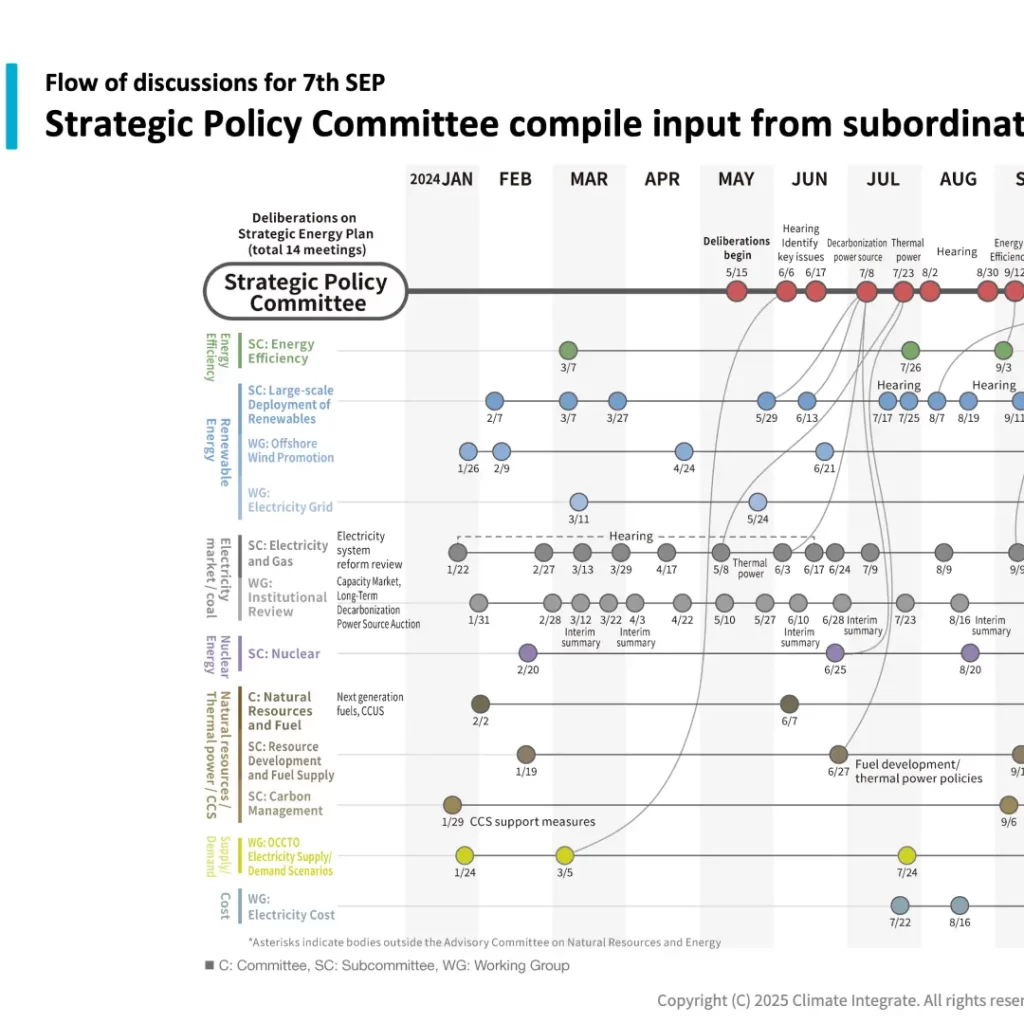

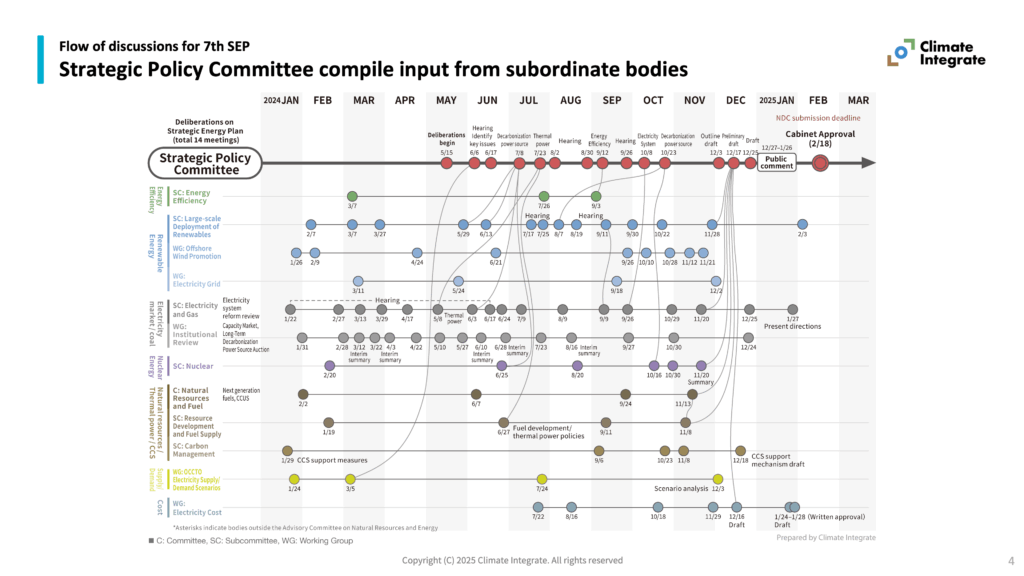

Flow of discussions for 7th SEP

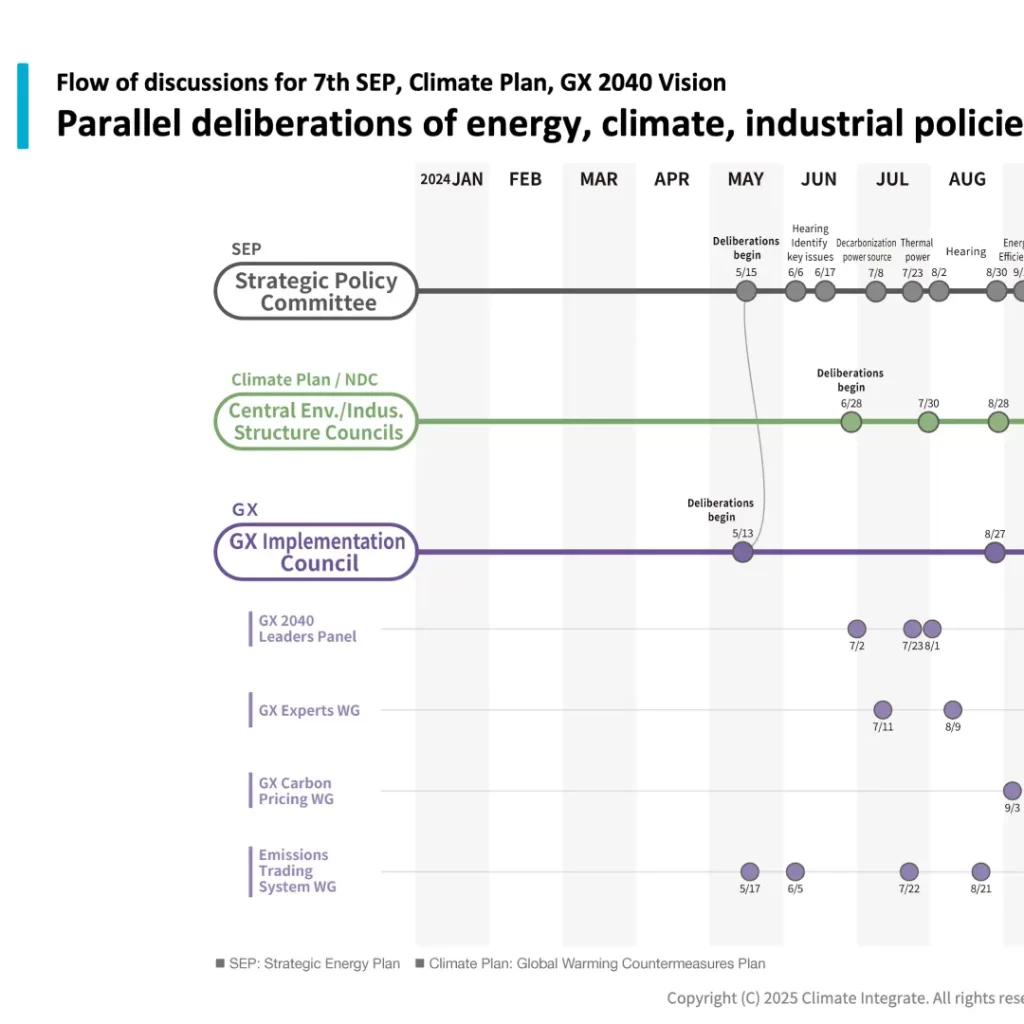

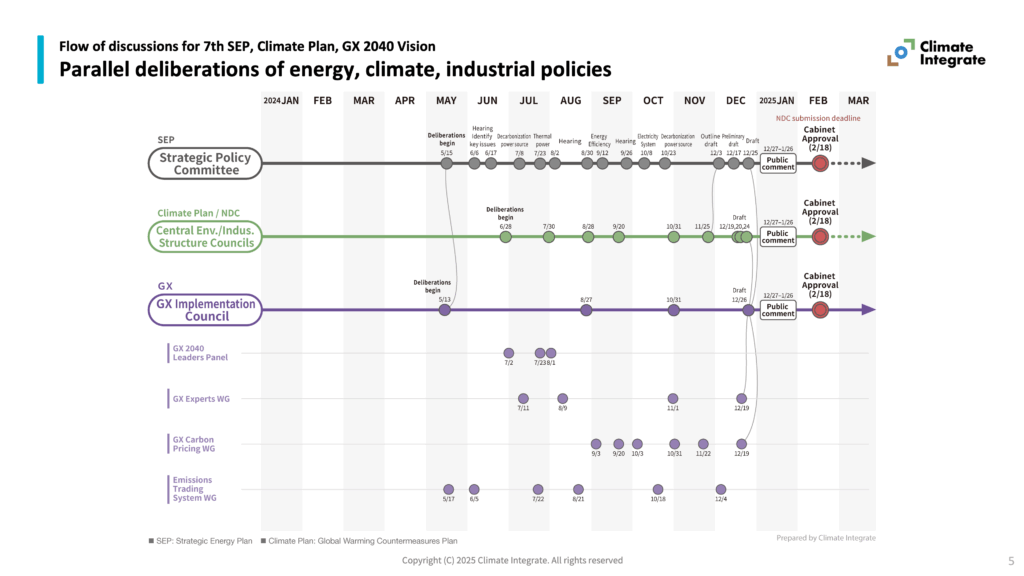

Flow of discussions for 7th SEP, Climate Plan, GX 2040 Vision

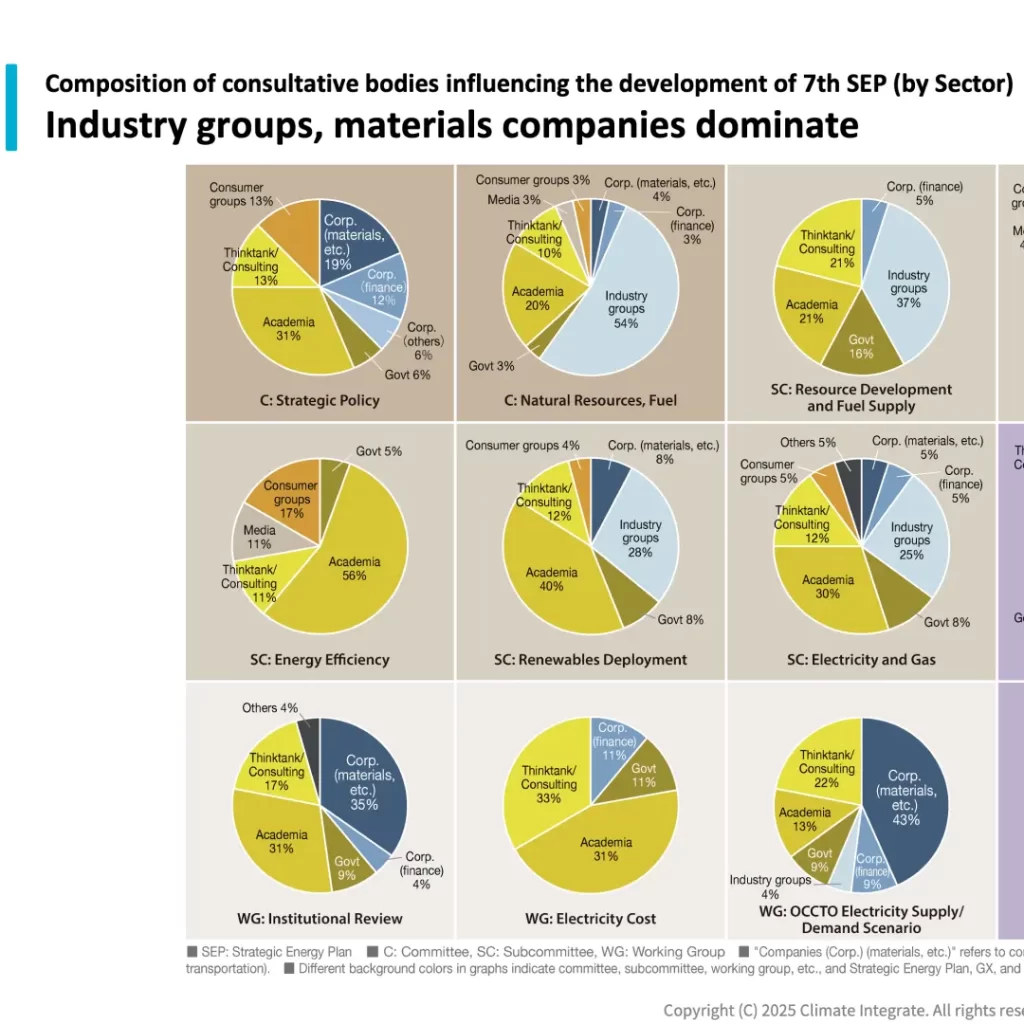

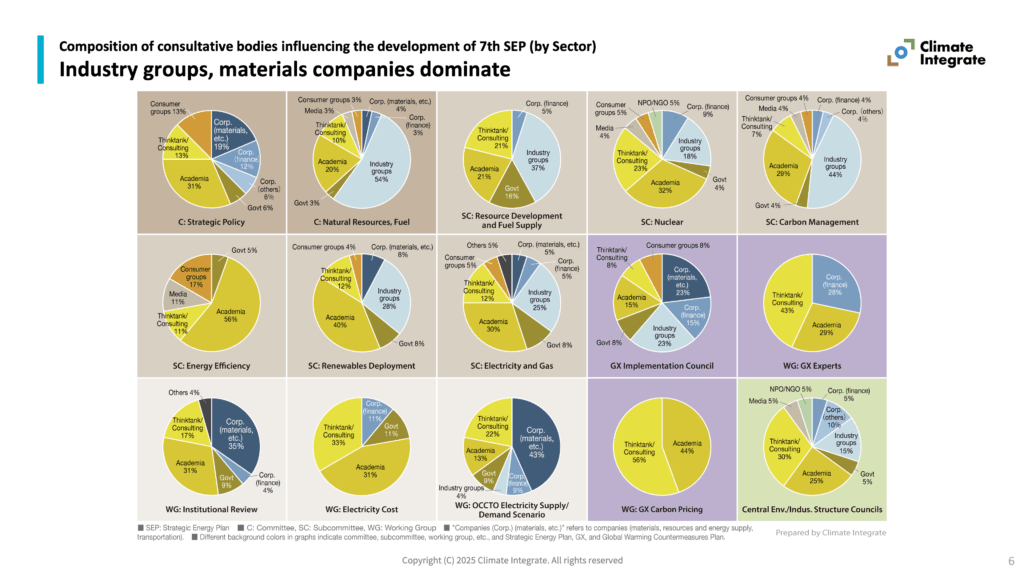

Composition of consultative bodies influencing the development of 7th SEP (by Sector)

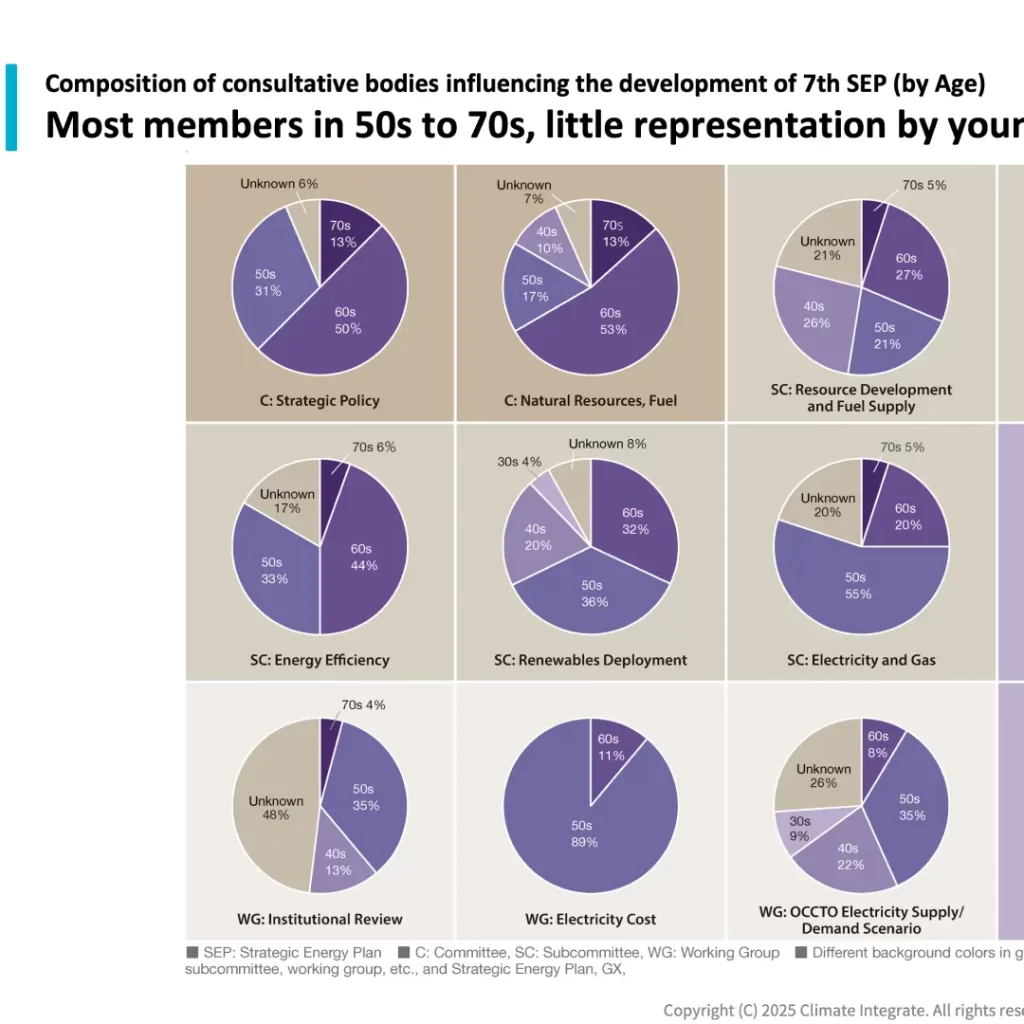

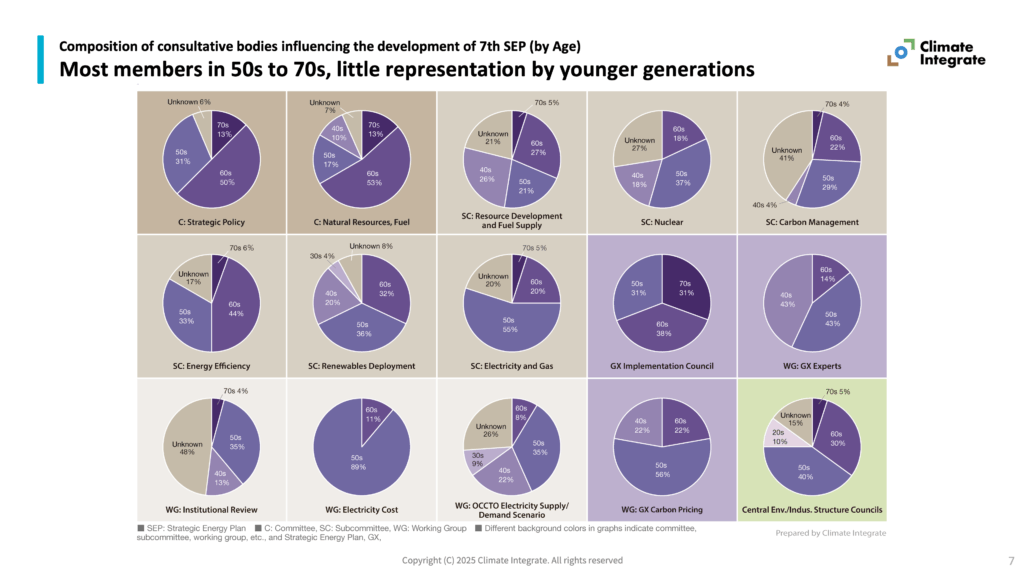

Composition of consultative bodies influencing the development of 7th SEP (by Age)

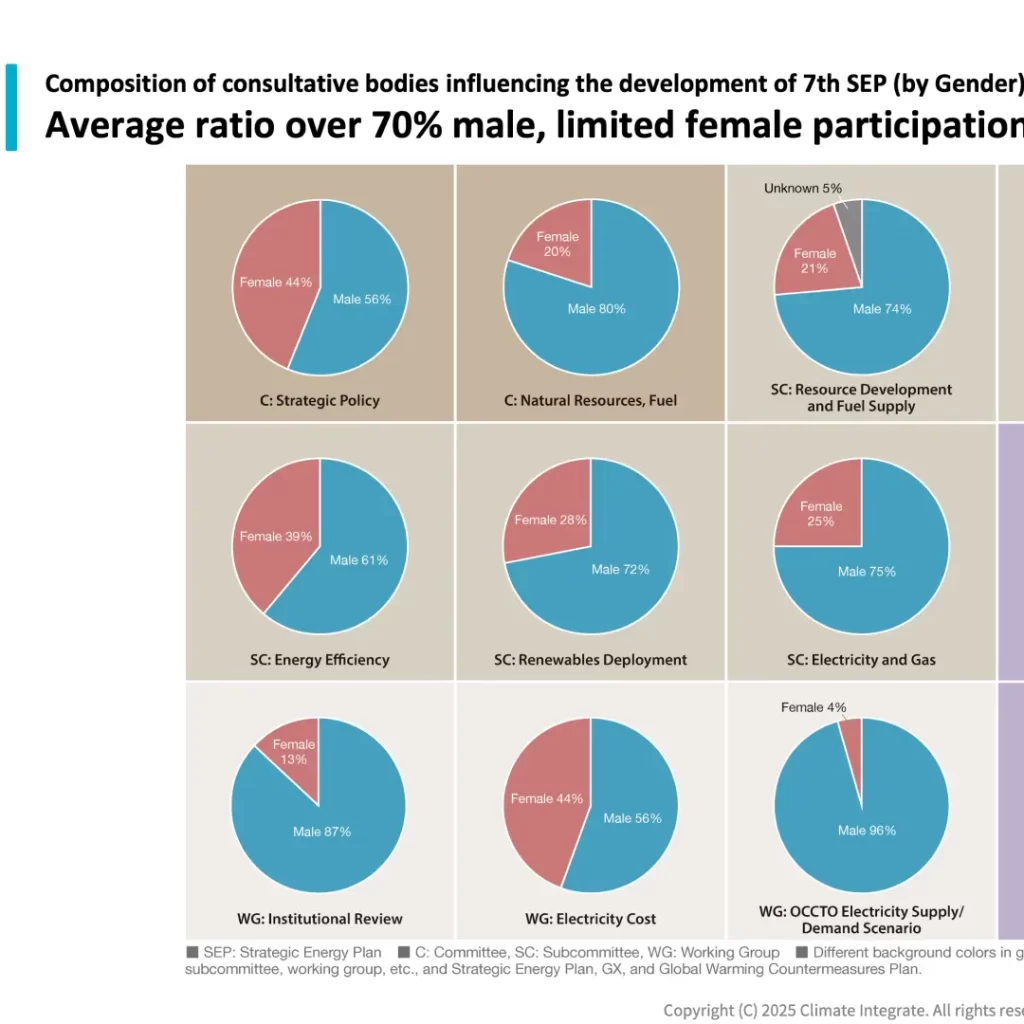

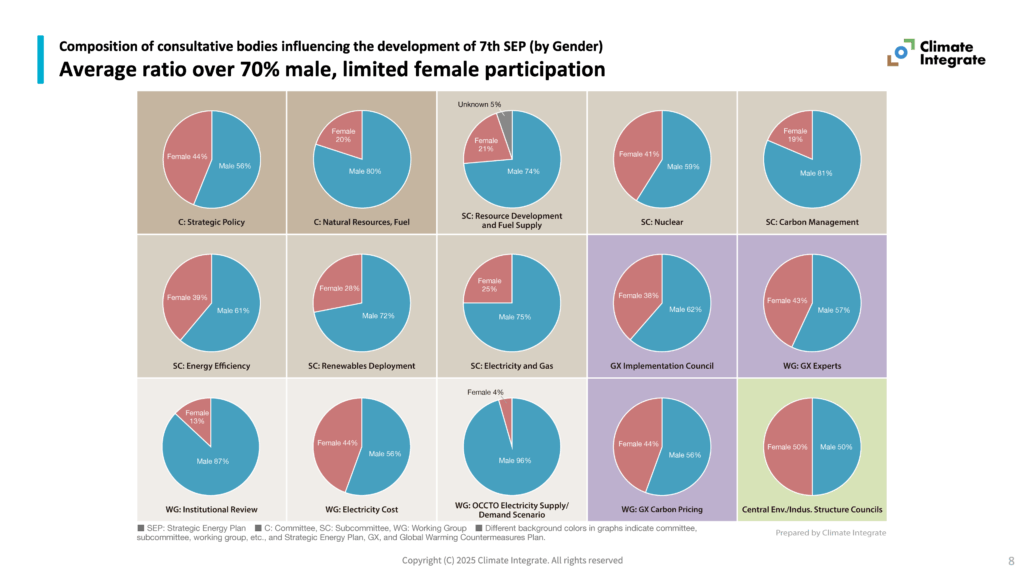

Composition of consultative bodies influencing the development of 7th SEP (by Gender)

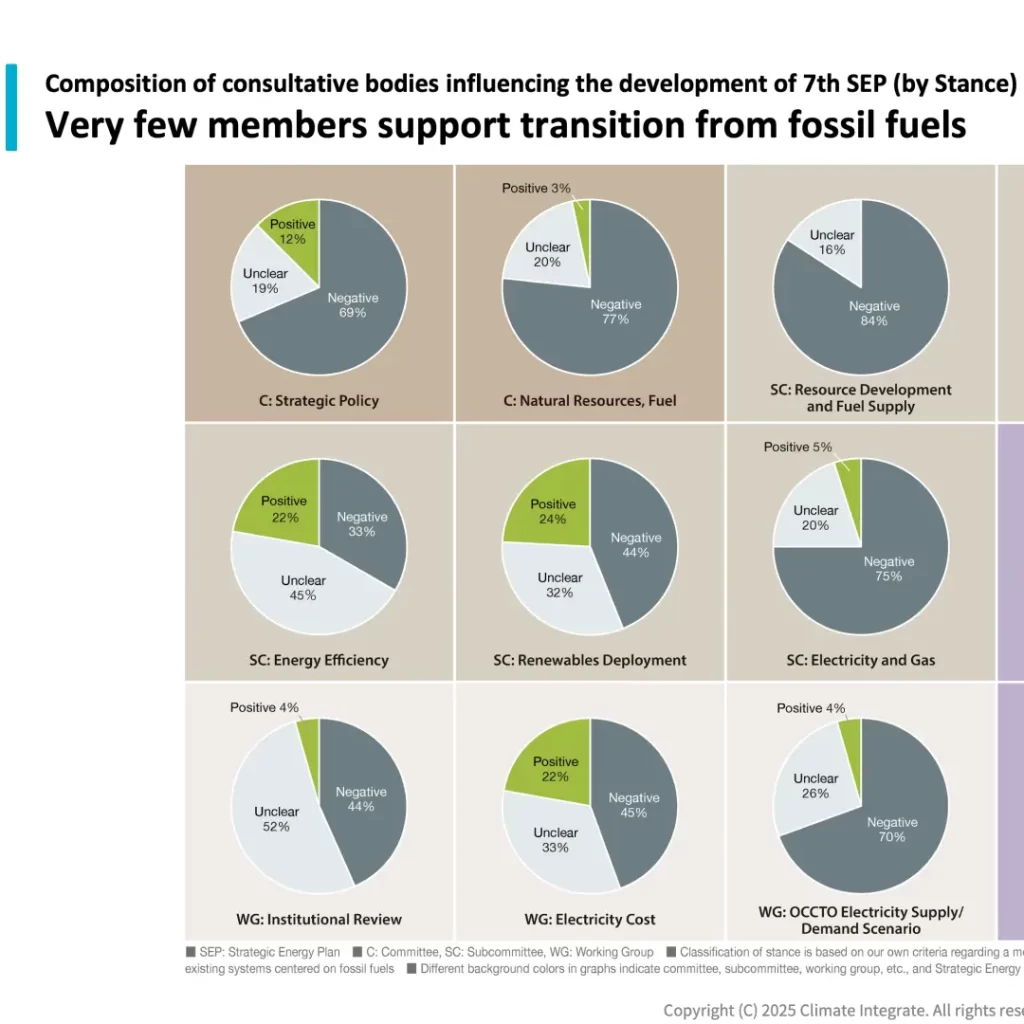

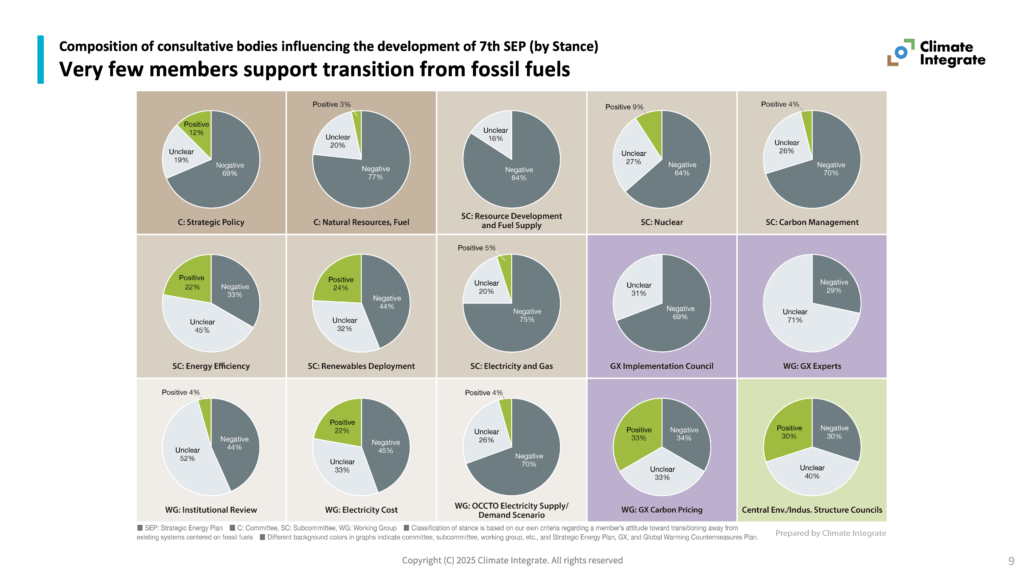

Composition of consultative bodies influencing the development of 7th SEP (by Stance)

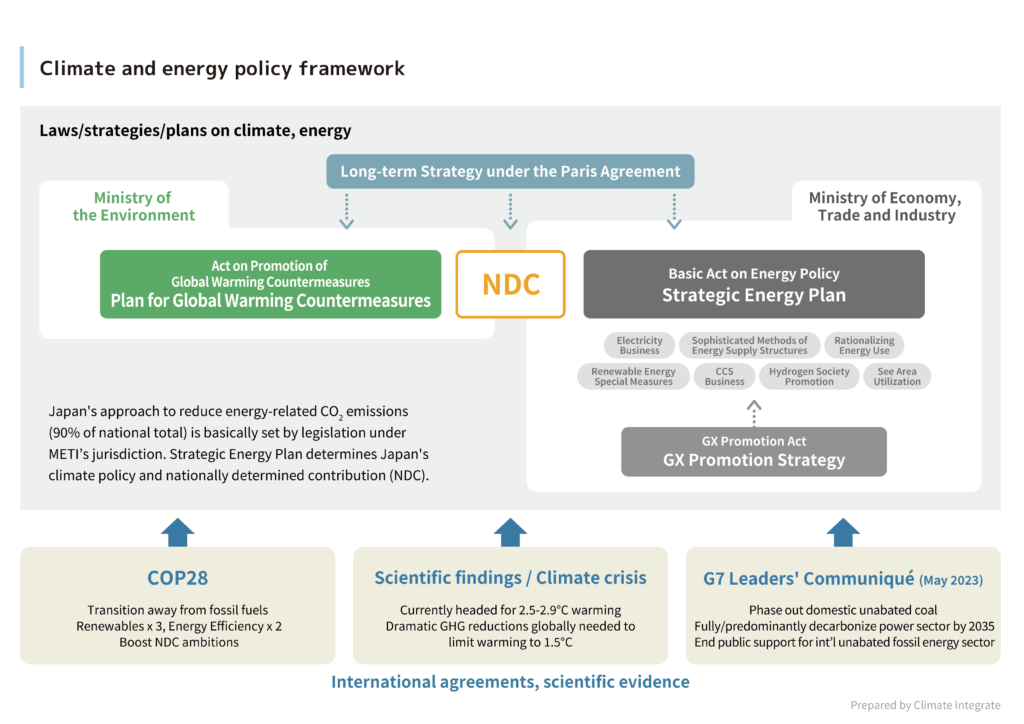

Japan’s Plan for Global Warming Countermeasures outlines the government’s overall GHG emissions reduction targets and specific measures, while the Strategic Energy Plan sets out fundamental policies and actions related to energy supply and demand. Based on these two plans, the government formulates its Nationally Determined Contribution (NDC) and submits it to the United Nations.

Related pages:

[Reports]Report “Policy Making Process in Japan: Strategic Energy Plan as a Case Study”

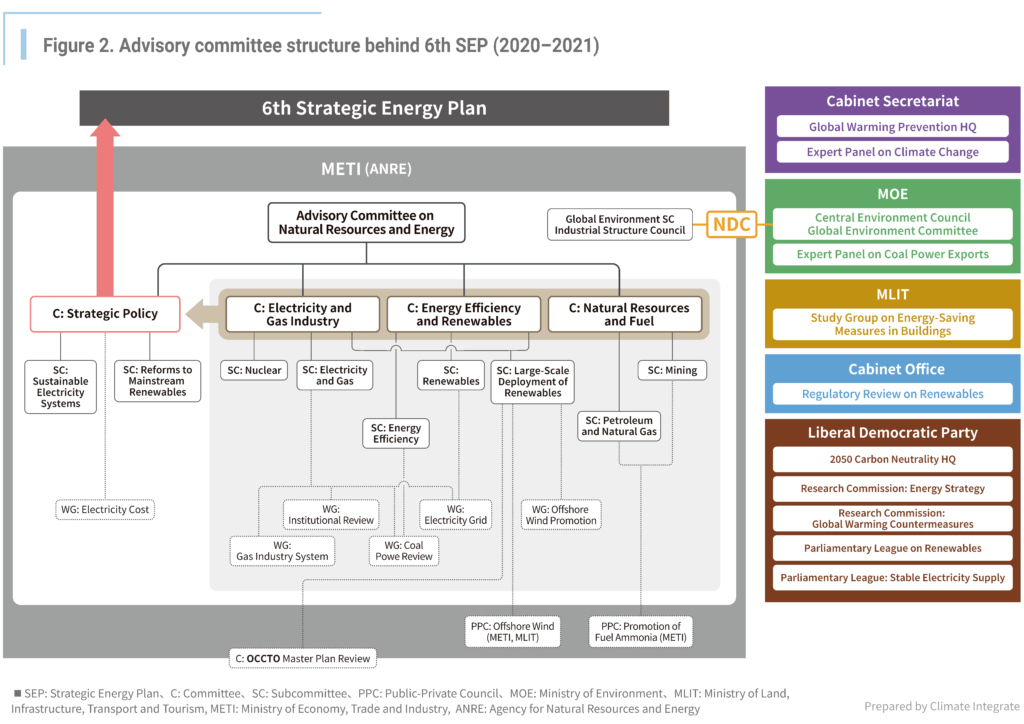

METI (specifically, the Agency for Natural Resources and Energy) takes the lead in Japan’s entire decision-making process for climate and energy policies. Numerous advisory bodies under METI’s Advisory Committee on Natural Resources and Energy are involved in drafting the Strategic Energy Plan. The Strategic Policy Committee under this committee consolidates the draft plan.

Related pages:

[Reports]Report “Policy Making Process in Japan: Strategic Energy Plan as a Case Study”

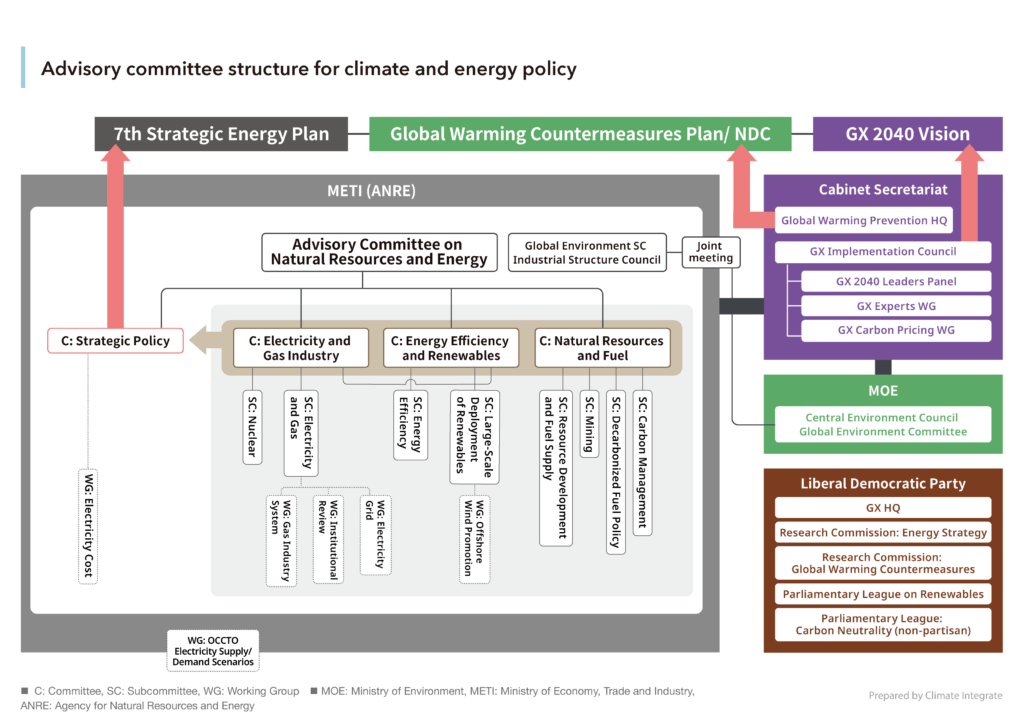

METI (specifically, the Agency for Natural Resources and Energy) takes the lead in Japan’s entire decision-making process for climate and energy policies. Numerous advisory bodies under METI’s Advisory Committee on Natural Resources and Energy are involved in drafting the Strategic Energy Plan. The Strategic Policy Committee under this committee consolidates the draft plan.

Related pages:

[Insights]An Analysis of Policy Making Processes: Japan’s 7th Strategic Energy Plan, GX 2040 Vision, Climate Plan

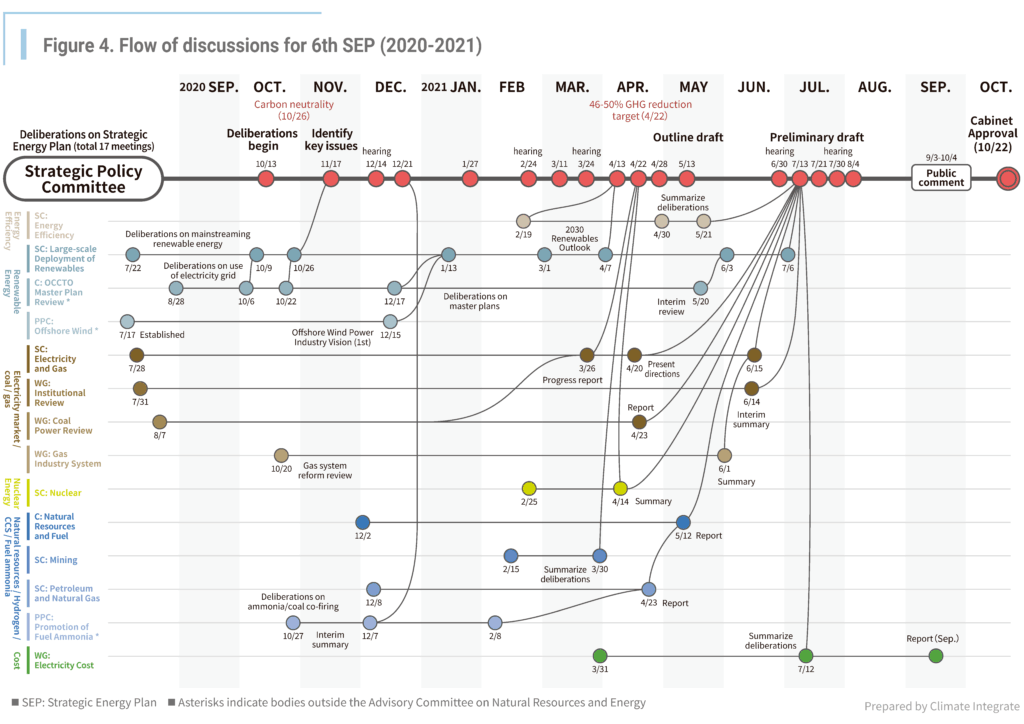

The structure of deliberations for Japan’s Strategic Energy Plan is complex, with discussions percolating up from topic-specific consultative bodies and working their way up to the highest level, to the Strategic Policy Committee. METI (specifically, the Agency for Natural Resources and Energy) oversees the entire process.

Related pages:

[Reports]Report “Policy Making Process in Japan: Strategic Energy Plan as a Case Study”

The structure of deliberations for Japan’s Strategic Energy Plan (SEP) is complex, with discussions percolating up from topic-specific consultative bodies and working their way up to the highest level, to the Strategic Policy Committee. METI (specifically, the Agency for Natural Resources and Energy) oversees the entire process. This structure has remained unchanged since the formulation of the 6th Strategic Energy Plan.

Related pages:

[Insights]An Analysis of Policy Making Processes: Japan’s 7th Strategic Energy Plan, GX 2040 Vision, Climate Plan

In FY2024, deliberations on Japan’s climate and energy policies progressed in parallel across three areas: energy policy (Strategic Energy Plan), climate policy (Plan for Global Warming Countermeasures and NDC), and industrial policy (GX2040 Vision).

Related pages:

[Insights]An Analysis of Policy Making Processes: Japan’s 7th Strategic Energy Plan, GX 2040 Vision, Climate Plan

By sector, the majority of members of the key committees deliberating Japan’s 7th Strategic Energy Plan are from industry associations and materials-related companies, while participation from energy demand-side businesses and nonprofit organizations remains limited.

Related pages:

[Insights]An Analysis of Policy Making Processes: Japan’s 7th Strategic Energy Plan, GX 2040 Vision, Climate Plan

By age group, the majority of members of the key committees deliberating Japan’s 7th Strategic Energy Plan are in their 50s or older, and there is minimal representation from younger generations, especially persons in their 30s or younger.

Related pages:

[Insights]An Analysis of Policy Making Processes: Japan’s 7th Strategic Energy Plan, GX 2040 Vision, Climate Plan

By gender, over 70% of the members of the key committees deliberating Japan’s 7th Strategic Energy Plan are male, while the participation of women remains limited.

Related pages:

[Insights]An Analysis of Policy Making Processes: Japan’s 7th Strategic Energy Plan, GX 2040 Vision, Climate Plan

By stance, very few members of the key committees deliberating Japan’s 7th Strategic Energy Plan have a proactive stance on shifting away from a fossil fuel–centered energy system.

Related pages:

[Insights]An Analysis of Policy Making Processes: Japan’s 7th Strategic Energy Plan, GX 2040 Vision, Climate Plan

Budget and Fiscal Policy

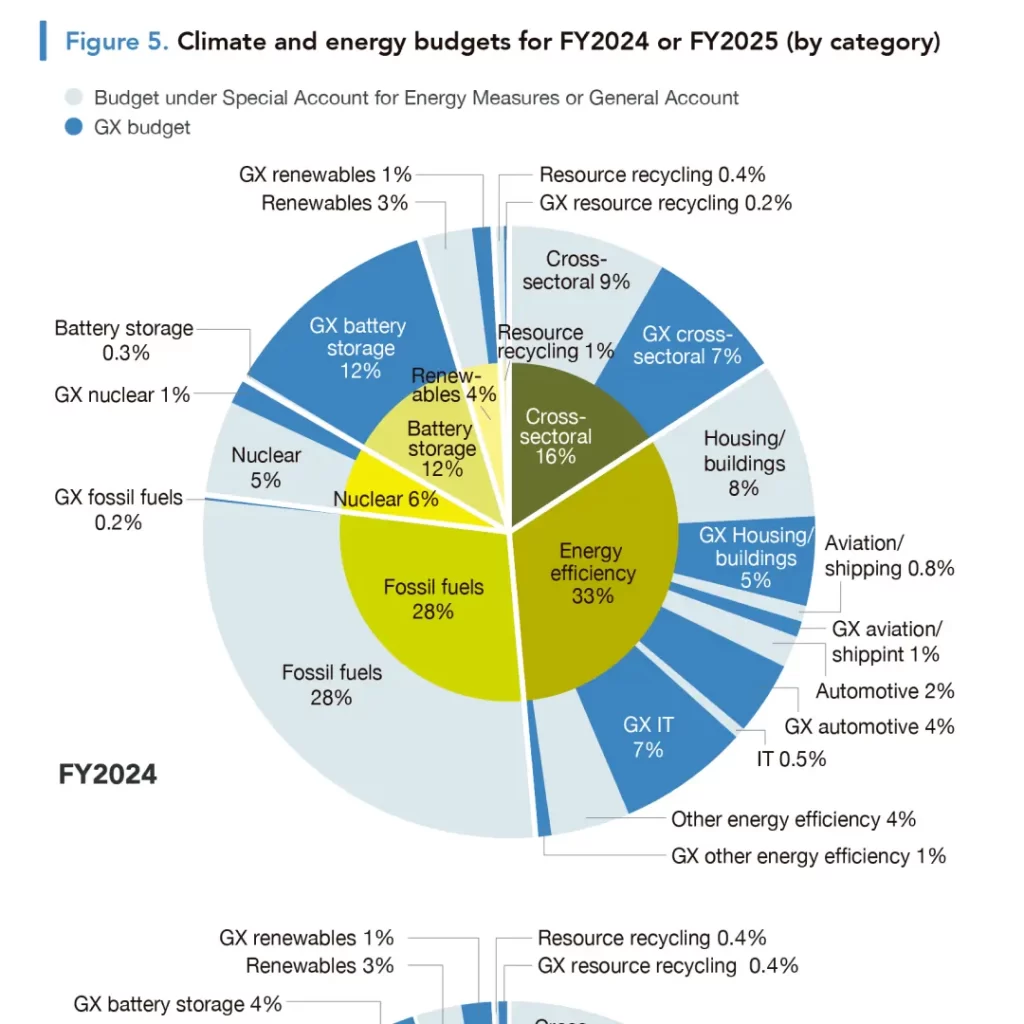

Climate and energy budgets for FY2024 or FY2025 (by category)

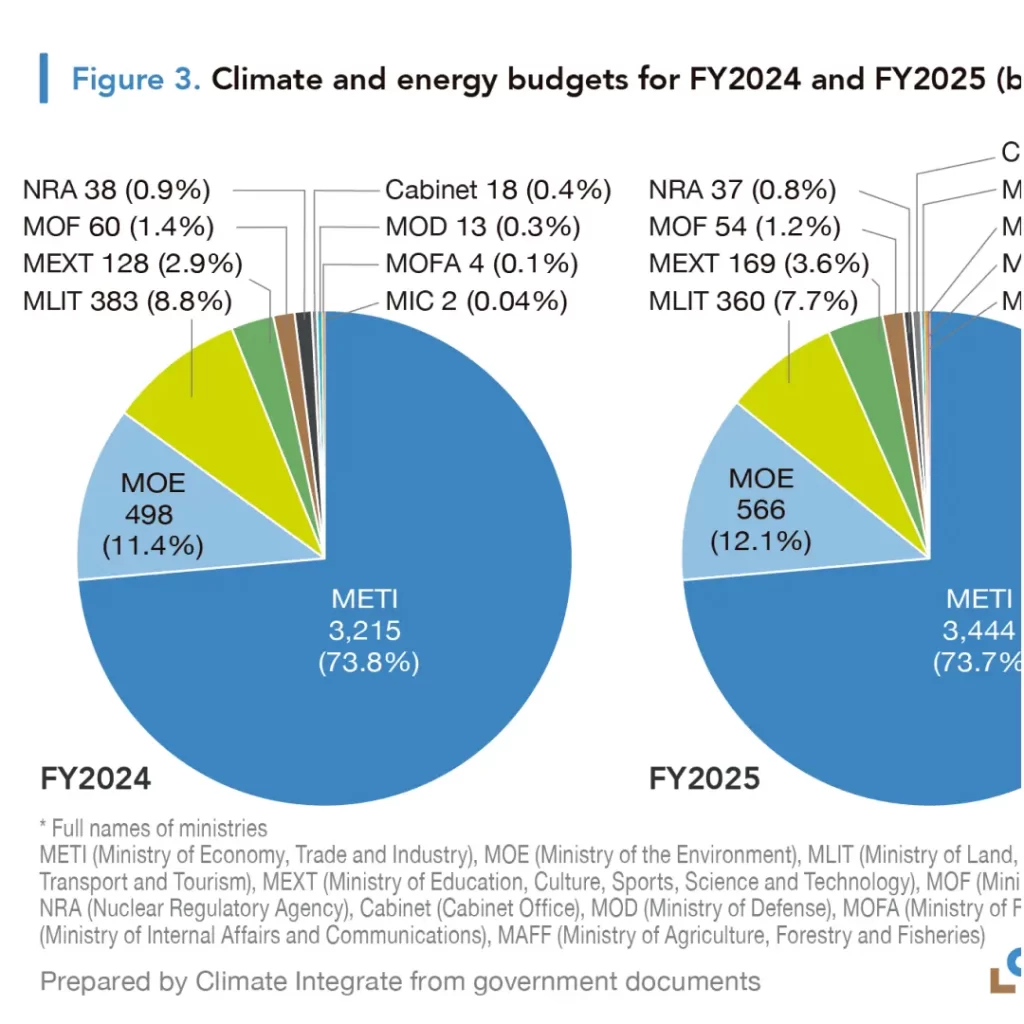

Climate and energy budgets for FY2024 and FY2025 (by ministry)

Public spending for fossil fuel imports (calendar year)

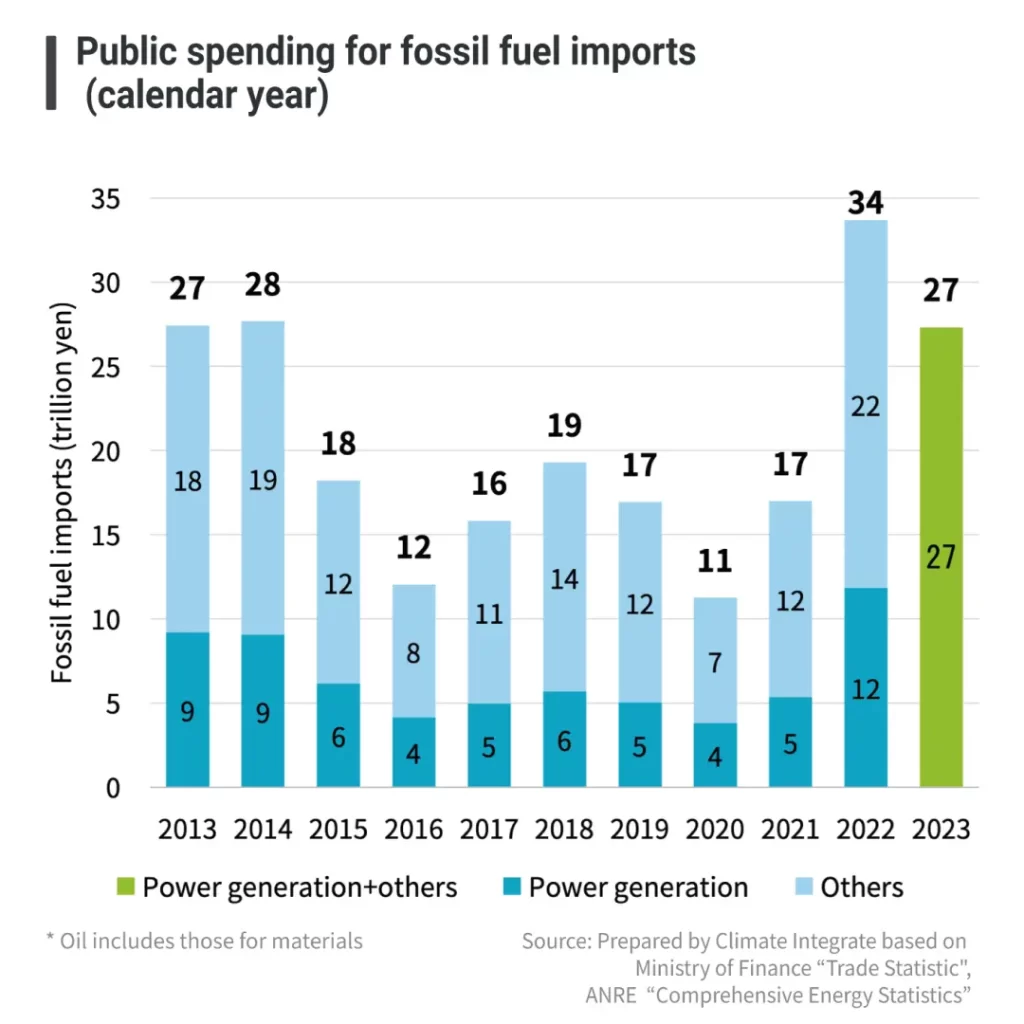

By category, fossil fuels (38%) and energy efficiency (32%) accounted for a large share (inner circle) of Japan’s climate and energy budget in FY2025. In the energy efficiency category, a large amount is allocated to housing/buildings, IT, and automotive. The GX budget share is high in the categories of battery storage, automotive, and IT (blue in outer circle). Battery storage and renewables each account for only about 4% of the total.

Related pages:

[Reports]Report “Japan’s Spending Plan for Climate and Energy 2025”

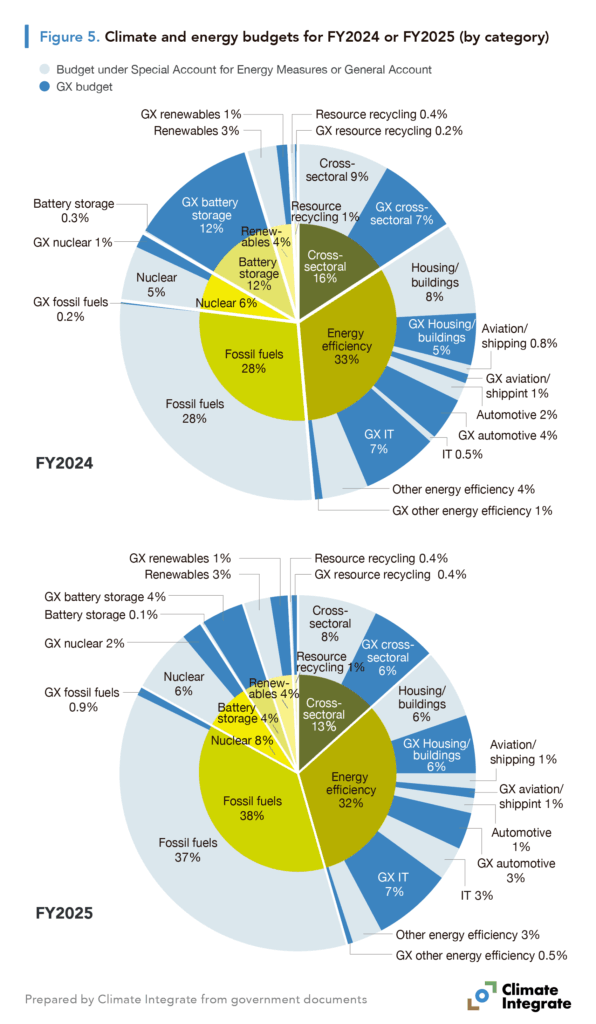

By ministry, the Ministry of Economy, Trade and Industry accounted for more than 70% of Japan’s climate and energy budget in FY2025, followed by the Ministry of the Environment (about 10%).

Related pages:

[Reports]Report “Japan’s Spending Plan for Climate and Energy 2025”

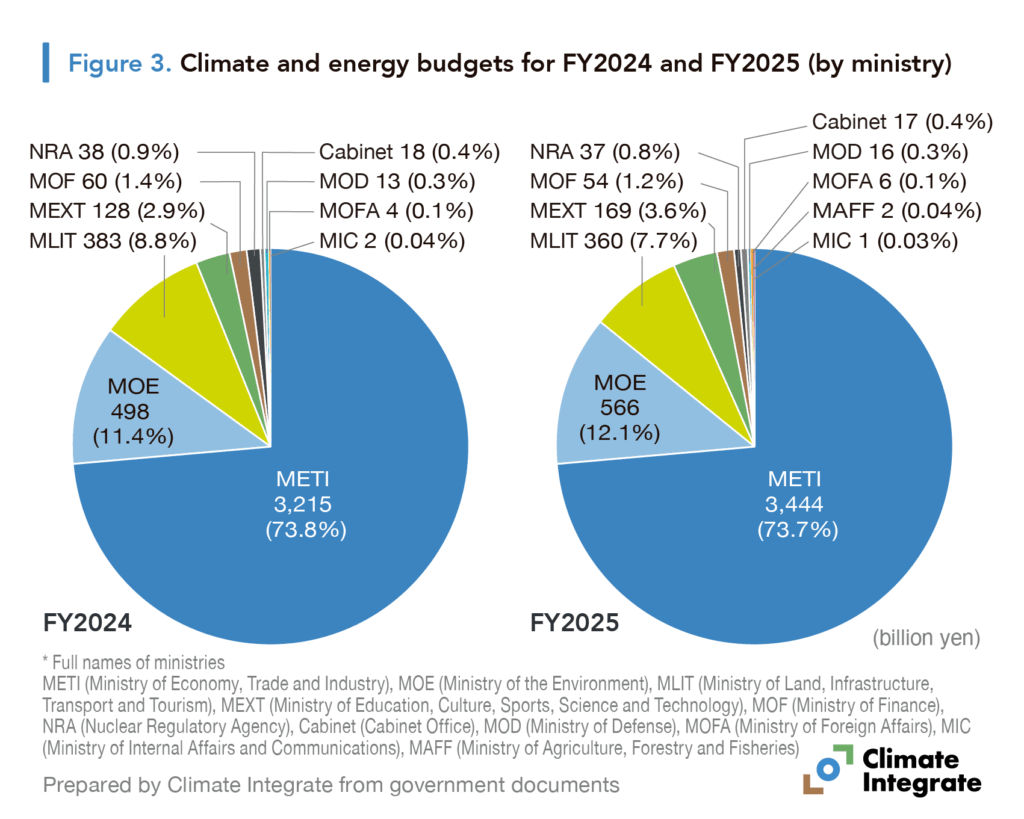

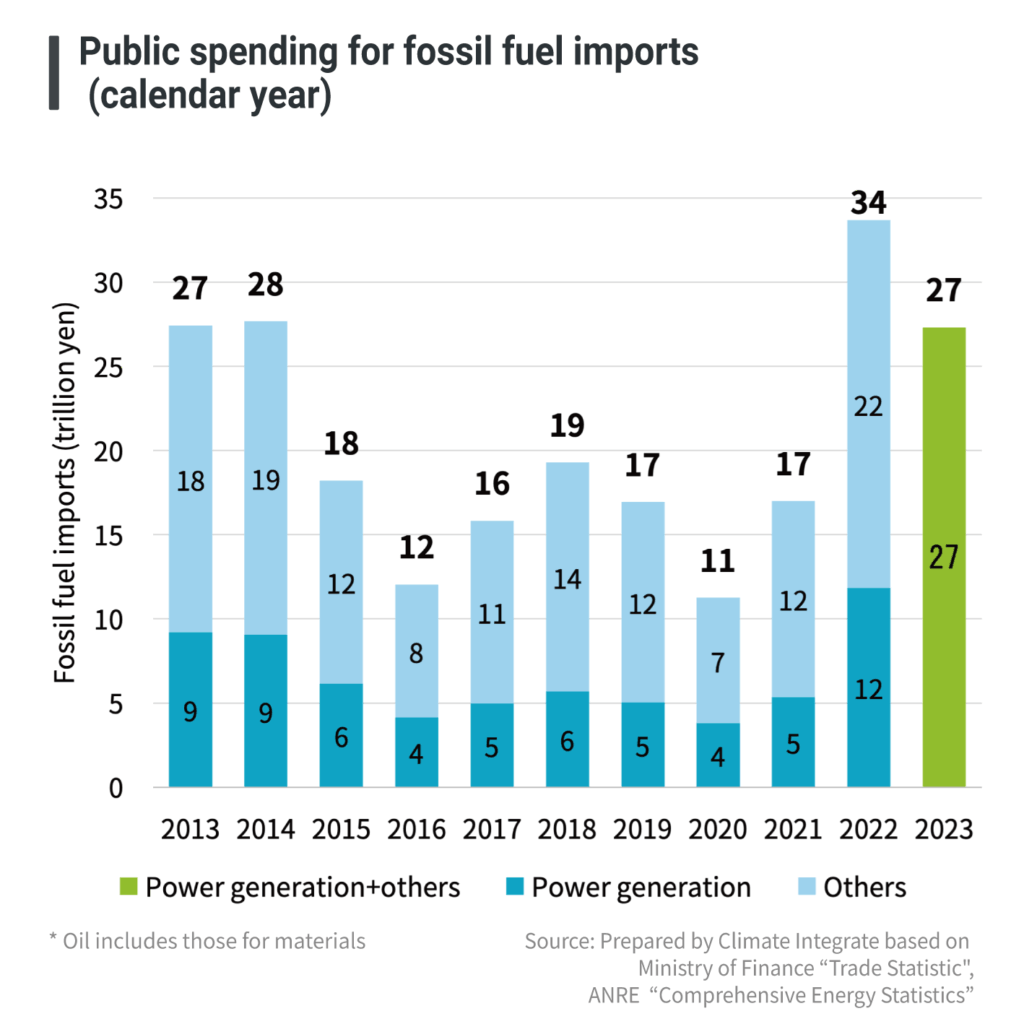

Japan relies almost 100% on imports for oil, coal, and natural gas. Japan spends a huge amount to import fossil fuels, at 34 trillion yen in 2022 (of which, 12 trillion yen to generate electricity), and 27 trillion yen in 2023.

Related pages:

[Insights]Fact sheet on Japan’s climate and energy policies

Intl. Coop. & Collaboration

Number of AZEC MoUs (By country)

Number of AZEC MoUs (By cooperation area)

Number of AZEC MoUs by sector of entity (Japan)

Number of AZEC MoUs by sector of entity (Partner countries)

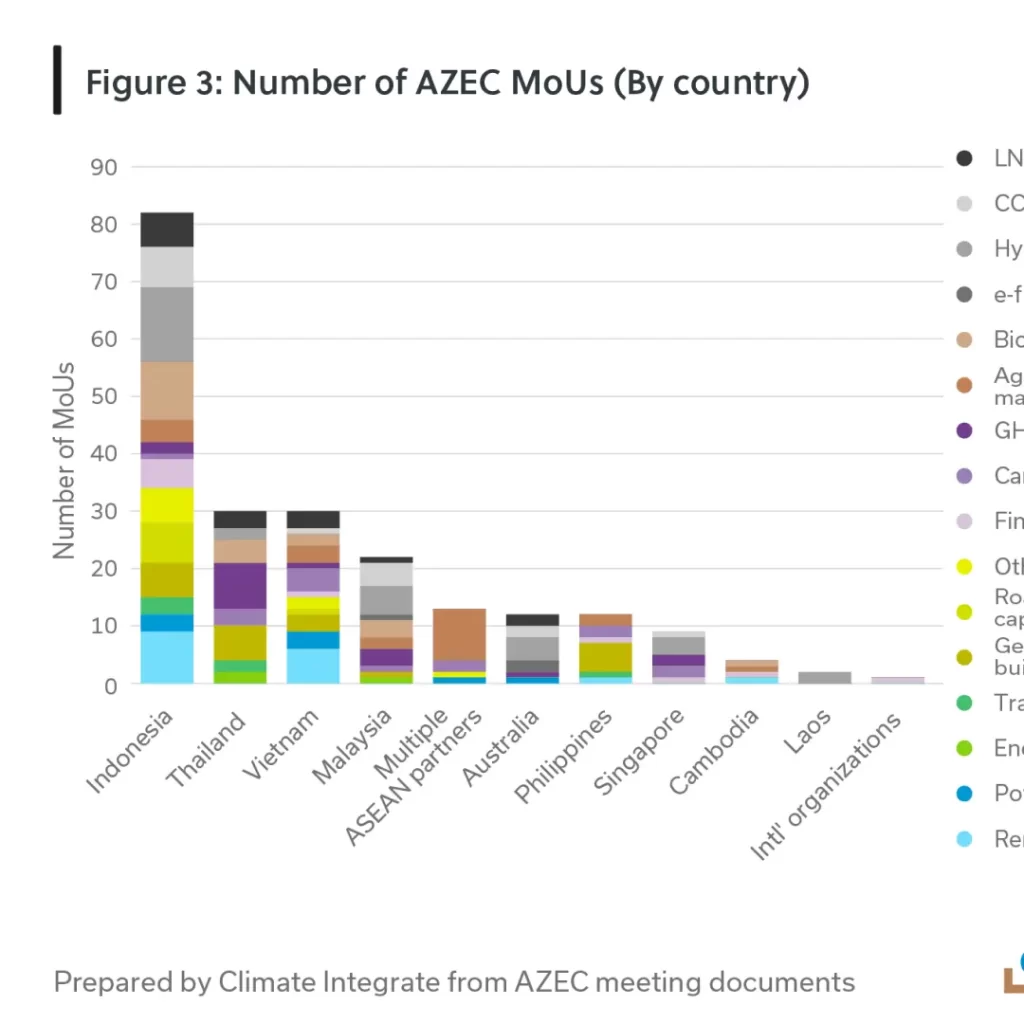

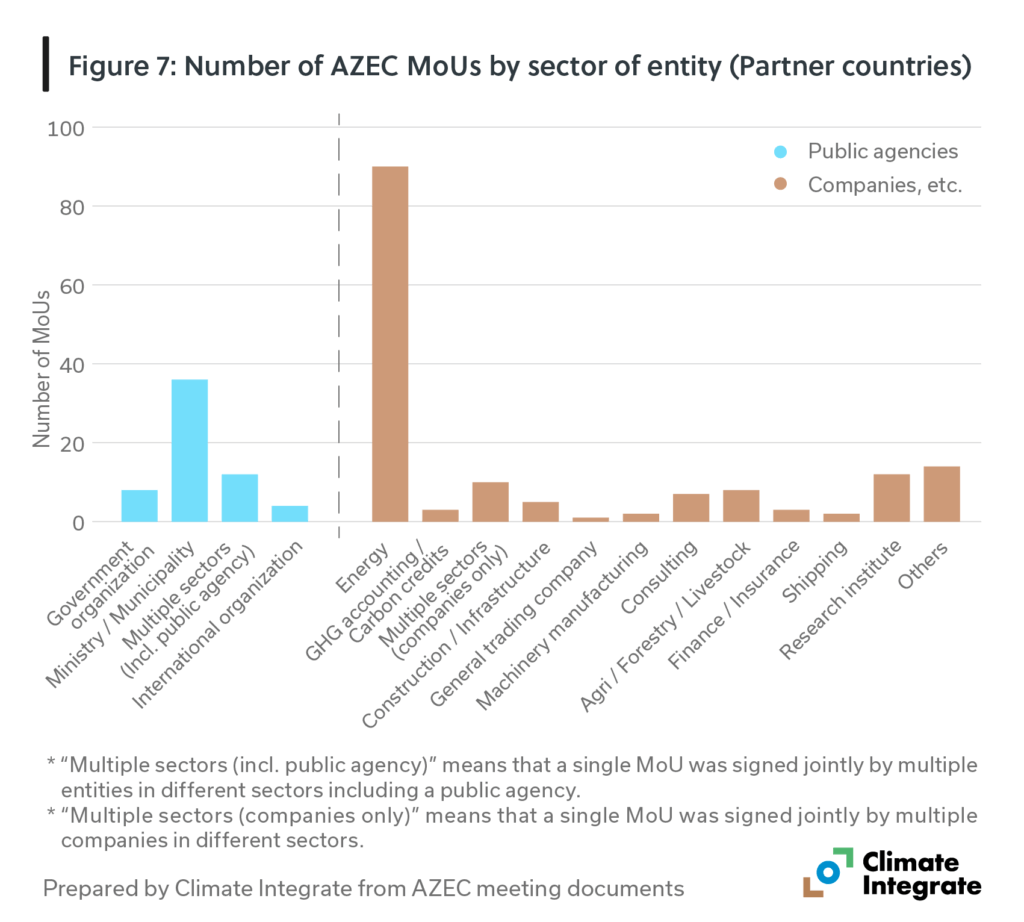

In the analysis of AZEC MoUs, Japanese public agencies or companies were involved as signatories. Among other partner countries, Indonesia has the highest number of AZEC MoUs (82 MoUs)—40% of all MoUs or more than twice that of any other country—followed by Thailand (30), Vietnam (30), and Malaysia (22).

While cooperation areas of MoUs vary by country, the most prominent area in Indonesia, Malaysia, Australia, Singapore, and Laos was hydrogen and ammonia. (Based on MoUs signed until 2024)

Related pages:

[Reports]Report “What’s AZEC?”

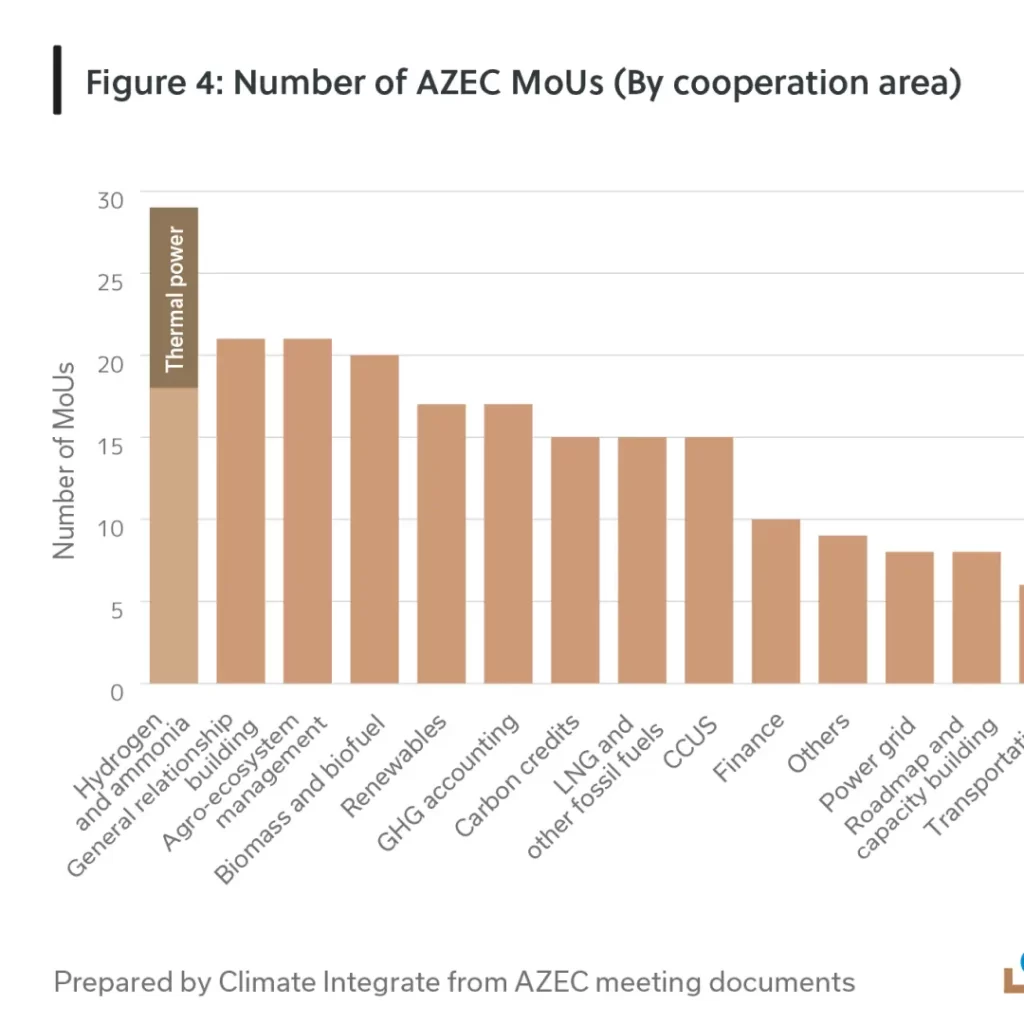

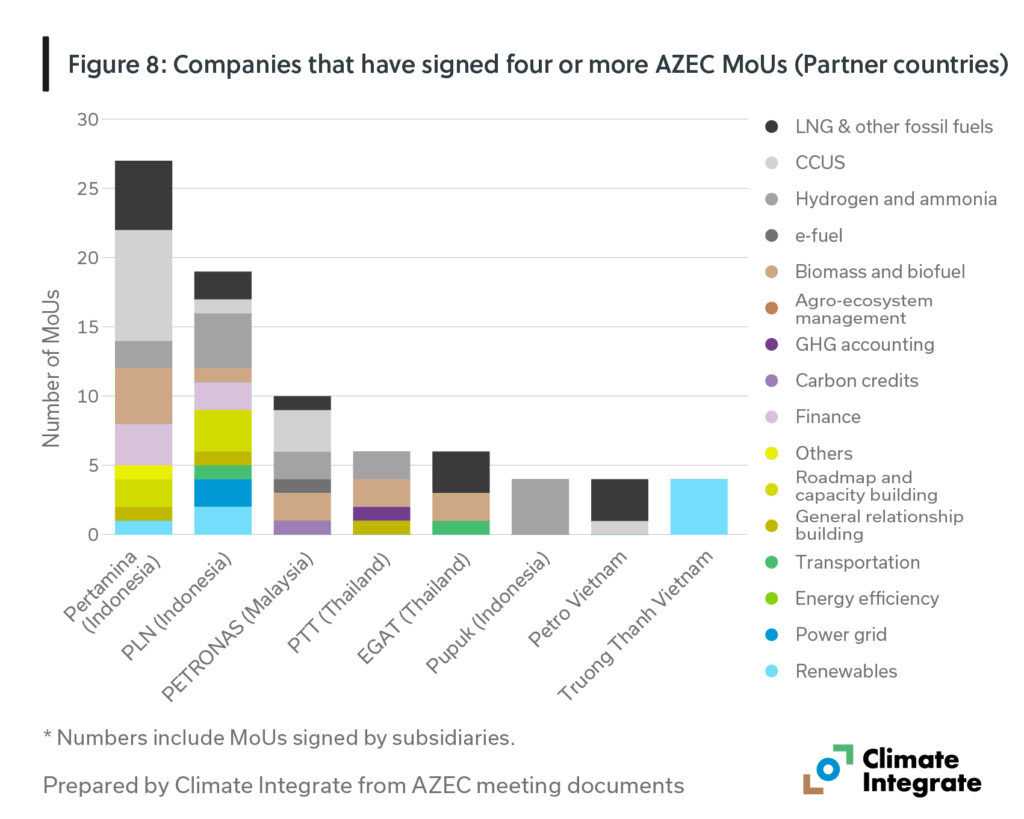

Among all cooperation areas of AZEC MoUs released until 2024, hydrogen and ammonia is the largest category, within which a notable portion is designated for use in the thermal power sector. Other prominent areas include general relationship building, agro-ecosystem management, and biomass and biofuel, followed closely by renewables, GHG accounting, carbon credits, LNG and other fossil fuels, and CCUS. Overall, about 30% (67 MoUs) are related to fuels, including hydrogen and ammonia, biomass and biofuels, and LNG. (Based on MoUs signed until 2024)

Related pages:

[Reports]Report “What’s AZEC?”

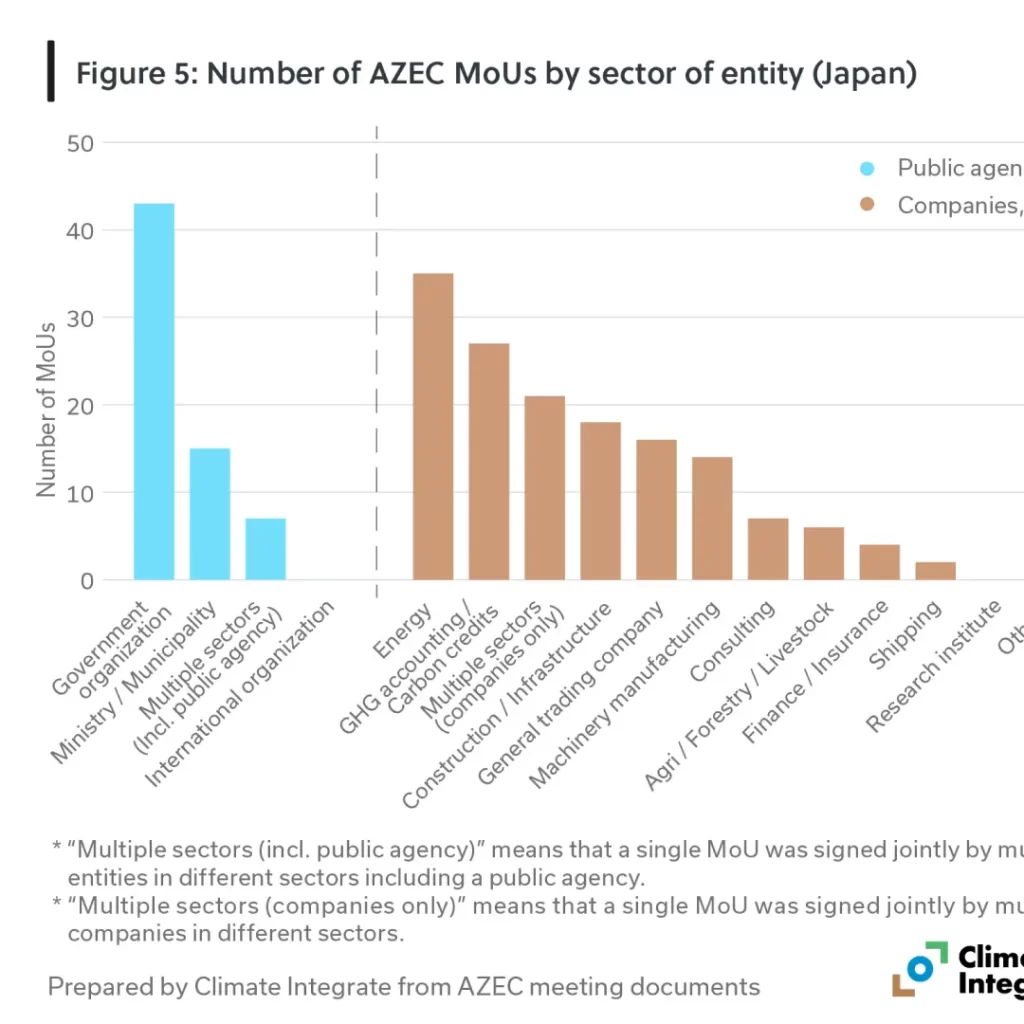

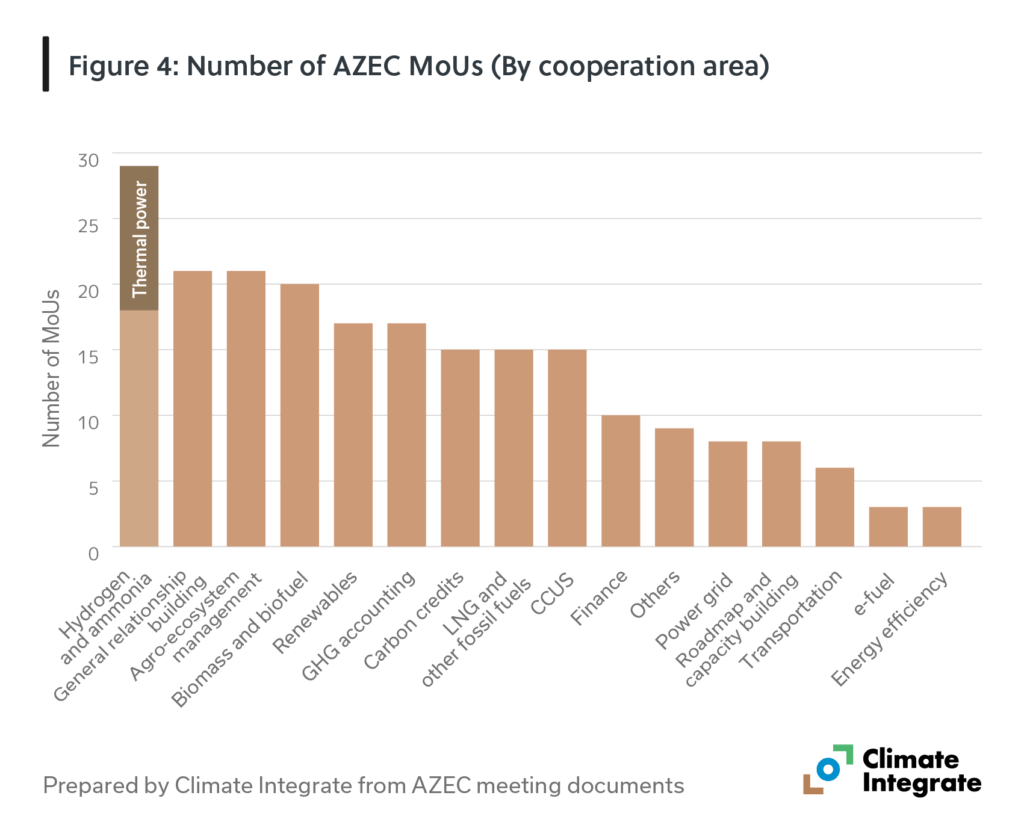

Among the Japanese participants in AZEC MoUs released until 2024, government organizations (43) account for the highest number within all sectors of entities. More than 10 MoUs were signed by corporate entities in each of the energy (35), GHG accounting / carbon credits (27), construction and infrastructure (18), general trading (16), and machine manufacturing (14) sectors. This demonstrates that, under strong government leadership and support, Japanese companies in a wide range of sectors are seeking to expand their business activities through AZEC. (Based on MoUs signed until 2024)

Related pages:

[Reports]Report “What’s AZEC?”

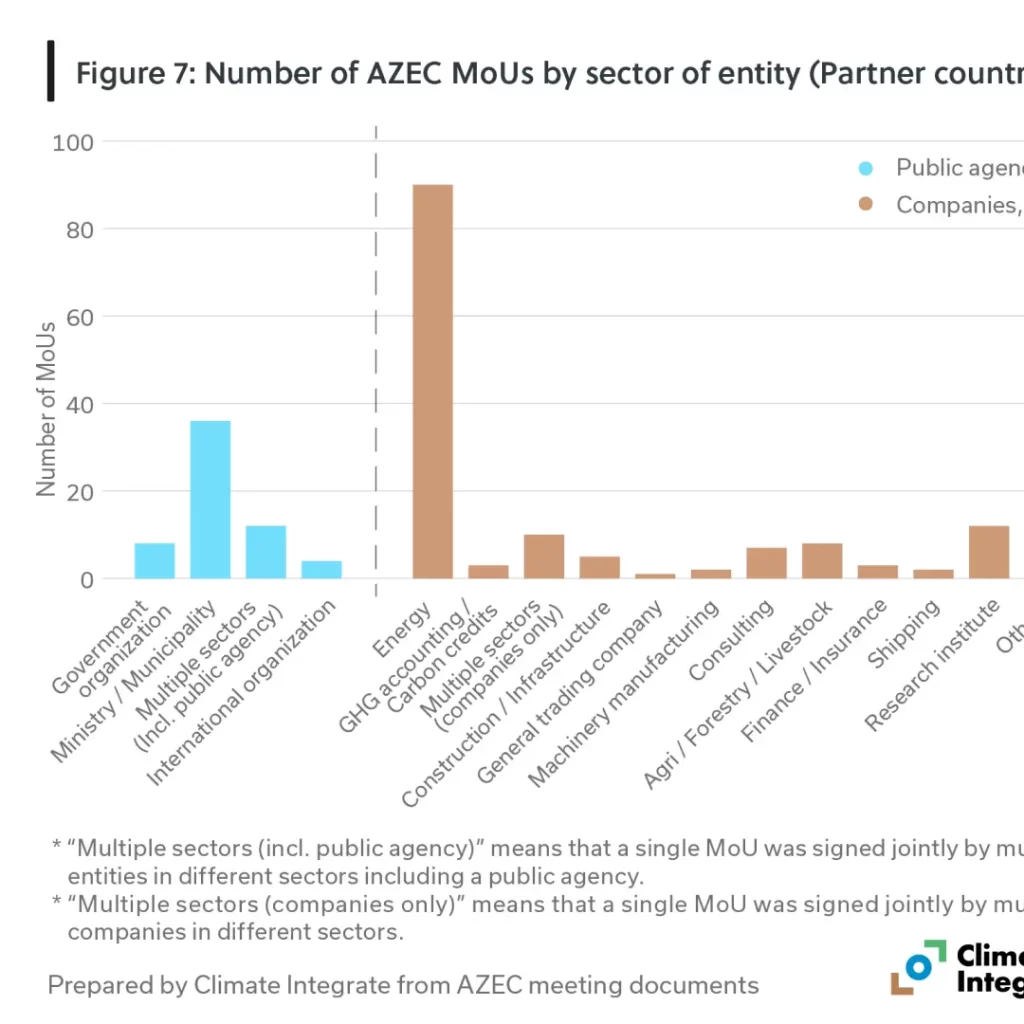

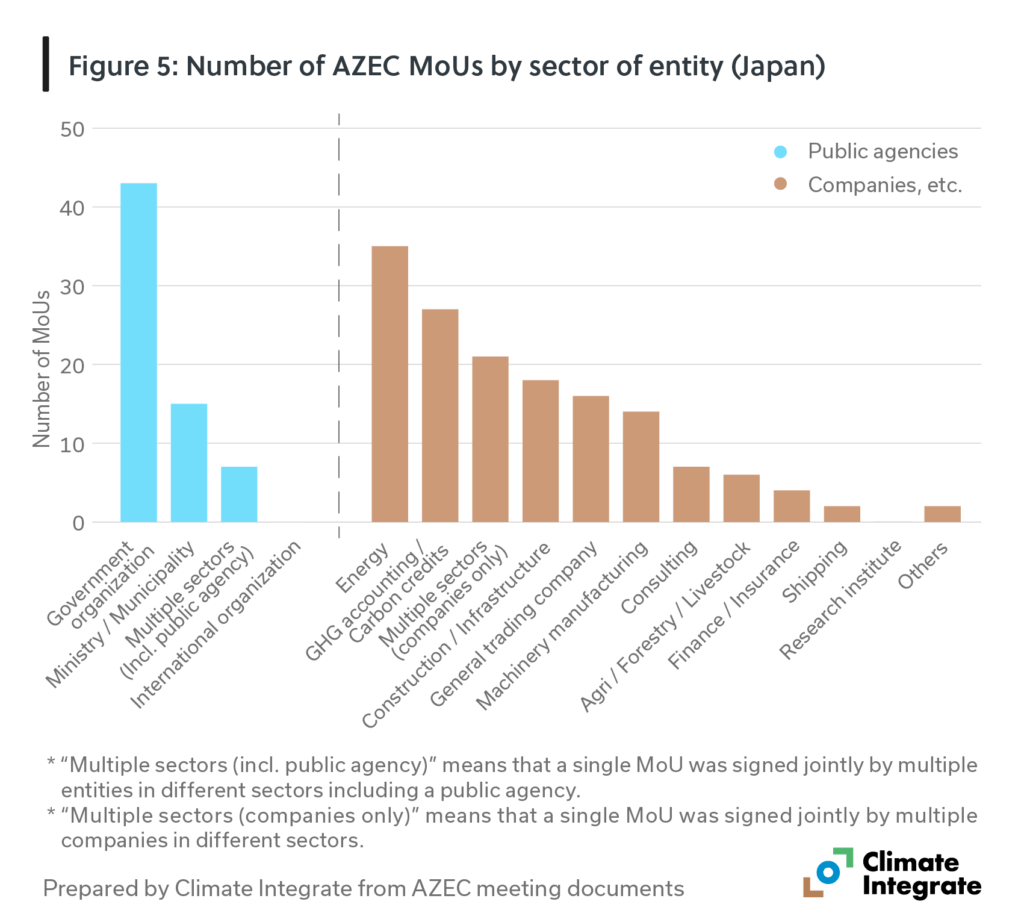

Among partner country entities, energy companies stand out, having signed 90 MoUs—41% of the total. This is in contrast to the diverse range of sectors represented by Japanese participants. This is likely due to the fact that many MoUs were related to fuels in partner countries, including fossil fuels, hydrogen and ammonia, biomass, and biofuel. (Based on MoUs signed until 2024)

Related pages:

[Reports]Report “What’s AZEC?”

Others

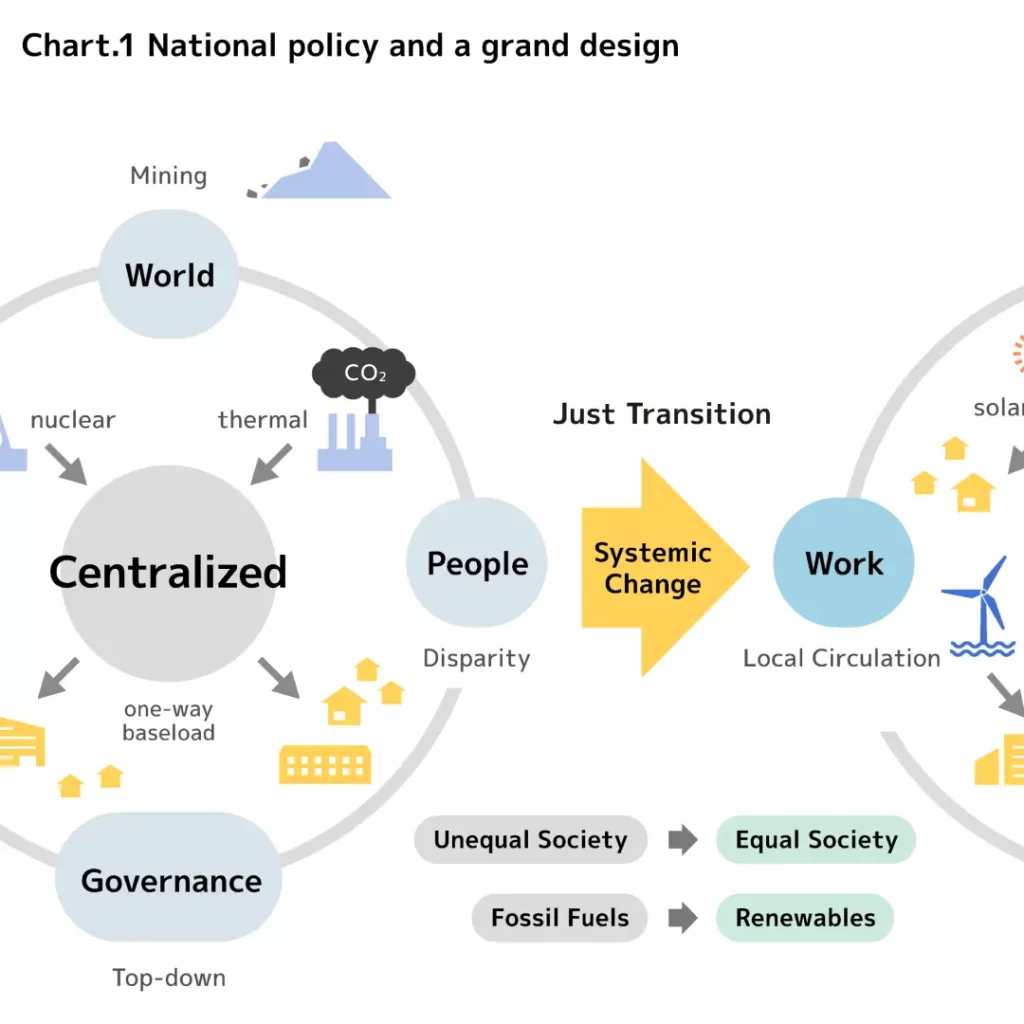

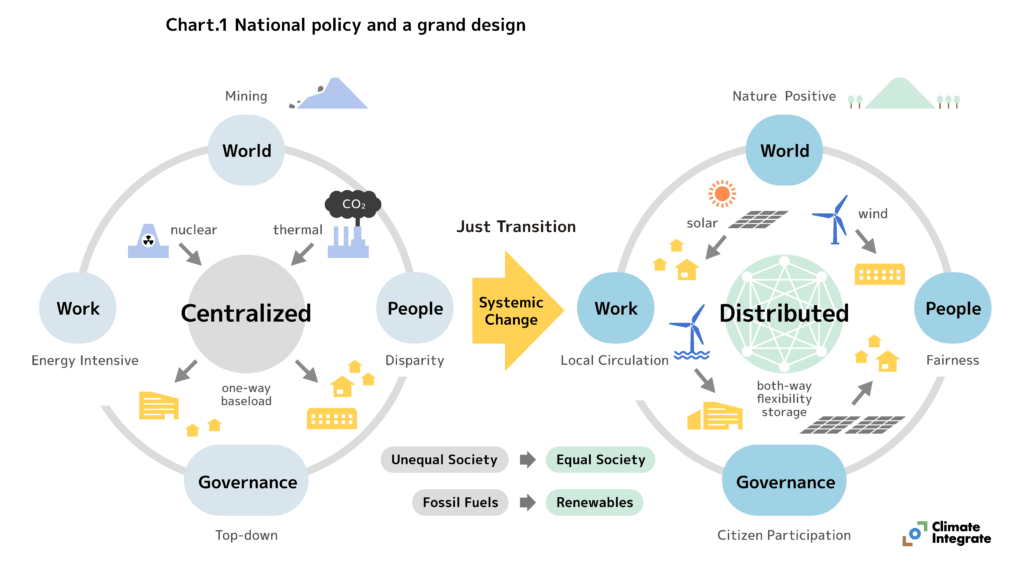

National policy and a grand design

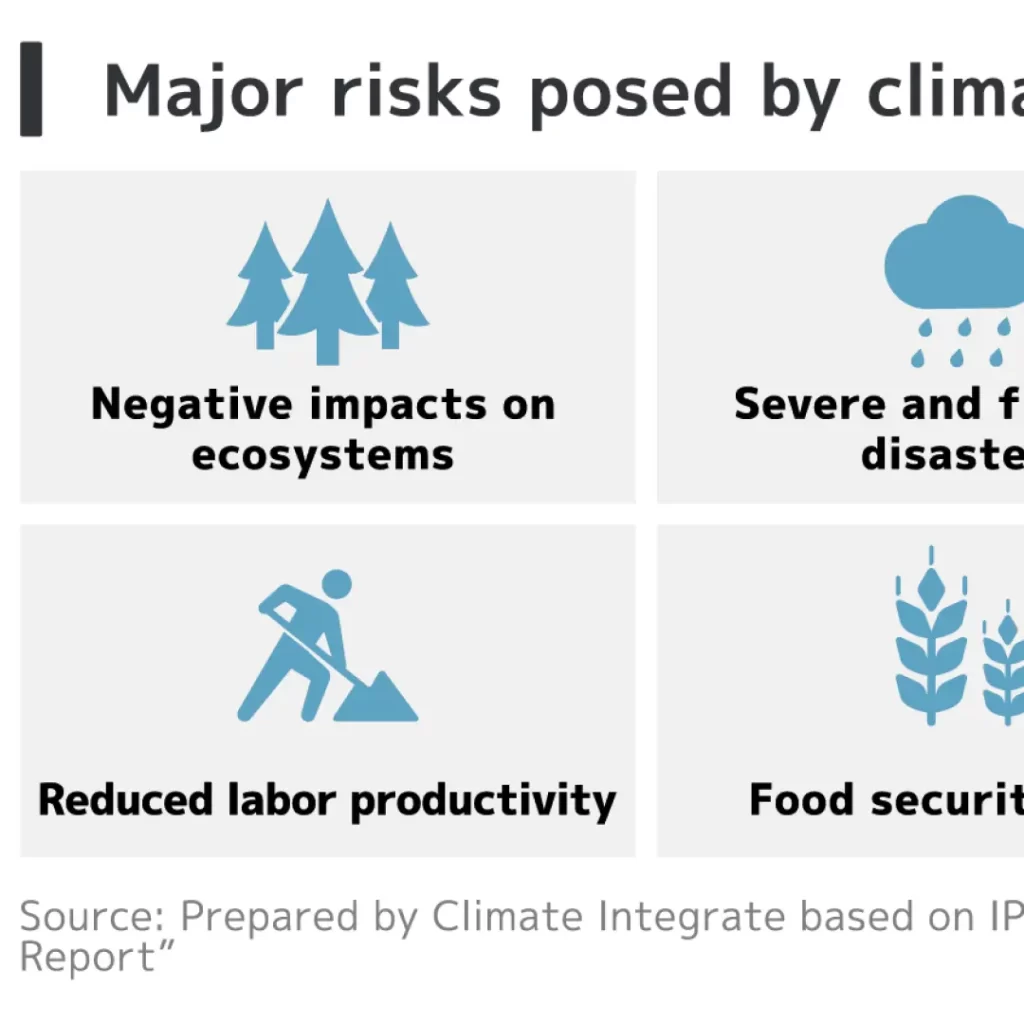

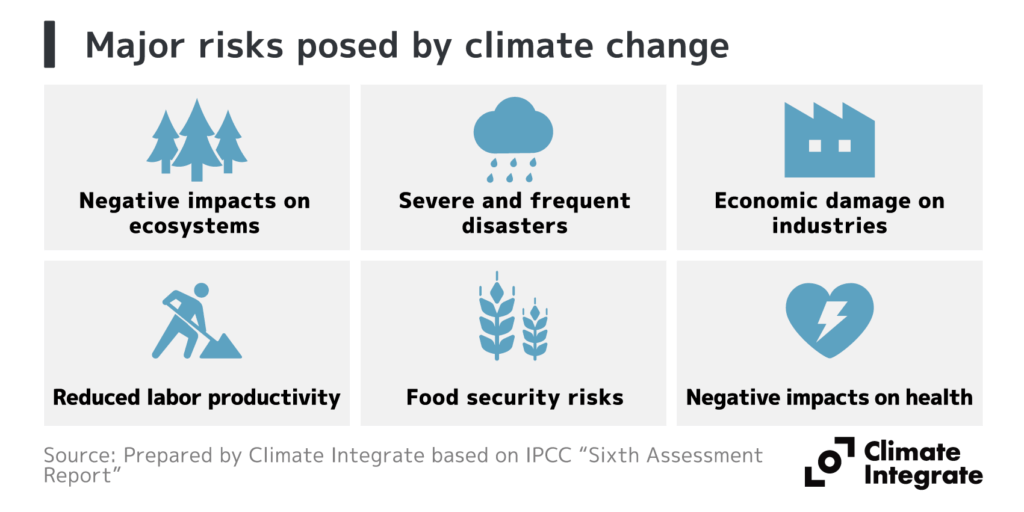

Major risks posed by climate change

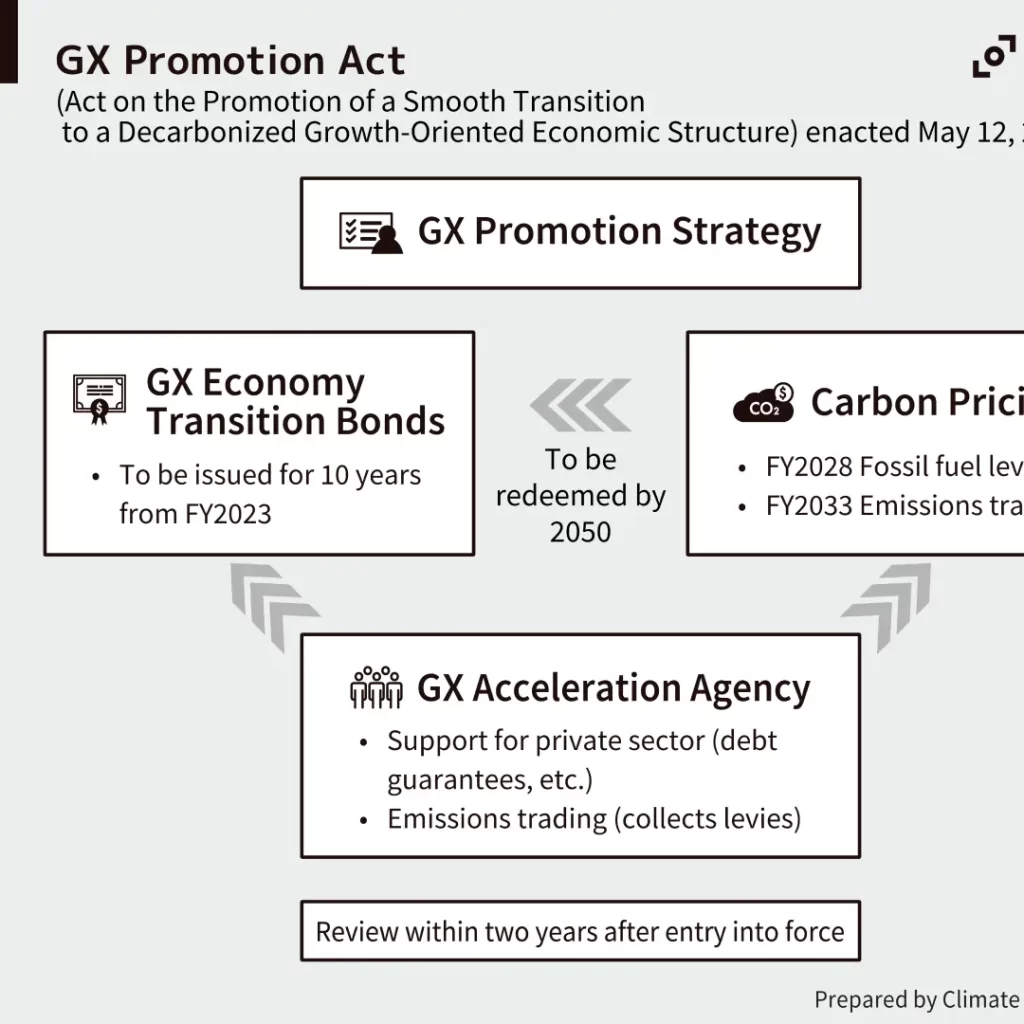

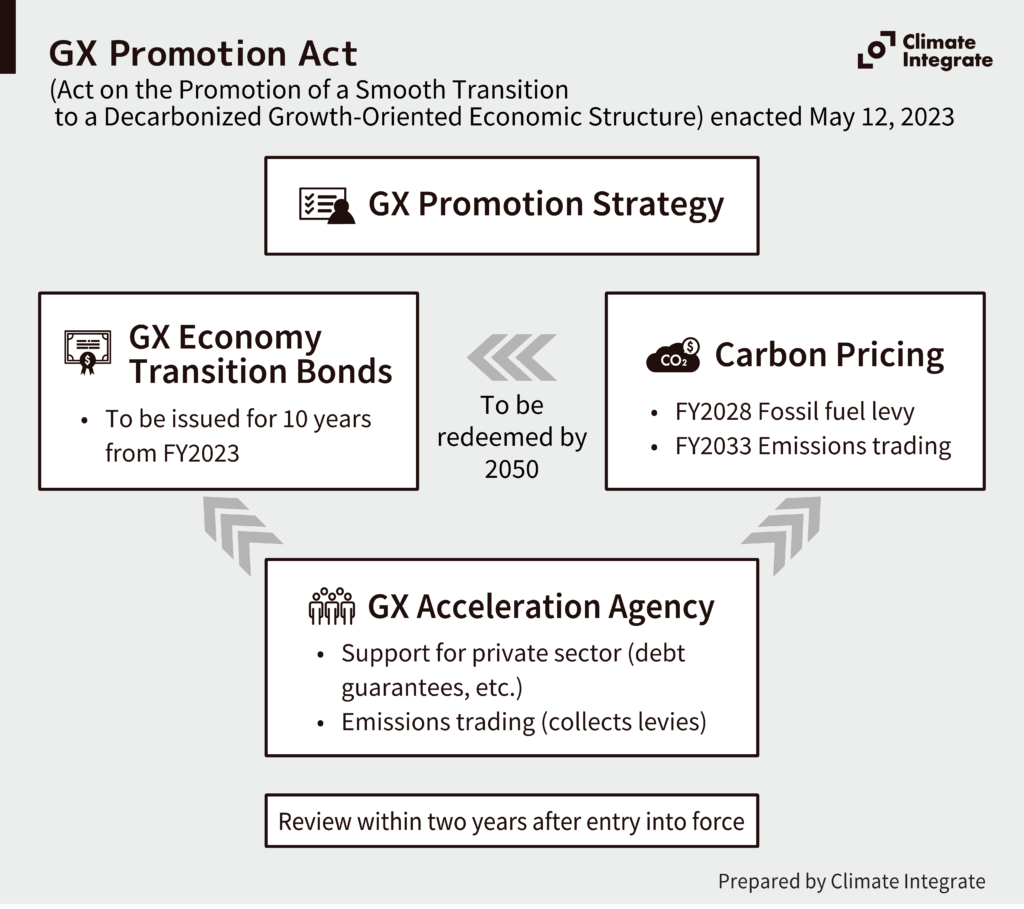

GX Promotion Act

Achieving carbon neutrality requires a bold shift to a power system centered on renewable energy, accompanied by a broader system change that transforms how we engage globally, work, make policy decisions, and shape societal values. A clear national vision (grand design) and strong industrial policy are essential to drive this transition.

Related pages:

[Reports]Report “Decarbonizing Japan’s Electricity System: Policy Change to Trigger a Shift”

Extreme weather events are becoming more frequent and intense due to climate change, expanding social impacts and economic losses. The loss of natural capital and biodiversity is also becoming more serious.

Related pages:

[Insights]Mainstreaming Renewable Energy in Japan

The Japanese government is promoting a “Green Transformation” (GX) as a strategy that will “transform our entire industrial and social structures centering around fossil energy sources, long established since the Industrial Revolution, into ones based on clean energy.” The Diet enacted the GX Promotion Act in May 2023 and the GX Promotion Strategy was approved by the Cabinet in July that year.

Related pages:

[Reports]Report “What is Green Transformation (GX)?”

Global Data – Science

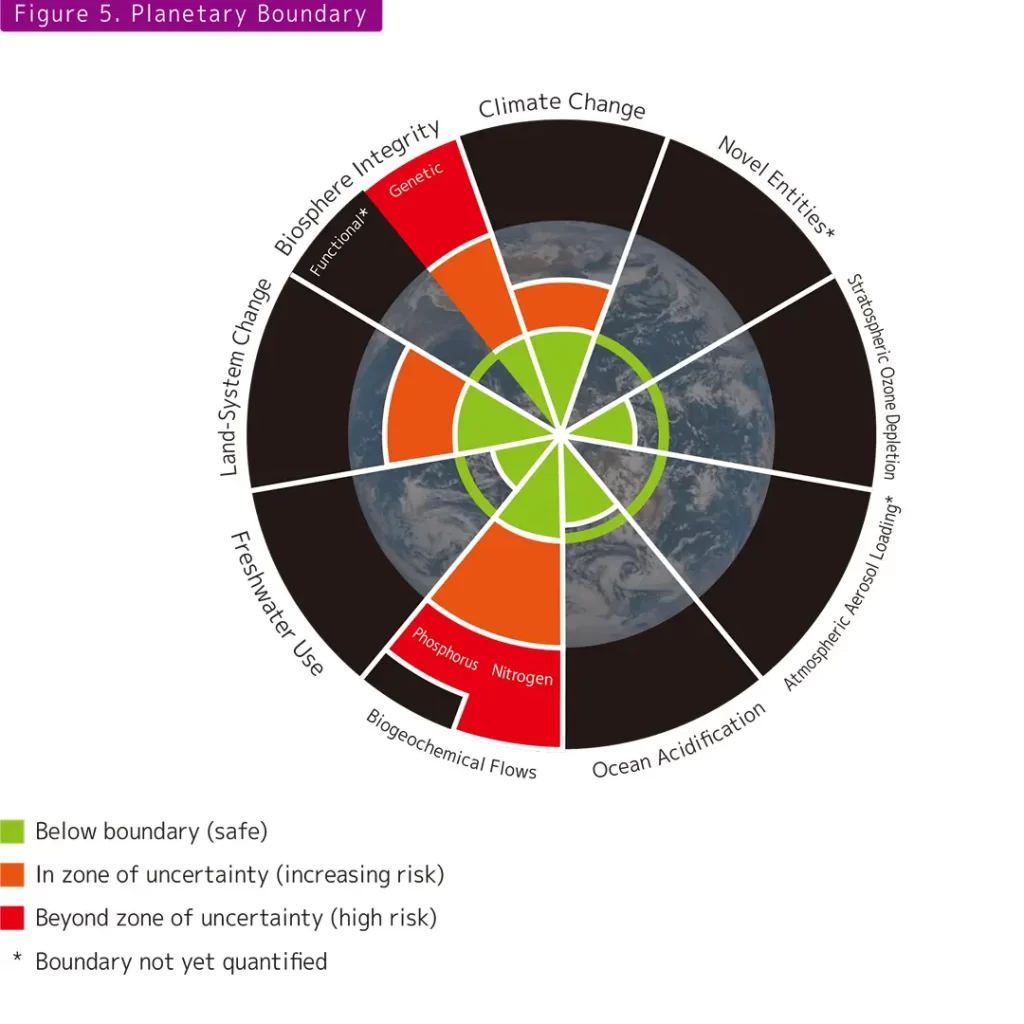

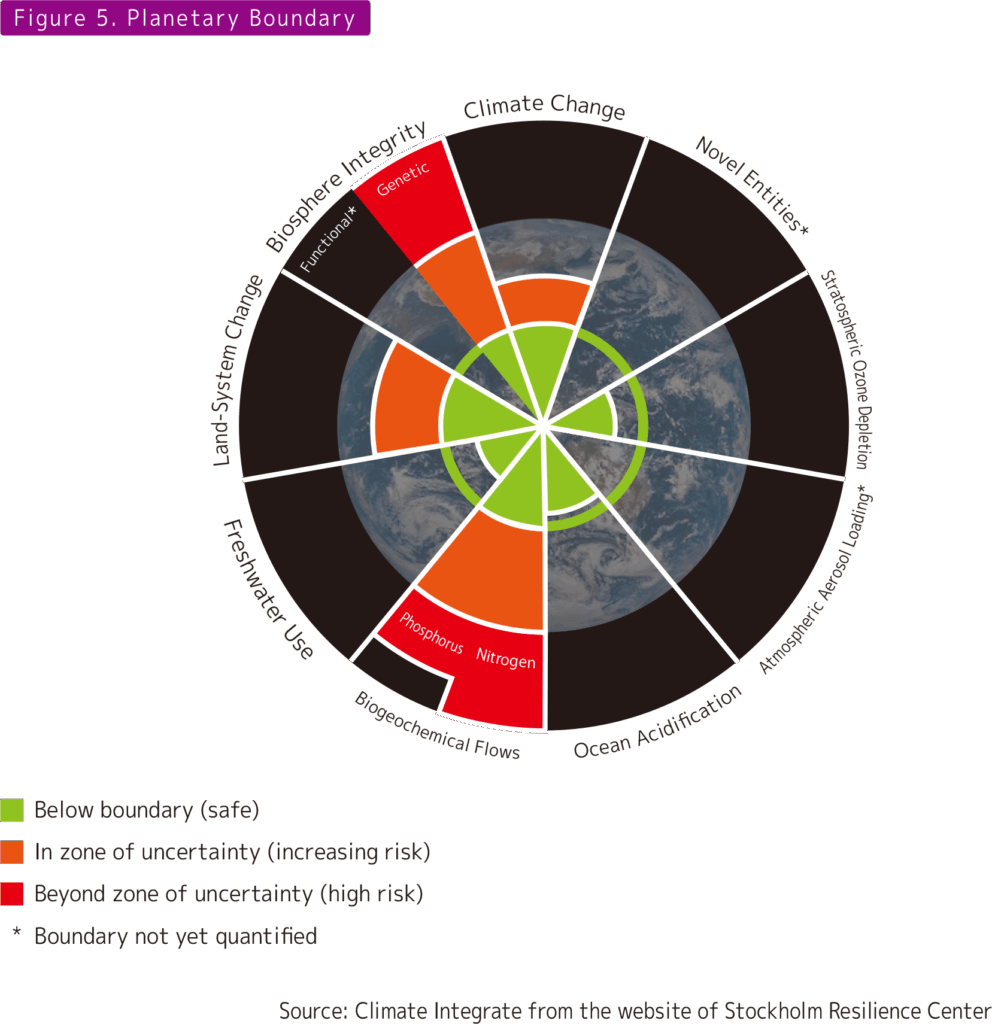

Planetary Boundary

Planetary boundaries define the scientifically determined limits of the safe operating space for humanity on Earth. Crossing these environmental limits risks triggering irreversible changes and potential collapse of ecosystems. This research finds that among the nine identified boundaries, nitrogen pollution is the most critically exceeded.

Related pages:

[Reports]Report “Getting Lost on the Road to Decarbonization: Japan’s Big Plans for Ammonia”(updated June, 2022)

Global Data – Policy

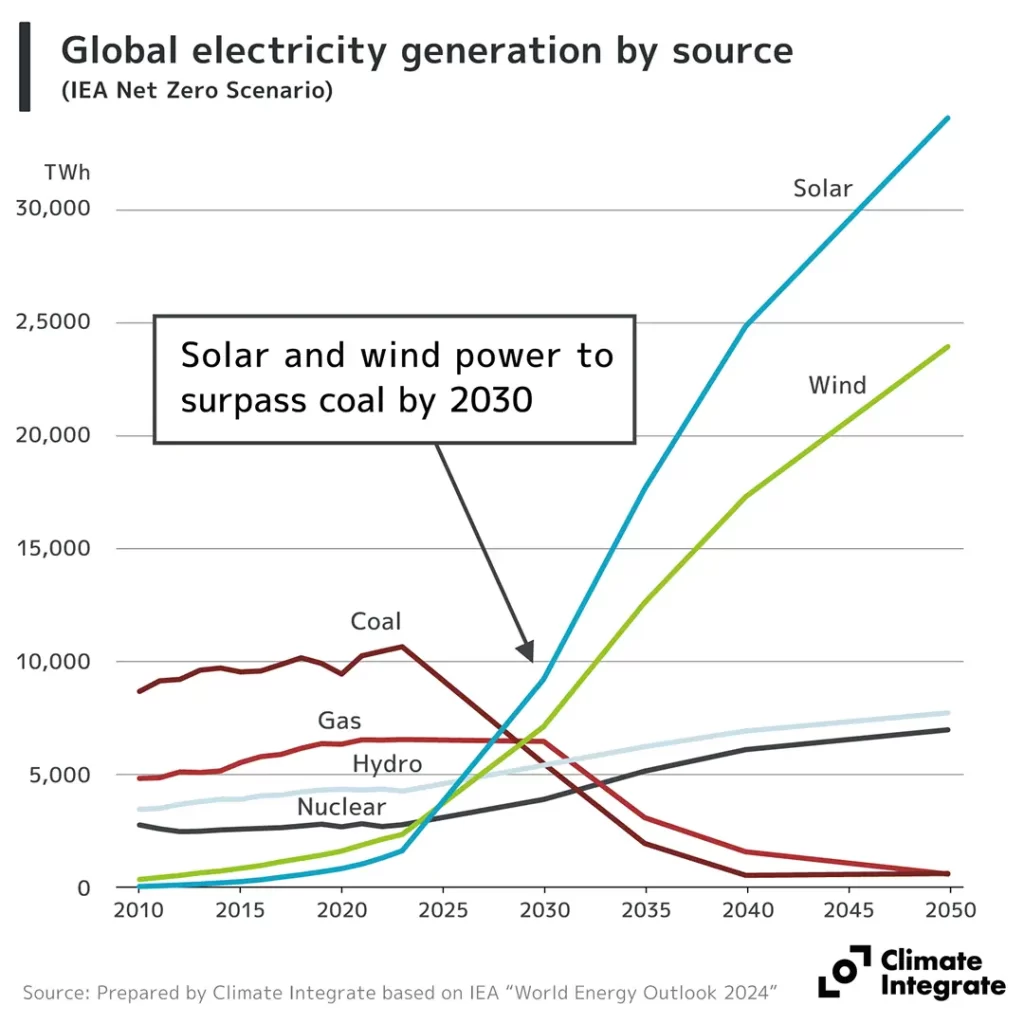

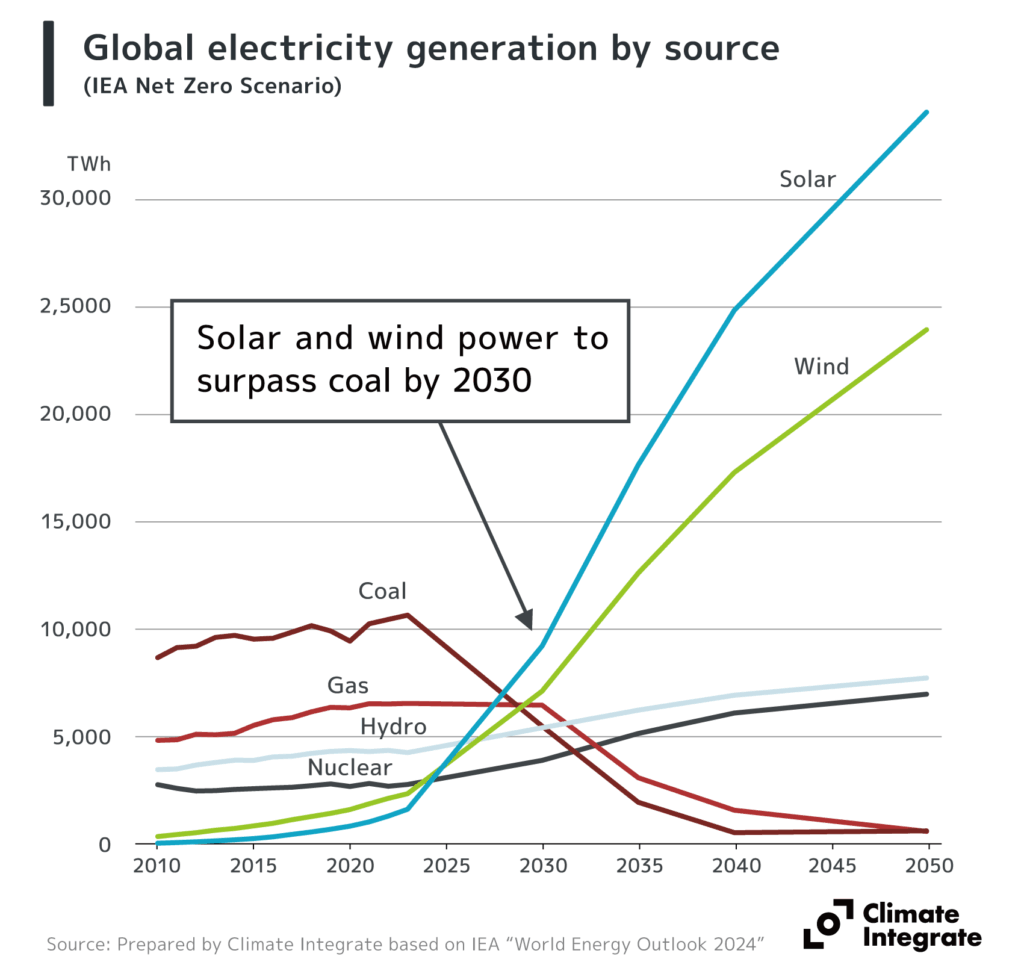

Global electricity generation by source (IEA Net Zero Scenario)

Under the International Energy Agency (IEA) Net Zero Scenario, renewables are projected to reach 59% of global power generation by 2030 and 85% by 2040. Solar and wind are expected to overtake coal-fired generation by 2030 and expand rapidly thereafter.

Related pages:

[Insights]Mainstreaming Renewable Energy in Japan